MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo

Understanding the MO 1120 Corporation Income Tax Return and MO FT Franchise Tax Form

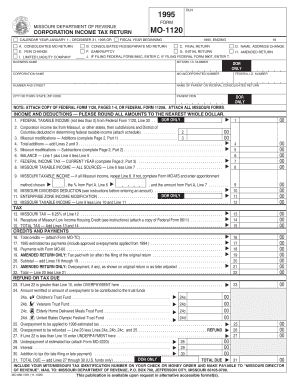

The MO 1120 Corporation Income Tax Return is a crucial document for corporations operating in Missouri. It is used to report income, deductions, and credits to determine the corporation's tax liability. The MO FT Franchise Tax Form is also essential, as it assesses a franchise tax on corporations doing business in Missouri. Both forms are integral to maintaining compliance with state tax regulations and ensuring accurate reporting of financial activities.

Steps to Complete the MO 1120 Corporation Income Tax Return and MO FT Franchise Tax Form

Completing the MO 1120 and MO FT forms involves several key steps:

- Gather all necessary financial records, including income statements, balance sheets, and previous tax returns.

- Fill out the MO 1120 form, ensuring all income, deductions, and credits are accurately reported.

- Complete the MO FT Franchise Tax Form, calculating the franchise tax based on the corporation's revenue.

- Review both forms for accuracy and completeness before submission.

- Submit the forms by the designated filing deadline to avoid penalties.

Required Documents for Filing the MO 1120 and MO FT Forms

To successfully file the MO 1120 Corporation Income Tax Return and the MO FT Franchise Tax Form, certain documents are essential:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of any deductions or credits claimed.

- Previous tax returns for reference and accuracy.

Filing Deadlines for the MO 1120 and MO FT Forms

Timely filing of the MO 1120 and MO FT forms is crucial to avoid penalties. The filing deadline for these forms typically aligns with the federal tax return deadline, which is usually April fifteenth. However, corporations may apply for an extension if necessary, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Digital Submission Options for the MO 1120 and MO FT Forms

Filing the MO 1120 and MO FT forms can be done digitally, providing a convenient option for corporations. Businesses can use electronic filing systems approved by the Missouri Department of Revenue. This method allows for faster processing and confirmation of receipt, reducing the risk of delays associated with paper submissions.

Penalties for Non-Compliance with the MO 1120 and MO FT Forms

Failure to file the MO 1120 Corporation Income Tax Return or the MO FT Franchise Tax Form on time can result in significant penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for corporations to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete mo 1120 corporation income tax returnmo ft franchise tax form dor mo

Complete [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional paper documents that require printing and signing, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The simplest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo

Create this form in 5 minutes!

How to create an eSignature for the mo 1120 corporation income tax returnmo ft franchise tax form dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo?

The MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo is a tax form used by corporations in Missouri to report their income and calculate their franchise tax. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately.

-

How can airSlate SignNow help with the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo?

airSlate SignNow provides a streamlined solution for businesses to eSign and send the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo efficiently. With our platform, you can easily manage document workflows, ensuring that your tax forms are completed and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo. You can choose from monthly or annual subscriptions, with options that include various features to enhance your document management experience.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo, automated reminders, and secure eSigning. These features help ensure that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo alongside your financial records. This integration simplifies the process of preparing and filing your tax forms.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo and other sensitive documents are protected. Our platform uses advanced encryption and security protocols to safeguard your information.

-

What benefits does airSlate SignNow offer for businesses filing tax forms?

Using airSlate SignNow for filing the MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your business rather than administrative tasks.

Get more for MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo

- Nebraska quitclaim deed from individual to llc form

- I am married to form

- Us 00401pdf form

- Florida warranty deed from individuals or husband and wife to three individuals as joint tenants with the right of survivorship form

- I of county ohio form

- South dakota lien account by corporation form

- The public papers and addresses of franklin d roosevelt volume form

- Arbitration agreement future dispute form

Find out other MO 1120 Corporation Income Tax ReturnMO FT Franchise Tax Form Dor Mo

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe