Form 211 Rev 3 Application for Award for Original Information

What is the Form 211 Rev 3 Application For Award For Original Information

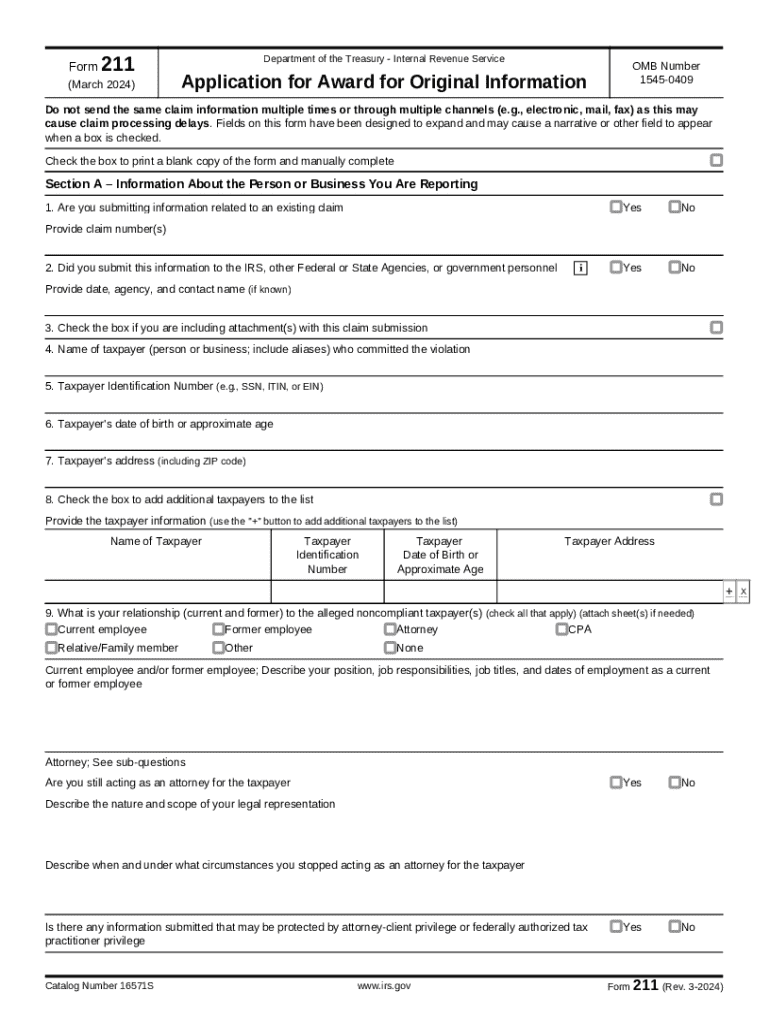

The IRS Form 211, officially known as the Application for Award for Original Information, is designed for individuals who provide original information leading to the detection of underreported income or tax fraud. This form allows whistleblowers to apply for monetary rewards based on the amount of tax collected by the IRS as a result of their information. The form is crucial for those who wish to report tax violations while remaining anonymous, ensuring that their identity is protected throughout the process.

How to Use the Form 211 Rev 3 Application For Award For Original Information

Using the IRS Form 211 involves several key steps. First, gather all relevant information regarding the tax violation you wish to report. This includes details about the taxpayer, the nature of the violation, and any supporting documentation. Next, complete the form accurately, ensuring all sections are filled out clearly. Once completed, submit the form to the IRS Whistleblower Office. It is essential to keep a copy of the submitted form for your records. Additionally, consider consulting with a tax professional to ensure your submission is thorough and meets all requirements.

Steps to Complete the Form 211 Rev 3 Application For Award For Original Information

Completing the IRS Form 211 involves a systematic approach:

- Step 1: Download the form from the IRS website or obtain a physical copy.

- Step 2: Provide your contact information, including your name, address, and phone number. If you wish to remain anonymous, you may leave this section blank.

- Step 3: Describe the tax violation in detail, including the taxpayer's name, the type of tax involved, and the specific issues.

- Step 4: Attach any supporting documents that substantiate your claim.

- Step 5: Review the form for accuracy and completeness before submitting.

Eligibility Criteria

To qualify for an award under the IRS Form 211, the information provided must be original and lead to the collection of taxes, penalties, or other amounts owed to the IRS. The informant must not be involved in the violation, and the information must be specific and credible. Additionally, the claim must be submitted within a certain timeframe following the discovery of the violation. Understanding these criteria is essential for anyone considering submitting the form.

Form Submission Methods

The IRS Form 211 can be submitted through multiple methods to accommodate various preferences. Individuals can choose to mail the completed form directly to the IRS Whistleblower Office. Alternatively, the form may be submitted in person at designated IRS offices. For those who prefer digital submission, it is advisable to check the IRS guidelines for any updates on electronic filing options. Each method has its own advantages, such as confidentiality and convenience.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 211. These guidelines outline the necessary information required, the importance of accuracy, and the potential for anonymity. It is crucial to adhere to these guidelines to ensure that your application is processed efficiently. The IRS also emphasizes the importance of providing detailed and credible information to maximize the chances of receiving an award.

Quick guide on how to complete form 211 rev 3 application for award for original information

Easily Prepare Form 211 Rev 3 Application For Award For Original Information on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 211 Rev 3 Application For Award For Original Information on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Form 211 Rev 3 Application For Award For Original Information Effortlessly

- Find Form 211 Rev 3 Application For Award For Original Information and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools designed by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 211 Rev 3 Application For Award For Original Information and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 211 rev 3 application for award for original information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 211 and how does it relate to airSlate SignNow?

IRS Form 211 is used to claim a reward for information provided to the IRS about tax fraud. With airSlate SignNow, you can easily eSign and send IRS Form 211 securely, ensuring that your submission is both efficient and compliant with IRS regulations.

-

How can airSlate SignNow help me complete IRS Form 211?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign IRS Form 211 quickly. Our templates and guided workflows simplify the process, making it easier for you to submit your claim without any hassle.

-

Is there a cost associated with using airSlate SignNow for IRS Form 211?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while enjoying the benefits of eSigning IRS Form 211 and other documents seamlessly.

-

What features does airSlate SignNow offer for IRS Form 211?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of completing IRS Form 211. These features ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for IRS Form 211?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling IRS Form 211. This integration capability helps you manage your documents more effectively across different platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 211 submissions?

Using airSlate SignNow for IRS Form 211 submissions offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your forms are completed correctly and submitted on time, reducing the risk of errors.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 211?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your IRS Form 211 submissions meet all necessary requirements. Our platform prioritizes security and compliance, giving you peace of mind when eSigning important documents.

Get more for Form 211 Rev 3 Application For Award For Original Information

- Cnic m 3502 2 form

- Request for tenancy approval 5707520 form

- Dpsmngovdivisionsdvs form

- Addendum regarding rental flood disclosure form

- Mindfulness questionnaire for students pdf form

- Cells reading comprehension pdf form

- Wi state bar form 16 fixed rate note

- Methods and assumptions appendix history of the oampc lands form

Find out other Form 211 Rev 3 Application For Award For Original Information

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document