MO MS Corporation Allocation and Apportionment of Income Schedule Form

What is the MO MS Corporation Allocation And Apportionment Of Income Schedule

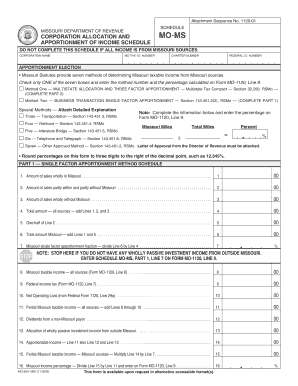

The MO MS Corporation Allocation And Apportionment Of Income Schedule is a crucial document used by corporations operating in Missouri to determine how to allocate and apportion their income for state tax purposes. This schedule helps in calculating the taxable income that is subject to Missouri state tax based on the corporation's business activities within and outside the state. It is particularly important for multi-state corporations, as it ensures compliance with state tax regulations while accurately reflecting the income earned in Missouri.

How to use the MO MS Corporation Allocation And Apportionment Of Income Schedule

To use the MO MS Corporation Allocation And Apportionment Of Income Schedule effectively, a corporation must first gather all relevant financial data, including total income, expenses, and the nature of business activities conducted in Missouri and other states. The corporation should then fill out the schedule by following the instructions provided, ensuring that all income is accurately allocated based on the appropriate apportionment factors. These factors typically include property, payroll, and sales, which help determine the proportion of income attributable to Missouri.

Steps to complete the MO MS Corporation Allocation And Apportionment Of Income Schedule

Completing the MO MS Corporation Allocation And Apportionment Of Income Schedule involves several steps:

- Gather financial records, including income statements and balance sheets.

- Identify the apportionment factors: property, payroll, and sales.

- Calculate the total income earned in Missouri and elsewhere.

- Complete the schedule by entering the calculated figures in the designated fields.

- Review the completed schedule for accuracy before submission.

Key elements of the MO MS Corporation Allocation And Apportionment Of Income Schedule

Several key elements are essential when filling out the MO MS Corporation Allocation And Apportionment Of Income Schedule. These include:

- Apportionment Factors: These factors help determine how much of the total income is taxable in Missouri.

- Income Sources: Clearly differentiate between income earned in Missouri and income from other states.

- Adjustments: Include any necessary adjustments for non-taxable income or expenses that may affect the taxable income.

Legal use of the MO MS Corporation Allocation And Apportionment Of Income Schedule

The MO MS Corporation Allocation And Apportionment Of Income Schedule is legally required for corporations operating in Missouri to ensure compliance with state tax laws. Failing to accurately complete and submit this schedule can result in penalties, interest on unpaid taxes, and potential audits. It is essential for corporations to understand the legal implications of this schedule and to maintain accurate records to support the figures reported.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the MO MS Corporation Allocation And Apportionment Of Income Schedule. Typically, the schedule is due on the same date as the corporation's annual tax return. It is important for businesses to stay informed about any changes to deadlines or requirements to avoid late fees and penalties.

Quick guide on how to complete mo ms corporation allocation and apportionment of income schedule

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MO MS Corporation Allocation And Apportionment Of Income Schedule

Create this form in 5 minutes!

How to create an eSignature for the mo ms corporation allocation and apportionment of income schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO MS Corporation Allocation And Apportionment Of Income Schedule?

The MO MS Corporation Allocation And Apportionment Of Income Schedule is a tax form used by corporations in Missouri to allocate and apportion income for tax purposes. This schedule helps ensure that income is reported accurately based on the corporation's business activities within the state. Understanding this schedule is crucial for compliance and optimizing tax liabilities.

-

How can airSlate SignNow assist with the MO MS Corporation Allocation And Apportionment Of Income Schedule?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign documents related to the MO MS Corporation Allocation And Apportionment Of Income Schedule. With its user-friendly interface, you can easily manage your tax documents and ensure timely submissions. This efficiency can help reduce errors and improve compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger corporations. Each plan provides access to features that can simplify the management of documents like the MO MS Corporation Allocation And Apportionment Of Income Schedule. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are particularly useful for managing the MO MS Corporation Allocation And Apportionment Of Income Schedule, ensuring that all necessary signatures are obtained efficiently. Additionally, the platform supports collaboration among team members.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow complies with all legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that documents like the MO MS Corporation Allocation And Apportionment Of Income Schedule are legally binding and secure. You can confidently use airSlate SignNow for all your eSigning needs.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage services. This capability allows for seamless management of documents related to the MO MS Corporation Allocation And Apportionment Of Income Schedule, enhancing your workflow and productivity.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow empowers businesses by providing a cost-effective solution for document management and eSigning. By using airSlate SignNow for the MO MS Corporation Allocation And Apportionment Of Income Schedule, businesses can save time, reduce paperwork, and improve accuracy in their tax filings. This leads to better compliance and overall efficiency.

Get more for MO MS Corporation Allocation And Apportionment Of Income Schedule

- Form96 1doc

- Form 8233 rev december 2001 fill in capable

- 1545 1743 department of the treasury internal revenue service trustees or custodians name number street and room or suite no form

- Form w 3c pr rev december 2011 internal revenue service

- Form 4506 t request for transcript of tax return omb no

- Sta no es una solicitud de pr rroga para presentar la declaraci n form

- Form 911 rev march 2000 not fill in capable application for taxpayer assistance order atao

- Form 1001 rev july 1998 not fill in capable ownership exemption or reduced rate certificate

Find out other MO MS Corporation Allocation And Apportionment Of Income Schedule

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word