Form 911 Rev March NOT Fill in Capable Application for Taxpayer Assistance Order ATAO

What is the Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

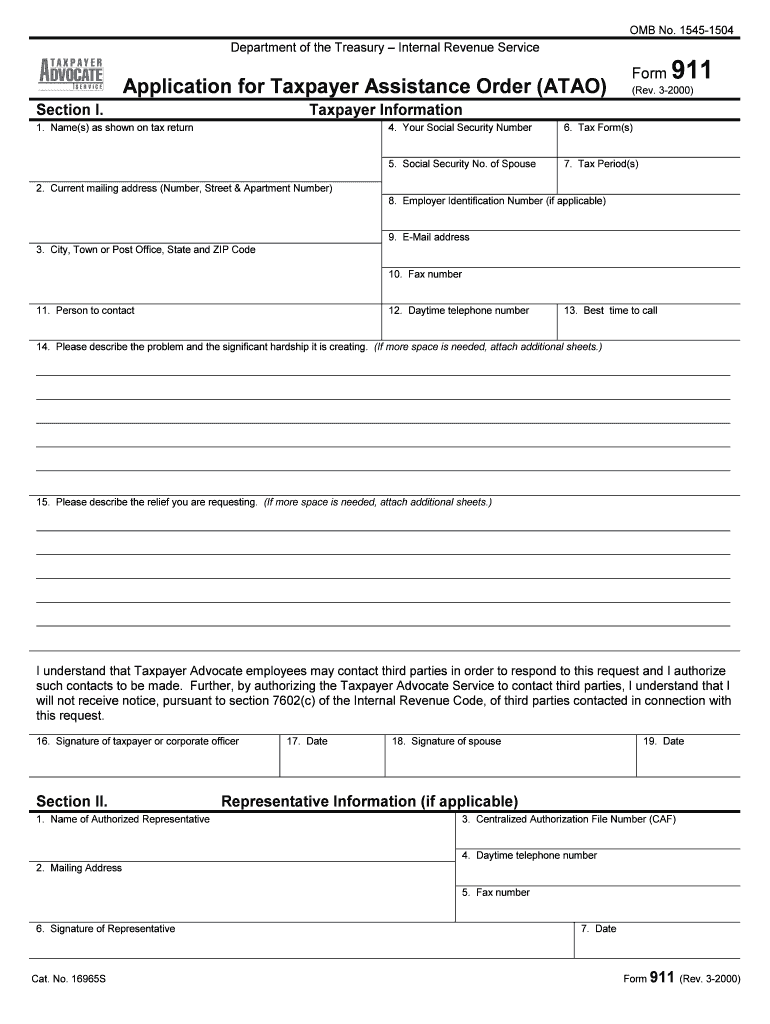

The Form 911, also known as the Application for Taxpayer Assistance Order (ATAO), is a critical document used by taxpayers in the United States seeking assistance with tax-related issues. This specific version, revised in March 2000, is not fillable online, meaning it must be printed and completed manually. The form serves as a formal request to the IRS for expedited assistance when a taxpayer faces significant hardship or delays in resolving tax matters. Understanding the purpose and requirements of this form is essential for ensuring that taxpayers can effectively communicate their needs to the IRS.

How to obtain the Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

To obtain the Form 911, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Alternatively, individuals can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that the correct version of the form is used, as updates may occur. Taxpayers should verify that they have the March 2000 revision to avoid any issues during submission.

Steps to complete the Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

Completing the Form 911 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your Social Security number, tax identification number, and details about the tax issue you are facing. Next, carefully fill out each section of the form, providing clear and concise explanations of your situation. It is crucial to include any supporting documents that may strengthen your case for assistance. Once completed, review the form for any errors before signing and dating it. Finally, submit the form according to the instructions provided, either by mail or in person at your local IRS office.

Legal use of the Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

The legal use of the Form 911 is governed by IRS guidelines that outline when and how the form should be utilized. Taxpayers are entitled to request assistance when they experience undue hardship due to IRS actions or delays. The form must be completed accurately and submitted in accordance with IRS regulations to be considered valid. It is essential for taxpayers to understand their rights and obligations when using this form to ensure compliance with tax laws and to facilitate a successful resolution of their issues.

Key elements of the Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

Key elements of the Form 911 include personal identification information, a detailed description of the taxpayer's situation, and a clear request for assistance. The form requires taxpayers to outline the specific issues they are facing and the impact these issues have on their financial situation. Additionally, taxpayers must provide any relevant documentation that supports their claims. The clarity and completeness of the information provided are crucial for the IRS to assess the request effectively.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 911. These guidelines emphasize the importance of providing accurate and comprehensive information to facilitate the review process. Taxpayers are encouraged to refer to the IRS website or contact the IRS directly for the most current instructions and requirements related to the form. Following these guidelines helps ensure that requests for assistance are processed efficiently and effectively.

Quick guide on how to complete form 911 rev march 2000 not fill in capable application for taxpayer assistance order atao

Effortlessly complete Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed forms, allowing you to locate the necessary paperwork and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without any delays. Handle Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO across any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

The most effective way to modify and electronically sign Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO effortlessly

- Locate Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 911 rev march 2000 not fill in capable application for taxpayer assistance order atao

How to generate an electronic signature for the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao online

How to make an electronic signature for the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao in Chrome

How to make an electronic signature for putting it on the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao in Gmail

How to make an electronic signature for the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao from your smartphone

How to create an electronic signature for the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao on iOS

How to generate an electronic signature for the Form 911 Rev March 2000 Not Fill In Capable Application For Taxpayer Assistance Order Atao on Android OS

People also ask

-

What is the purpose of form 911 in airSlate SignNow?

Form 911 in airSlate SignNow allows you to create, send, and eSign important documents quickly and securely. It’s designed to streamline document workflows, making it ideal for businesses looking to enhance their efficiency and reduce paperwork.

-

How does airSlate SignNow integrate with form 911?

The integration of form 911 within airSlate SignNow ensures seamless document management. You can easily incorporate the form into your existing workflows, allowing for a more organized approach to eSigning and document processing.

-

Is there a free trial for using form 911 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to test the functionality of form 911 without any commitment. This is a great opportunity to explore its features and see how it can meet your business needs.

-

What features does form 911 offer in airSlate SignNow?

Form 911 includes features such as customizable templates, automated reminders, and secure document storage. These capabilities help ensure that your documents are both professional and compliant while enhancing the overall signing experience.

-

What are the pricing options for using form 911 with airSlate SignNow?

Pricing for airSlate SignNow, including access to form 911, is tailored to fit various business sizes and needs. You can choose from different plans that offer various features and user limits to ensure you find the ideal fit for your organization.

-

Can I use form 911 for multiple document types?

Yes, form 911 in airSlate SignNow is versatile and can be used for various document types, including contracts, consent forms, and more. This flexibility allows businesses to streamline their processes across different document requirements.

-

What benefits can I expect from using form 911 in airSlate SignNow?

Using form 911 in airSlate SignNow provides numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced collaboration among team members. These advantages contribute to smoother operations and improved customer satisfaction.

Get more for Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

- Wellstar new patient forms

- Calculating tax on beer omb no 1513 0083 form

- Tdlr form

- Rpd 41329 sustainable building tax credit claim form tax newmexico

- Account upgrade form

- Priority processing request form

- Creative retainer proposal pdf form

- Article 19 a motor carrier accident and conviction notification program application 535906788 form

Find out other Form 911 Rev March NOT Fill In Capable Application For Taxpayer Assistance Order ATAO

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors