Form 8911 Rev December 2024-2026

What is the Form 8911 Rev December

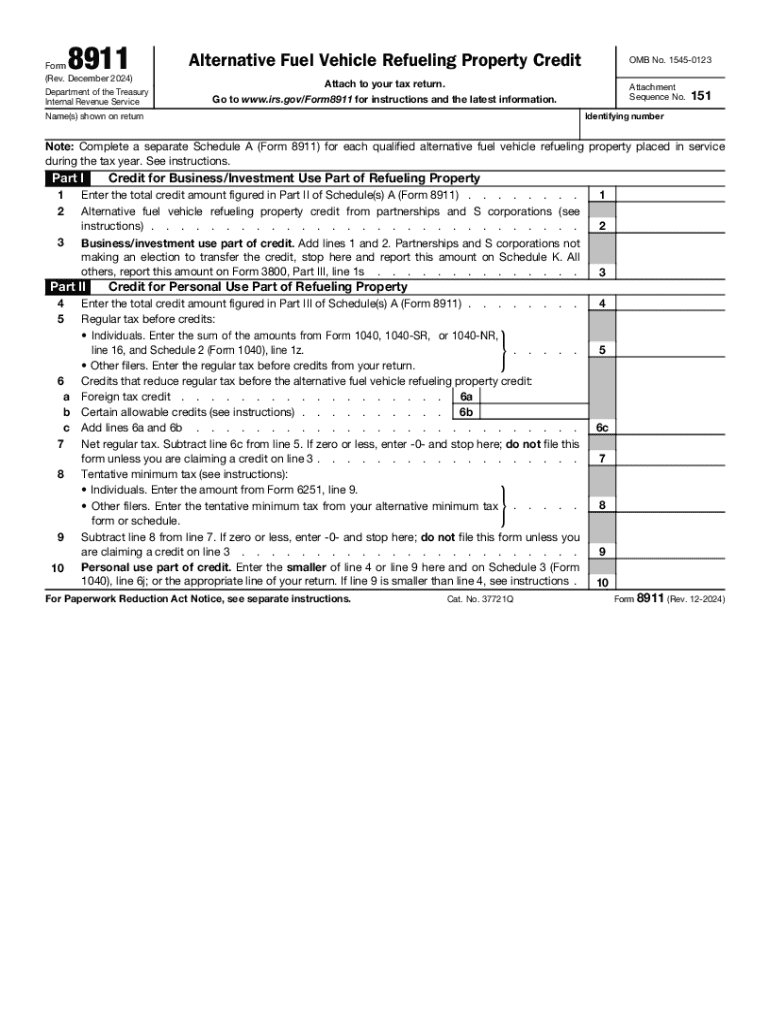

The Form 8911, officially titled "Alternative Fuel Vehicle Refueling Property Credit," is a tax form used by businesses and individuals to claim a credit for the installation of refueling property for alternative fuel vehicles. This form is specifically relevant for the tax year 2024 and is designed to encourage the use of alternative fuels by providing financial incentives. The credit can apply to various types of property, including electric vehicle charging stations and hydrogen refueling stations.

How to use the Form 8911 Rev December

To effectively use the Form 8911, taxpayers must first determine their eligibility for the credit. This involves identifying the types of refueling property installed and ensuring they meet the IRS guidelines. After confirming eligibility, the taxpayer will need to fill out the form accurately, detailing the costs associated with the installation and the type of alternative fuel property. Once completed, the form should be submitted with the taxpayer's annual tax return.

Steps to complete the Form 8911 Rev December

Completing the Form 8911 involves several key steps:

- Gather necessary documentation, including receipts for installation costs and details about the refueling property.

- Fill out the form, providing information on the type of property, installation costs, and any other required details.

- Calculate the credit amount based on the costs provided and the applicable IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8911. Taxpayers should familiarize themselves with the requirements for eligibility, including the types of alternative fuel vehicles and refueling property that qualify for the credit. Additionally, the IRS outlines the documentation needed to support the claim, such as invoices and installation contracts. Adhering to these guidelines is crucial to ensure that the credit is granted without issues.

Filing Deadlines / Important Dates

For the tax year 2024, the deadline for filing Form 8911 coincides with the standard tax return deadline, which is typically April 15 of the following year. However, if taxpayers file for an extension, they should also extend the deadline for submitting Form 8911. It is important to keep track of these dates to avoid penalties and ensure that the credit is claimed in a timely manner.

Eligibility Criteria

Eligibility for the credit claimed on Form 8911 is contingent upon several factors. Taxpayers must have installed qualified alternative fuel vehicle refueling property during the tax year. The property must be used primarily for business purposes, and the installation costs must be substantiated with proper documentation. Additionally, the property must meet the specifications outlined by the IRS to qualify for the credit.

Create this form in 5 minutes or less

Find and fill out the correct form 8911 rev december

Create this form in 5 minutes!

How to create an eSignature for the form 8911 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 IRS 8911 form and why is it important?

The 2024 IRS 8911 form is used to claim the credit for the alternative fuel vehicle refueling property. Understanding this form is crucial for businesses looking to maximize their tax benefits related to alternative fuel investments. Properly filing the 2024 IRS 8911 can lead to signNow savings and incentives.

-

How can airSlate SignNow help with the 2024 IRS 8911 form?

airSlate SignNow simplifies the process of preparing and signing documents, including the 2024 IRS 8911 form. With our platform, you can easily create, edit, and eSign your tax documents, ensuring compliance and accuracy. This streamlines your workflow and saves you time during tax season.

-

What features does airSlate SignNow offer for managing the 2024 IRS 8911?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the 2024 IRS 8911 form. These tools help ensure that your submissions are accurate and timely. Additionally, our platform provides reminders and notifications to keep you on track.

-

Is airSlate SignNow cost-effective for small businesses filing the 2024 IRS 8911?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. Our pricing plans are flexible and cater to various needs, making it affordable to manage documents like the 2024 IRS 8911 form. Investing in our service can lead to savings in both time and resources.

-

Can I integrate airSlate SignNow with other software for the 2024 IRS 8911?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage the 2024 IRS 8911 form. This connectivity allows for a more streamlined workflow, ensuring that all your documents are in one place and easily accessible.

-

What are the benefits of using airSlate SignNow for the 2024 IRS 8911?

Using airSlate SignNow for the 2024 IRS 8911 provides numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform ensures that your documents are securely stored and easily retrievable. Additionally, the user-friendly interface makes it simple for anyone to navigate the eSigning process.

-

How does airSlate SignNow ensure the security of my 2024 IRS 8911 documents?

airSlate SignNow prioritizes the security of your documents, including the 2024 IRS 8911 form. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your data remains confidential and secure.

Get more for Form 8911 Rev December

- Eddcagovpdfpubctrde8714afact sheet employment development department de 8714a form

- Continued claim form ca receive edd fill money unemployment

- Labor standards complaint form

- F417 202 000 forklift safety fact sheet this document answers questions about training requirements and tips to help operate form

- Fillable pers enrollment application form

- Fillable online application for transfer of reserve form

- For you amp your employees form

- 2021 updates to laws and regulations in a complete guide form

Find out other Form 8911 Rev December

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now