Federal Form 8911 Alternative Fuel Vehicle Refueling Property 2024

What is the Federal Form 8911 Alternative Fuel Vehicle Refueling Property

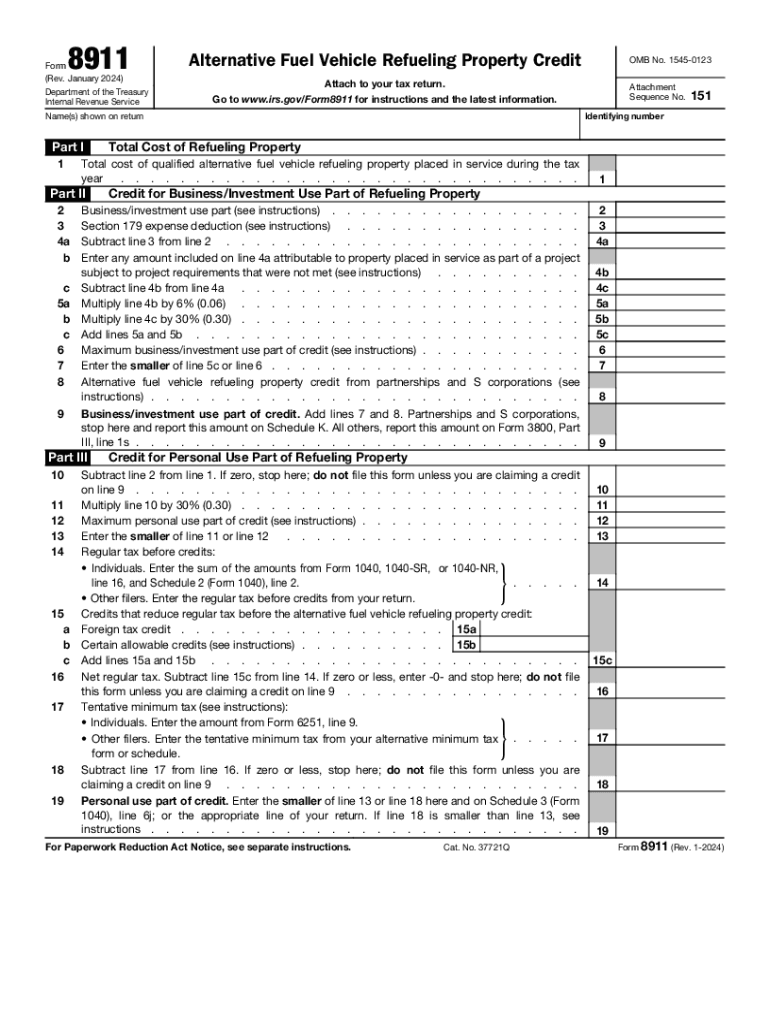

The Federal Form 8911 is used to claim a tax credit for the installation of alternative fuel vehicle refueling property. This form specifically targets businesses and individuals who invest in infrastructure to support alternative fuel vehicles, such as electric cars and hydrogen-powered vehicles. The credit is designed to encourage the development of a cleaner transportation system by providing financial incentives for the installation of refueling stations.

How to use the Federal Form 8911 Alternative Fuel Vehicle Refueling Property

To utilize the Federal Form 8911, taxpayers must first determine their eligibility for the tax credit. After confirming eligibility, the form can be filled out to report the costs associated with the installation of refueling property. This includes costs for equipment, installation, and any necessary modifications to existing structures. Once completed, the form should be submitted with the taxpayer's federal income tax return.

Steps to complete the Federal Form 8911 Alternative Fuel Vehicle Refueling Property

Completing the Federal Form 8911 involves several key steps:

- Gather necessary documentation, including receipts and invoices for the refueling property.

- Fill out the form by providing details about the property, including its location and the type of alternative fuel it supports.

- Calculate the total eligible costs and the resulting tax credit.

- Review the completed form for accuracy before submission.

Eligibility Criteria

Eligibility for the tax credit associated with Federal Form 8911 requires that the property installed be used primarily for the purpose of refueling alternative fuel vehicles. The property must meet specific technical requirements set forth by the IRS, and the taxpayer must be the owner of the refueling property. Additionally, the installation must occur during the tax year for which the credit is claimed.

Required Documents

When filing the Federal Form 8911, taxpayers should prepare the following documents:

- Receipts and invoices for the purchase and installation of the refueling property.

- Proof of payment for the installation costs.

- Any relevant permits or approvals required by local authorities for the installation of refueling stations.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Federal Form 8911. The form should be submitted along with the federal income tax return, typically due on April fifteenth of the following year. If an extension is filed, the deadline for submitting the form will also extend accordingly. It is crucial to keep track of any changes in tax laws that may affect filing dates.

Quick guide on how to complete federal form 8911 alternative fuel vehicle refueling property

Complete Federal Form 8911 Alternative Fuel Vehicle Refueling Property effortlessly on any device

Digital document management has become favored by businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Handle Federal Form 8911 Alternative Fuel Vehicle Refueling Property on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Federal Form 8911 Alternative Fuel Vehicle Refueling Property without hassle

- Locate Federal Form 8911 Alternative Fuel Vehicle Refueling Property and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Edit and eSign Federal Form 8911 Alternative Fuel Vehicle Refueling Property and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 8911 alternative fuel vehicle refueling property

Create this form in 5 minutes!

How to create an eSignature for the federal form 8911 alternative fuel vehicle refueling property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 8911 in airSlate SignNow?

The number 8911 represents a unique identifier for our service offerings, ensuring that users can easily find and access the specific features they need. By focusing on 8911, businesses can streamline their document management processes effectively.

-

How does airSlate SignNow pricing work for the 8911 plan?

The 8911 plan offers competitive pricing tailored for businesses of all sizes. With flexible subscription options, users can choose a plan that fits their budget while enjoying the full range of features that airSlate SignNow provides.

-

What features are included in the airSlate SignNow 8911 package?

The 8911 package includes essential features such as eSigning, document templates, and real-time collaboration tools. These features empower businesses to manage their documents efficiently and enhance productivity.

-

What are the benefits of using airSlate SignNow with the 8911 identifier?

Using airSlate SignNow with the 8911 identifier allows businesses to access a streamlined eSigning process that saves time and reduces errors. This cost-effective solution enhances workflow efficiency and improves overall document management.

-

Can I integrate airSlate SignNow 8911 with other software?

Yes, airSlate SignNow 8911 seamlessly integrates with various software applications, including CRM and project management tools. This integration capability allows businesses to enhance their existing workflows and improve collaboration.

-

Is there a free trial available for the 8911 plan?

Absolutely! airSlate SignNow offers a free trial for the 8911 plan, allowing prospective customers to explore its features without any commitment. This trial period helps businesses assess how the solution meets their needs.

-

How secure is the airSlate SignNow 8911 solution?

The airSlate SignNow 8911 solution prioritizes security with advanced encryption and compliance with industry standards. Businesses can trust that their documents are protected while using our platform for eSigning and document management.

Get more for Federal Form 8911 Alternative Fuel Vehicle Refueling Property

- Doc 098 pepco view sample bills pdf for pepco md customer form

- Larry goins pdf form

- Bankruptcy worksheet 444888703 form

- Tamil aunty item photos form

- Confidential patient insurance information form patient name

- Wbsedcl annexure a b combined form

- Ignition interlock device complaints form

- Rental arbitrage lease agreement template form

Find out other Federal Form 8911 Alternative Fuel Vehicle Refueling Property

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form