12 08, Page 1 MICHIGAN Nonresident and Part Year Resident Schedule Click on the I for Instructions Form

Understanding the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

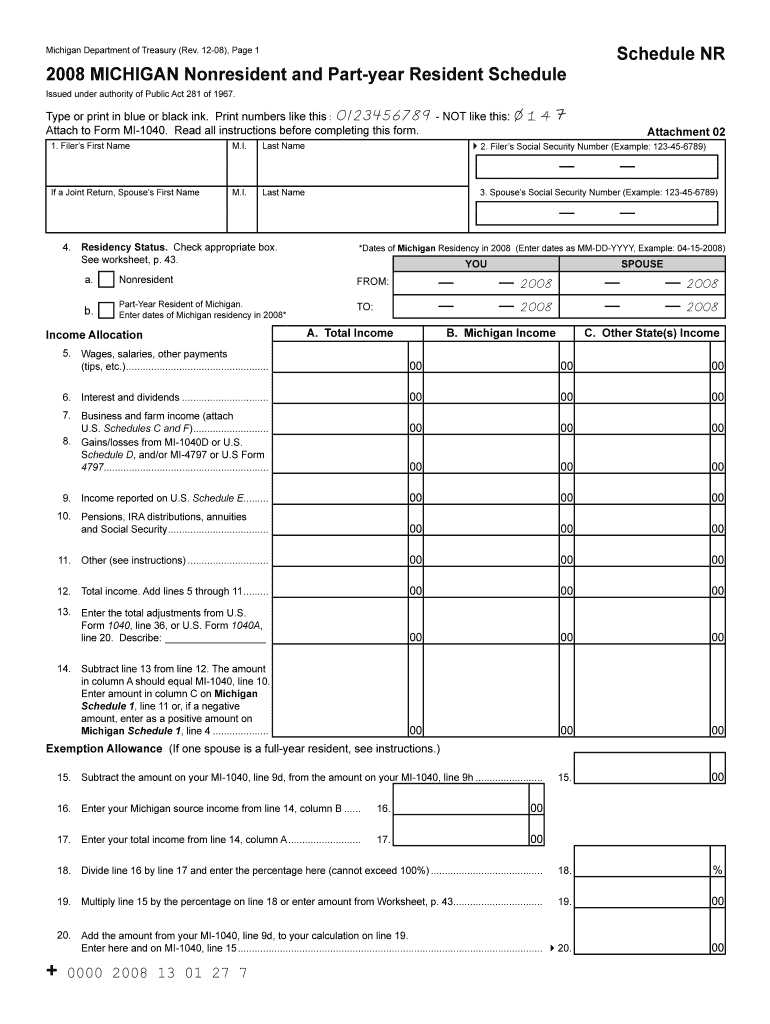

The 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule is a crucial document for individuals who earn income in Michigan but do not reside there full-time. This form is specifically designed for nonresidents and part-year residents to report their income accurately and ensure compliance with state tax laws. It helps determine the appropriate tax liability based on the income earned within Michigan during the tax year.

Steps to Complete the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

Completing the 12 08 form involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, accurately report your total income earned while working in Michigan. You will also need to calculate any deductions or credits applicable to your situation. Finally, ensure that all information is correct before submitting the form to the Michigan Department of Treasury.

Required Documents for the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

To successfully fill out the 12 08 form, you will need specific documents. These typically include:

- W-2 forms from employers indicating income earned in Michigan.

- 1099 forms for other income sources, such as freelance work or interest.

- Any documentation related to deductions, such as receipts for business expenses.

Having these documents ready will streamline the process and help ensure accuracy in your filing.

Filing Deadlines for the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

It is important to be aware of the filing deadlines associated with the 12 08 form. Typically, the deadline for submitting this schedule aligns with the federal tax filing deadline, which is usually April fifteenth. However, if you are unable to meet this deadline, you may be eligible for an extension. Always check for any specific updates or changes from the Michigan Department of Treasury regarding deadlines.

Eligibility Criteria for the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

To use the 12 08 form, you must meet certain eligibility criteria. This includes being a nonresident or part-year resident of Michigan who has earned income in the state. Additionally, you should not be a full-time resident for the tax year in question. Understanding these criteria is essential to ensure that you are filing the correct form and complying with state tax regulations.

Legal Use of the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule

The legal use of the 12 08 form is to report income earned in Michigan by individuals who do not reside in the state full-time. Filing this form accurately is essential to avoid penalties for non-compliance with state tax laws. It is important to adhere to all guidelines provided by the Michigan Department of Treasury to ensure that your filing is legitimate and recognized by the state.

Quick guide on how to complete 12 08 page 1 michigan nonresident and part year resident schedule click on the i for instructions

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-focused process today.

The easiest way to modify and electronically sign [SKS] seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Click On The i For Instructions

Create this form in 5 minutes!

How to create an eSignature for the 12 08 page 1 michigan nonresident and part year resident schedule click on the i for instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Click On The i For Instructions?

The 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Click On The i For Instructions is a tax form designed for nonresident and part-year residents of Michigan. It provides guidance on how to report income and calculate taxes owed. Understanding this form is crucial for compliance with Michigan tax laws.

-

How can airSlate SignNow help with the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule?

airSlate SignNow simplifies the process of completing and submitting the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule. With our eSigning capabilities, you can easily fill out and sign your tax documents online. This ensures accuracy and saves time during tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule. You can streamline your workflow and ensure all documents are completed accurately.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage tax forms like the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule. Our pricing plans are designed to fit various budgets, allowing you to access essential features without overspending.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule alongside your other financial documents, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule, offers numerous benefits. You gain access to a user-friendly interface, secure document storage, and the ability to collaborate with team members in real-time, ensuring a smooth tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information. When working with documents like the 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule, you can trust that your data is safe and secure throughout the entire process.

Get more for 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Click On The i For Instructions

- City of aspen electrical permit application 3 130 south galena street aspen colorado 81611 phone 970 9205090 fax 970 9205440 form

- Form st 14 virginia sales and buse tax certificateb of exemption pdf

- Tsa 403b policy loan request form bis

- Scsg form 20 66 rev 20141109 sg sc

- Building inspection request form county of maui department of

- City of royal oak car show in the park form

- Connecticut state department of education school nurse competency evaluation summary school nurse school school year following form

- Electrical permit application ogemaw county ogemawcountymi form

Find out other 12 08, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Click On The i For Instructions

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later