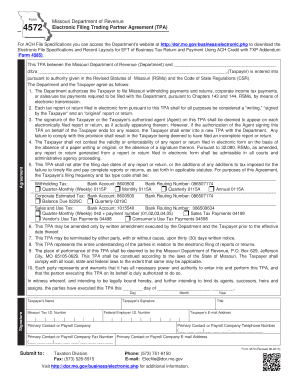

DOR 4585 Missouri Department of Revenue Form

What is the DOR 4585 Missouri Department Of Revenue

The DOR 4585 is a specific form issued by the Missouri Department of Revenue. This form is primarily used for tax-related purposes, enabling individuals and businesses to report certain financial information to the state. It is essential for maintaining compliance with Missouri tax laws and regulations.

Understanding the DOR 4585 is crucial for taxpayers as it outlines the necessary information required for accurate tax reporting. This form may be relevant for various financial activities, including income reporting, deductions, and credits applicable under Missouri law.

How to use the DOR 4585 Missouri Department Of Revenue

Using the DOR 4585 involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary financial documents, including income statements and previous tax returns. This preparation helps in accurately filling out the form.

Once the required documents are in hand, individuals can proceed to fill out the DOR 4585. It is important to follow the instructions provided on the form carefully, ensuring that all sections are completed thoroughly. After completing the form, review it for any errors before submission.

Steps to complete the DOR 4585 Missouri Department Of Revenue

Completing the DOR 4585 involves a systematic approach:

- Gather necessary documents, such as income statements and previous tax returns.

- Obtain the DOR 4585 form from the Missouri Department of Revenue website or office.

- Carefully read the instructions provided with the form.

- Fill out the form, ensuring all required information is included.

- Review the completed form for accuracy and completeness.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Required Documents

To successfully complete the DOR 4585, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation supporting any deductions or credits claimed.

- Identification information, such as Social Security numbers or tax identification numbers.

Having these documents ready can streamline the process and help ensure that the DOR 4585 is filled out accurately.

Form Submission Methods

The DOR 4585 can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers prefer to submit the form electronically through the Missouri Department of Revenue's online portal.

- By Mail: Completed forms can be mailed to the appropriate address specified on the form.

- In-Person: Taxpayers may also choose to submit the form in person at designated Missouri Department of Revenue offices.

Choosing the right submission method is important for ensuring timely processing of the form.

Penalties for Non-Compliance

Failing to submit the DOR 4585 or submitting incorrect information can lead to penalties. The Missouri Department of Revenue may impose fines or interest on any unpaid taxes. Additionally, taxpayers may face legal repercussions for fraudulent reporting.

To avoid these penalties, it is crucial to complete and submit the DOR 4585 accurately and on time. Regularly reviewing tax obligations can help ensure compliance with state regulations.

Quick guide on how to complete dor 4585 missouri department of revenue

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed materials, allowing you to locate the right form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or shareable link—or download it to your computer.

Eliminate concerns about lost or forgotten files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DOR 4585 Missouri Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the dor 4585 missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DOR 4585 Missouri Department Of Revenue form?

The DOR 4585 Missouri Department Of Revenue form is used for various tax-related purposes in Missouri. It is essential for businesses to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow can simplify the process of filling out and submitting this form electronically.

-

How can airSlate SignNow help with the DOR 4585 Missouri Department Of Revenue form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the DOR 4585 Missouri Department Of Revenue form. This streamlines the process, reduces paperwork, and ensures that your documents are securely stored and easily accessible. Our solution enhances efficiency and compliance for businesses dealing with this form.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to features that assist with forms like the DOR 4585 Missouri Department Of Revenue. Contact us for a detailed pricing breakdown.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time collaboration. These tools are particularly beneficial when managing forms like the DOR 4585 Missouri Department Of Revenue, allowing users to complete and sign documents efficiently. Our platform is designed to enhance productivity and streamline workflows.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the DOR 4585 Missouri Department Of Revenue form, are protected. We utilize advanced encryption and secure storage solutions to safeguard your data. You can trust our platform to handle sensitive information with the utmost care.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. Whether you need to connect with CRM systems or accounting software, our platform can seamlessly integrate to help manage documents like the DOR 4585 Missouri Department Of Revenue more effectively.

-

What are the benefits of using airSlate SignNow for the DOR 4585 Missouri Department Of Revenue?

Using airSlate SignNow for the DOR 4585 Missouri Department Of Revenue offers numerous benefits, including time savings, reduced errors, and improved compliance. Our platform simplifies the signing process, allowing you to focus on your business rather than paperwork. Experience the convenience of managing your documents electronically.

Get more for DOR 4585 Missouri Department Of Revenue

- Food processing in food service establishments state of michigan michigan form

- Survivor benefits application section one victim jud ct form

- Registration form 4 2007pub village of glendale heights glendaleheights

- Adjudicatorydispositional orders connecticut judicial branch jud ct form

- Jv 432 six month prepermanency attachment reunification services continued welf amp inst code 36621e judicial council forms

- Application for hearing on exempt status of funds jud ct form

- Form 1097 btc issuer s name street address city state zip code irs

- 08 10 form cms 2552 96 36215 column 6 cost report data

Find out other DOR 4585 Missouri Department Of Revenue

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation