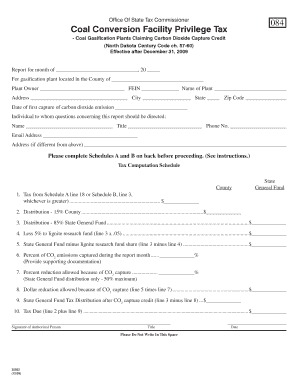

Coal Conversion Facility Privilege Tax Coal Gasification Plants Carbon Dioxide Credit Coal Conversion Facility Privilege Tax Coa Form

Understanding the Coal Conversion Facility Privilege Tax

The Coal Conversion Facility Privilege Tax is a specific tax imposed on coal gasification plants within the United States. This tax is designed to generate revenue from facilities that convert coal into gas, which can then be used for energy production or other industrial purposes. The tax applies to the privilege of operating such facilities and is often calculated based on the amount of coal processed or the energy produced. Understanding this tax is crucial for businesses involved in coal gasification, as it can significantly impact operational costs and financial planning.

Key Elements of the Coal Conversion Facility Privilege Tax

Several key elements define the Coal Conversion Facility Privilege Tax. These include:

- Tax Rate: The specific rate applied to the facility, which may vary by state or locality.

- Calculation Basis: The method used to calculate the tax, often based on production metrics.

- Exemptions: Certain facilities may qualify for exemptions or reduced rates based on specific criteria.

- Compliance Requirements: Facilities must adhere to reporting and payment schedules to remain compliant with tax laws.

Steps to Complete the Coal Conversion Facility Privilege Tax Filing

Filing for the Coal Conversion Facility Privilege Tax involves several important steps:

- Determine the applicable tax rate based on your facility's location.

- Calculate the total amount of coal processed during the tax period.

- Complete the required tax forms, ensuring all information is accurate.

- Submit the forms by the designated deadline to avoid penalties.

- Keep records of all submissions and calculations for future reference.

Legal Use of the Coal Conversion Facility Privilege Tax

The legal framework surrounding the Coal Conversion Facility Privilege Tax is established by state and federal regulations. It is essential for operators of coal gasification plants to understand their legal obligations, including tax reporting and payment requirements. Non-compliance can result in penalties, including fines or legal action. Consulting with a tax professional or legal advisor can provide clarity on these obligations and help ensure compliance.

Eligibility Criteria for the Coal Conversion Facility Privilege Tax

Eligibility for the Coal Conversion Facility Privilege Tax generally depends on the type of facility and its operational status. Key criteria include:

- The facility must be engaged in the conversion of coal to gas.

- It must be located within a jurisdiction that imposes this tax.

- Facilities must comply with environmental regulations and obtain necessary permits.

Examples of Using the Coal Conversion Facility Privilege Tax

Understanding how the Coal Conversion Facility Privilege Tax applies in real-world scenarios can provide valuable insights. For instance:

- A coal gasification plant producing a significant amount of energy may face a higher tax burden due to increased production levels.

- Facilities that implement environmentally friendly practices may qualify for tax credits or exemptions.

- New entrants in the coal gasification market should assess potential tax liabilities to inform their business plans.

Quick guide on how to complete coal conversion facility privilege tax coal gasification plants carbon dioxide credit coal conversion facility privilege tax

Easily prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without holdups. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the coal conversion facility privilege tax coal gasification plants carbon dioxide credit coal conversion facility privilege tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Coal Conversion Facility Privilege Tax and how does it apply to Coal Gasification Plants?

The Coal Conversion Facility Privilege Tax is a tax imposed on facilities that convert coal into gas. This tax is specifically relevant for Coal Gasification Plants, which utilize coal to produce synthetic gas. Understanding this tax is crucial for businesses operating in this sector to ensure compliance and optimize their financial strategies.

-

How can I benefit from the Carbon Dioxide Credit associated with Coal Conversion Facilities?

The Carbon Dioxide Credit allows Coal Conversion Facilities to receive financial incentives for reducing carbon emissions. By participating in this program, Coal Gasification Plants can lower their operational costs and enhance their sustainability profile. This credit can signNowly improve the financial viability of your facility.

-

What features does airSlate SignNow offer for managing documents related to Coal Conversion Facility Privilege Tax?

airSlate SignNow provides a range of features tailored for managing documents related to the Coal Conversion Facility Privilege Tax. Users can easily create, send, and eSign documents, ensuring compliance with tax regulations. The platform's user-friendly interface simplifies the documentation process for Coal Gasification Plants.

-

Is airSlate SignNow cost-effective for businesses involved in Coal Gasification?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, including those involved in Coal Gasification. With competitive pricing and a variety of plans, it allows companies to manage their documentation efficiently without incurring high costs. This is particularly beneficial for managing the complexities of the Coal Conversion Facility Privilege Tax.

-

What integrations does airSlate SignNow offer for Coal Gasification Plants?

airSlate SignNow integrates seamlessly with various business applications, enhancing workflow efficiency for Coal Gasification Plants. These integrations allow for streamlined document management and compliance tracking related to the Coal Conversion Facility Privilege Tax. This ensures that all necessary documentation is easily accessible and manageable.

-

How does airSlate SignNow ensure compliance with the Coal Conversion Facility Privilege Tax regulations?

airSlate SignNow helps ensure compliance with the Coal Conversion Facility Privilege Tax regulations by providing templates and tools specifically designed for this purpose. Users can create compliant documents quickly and efficiently, reducing the risk of errors. This is essential for Coal Gasification Plants to maintain regulatory compliance.

-

Can airSlate SignNow help in tracking Carbon Dioxide Credits for my facility?

Absolutely! airSlate SignNow can assist in tracking Carbon Dioxide Credits by providing tools for document management and compliance tracking. This is particularly useful for Coal Conversion Facilities looking to maximize their credits and ensure they are meeting all necessary requirements. Efficient tracking can lead to signNow financial benefits.

Get more for Coal Conversion Facility Privilege Tax Coal Gasification Plants Carbon Dioxide Credit Coal Conversion Facility Privilege Tax Coa

- Landlord tenant and michigan courts form

- Uniform child order 2014 2018

- Pc 639 petition for appointment of conservator michigan courts courts mi form

- Mc 315 authorization 2017 2019 form

- Parenting plan missouri 2018 2019 form

- Warrant to satisfy judgment nj judiciary form

- Fill a online pti 2016 2019 form

- Criminal procedure law section 30301 manual 2017 2018 form

Find out other Coal Conversion Facility Privilege Tax Coal Gasification Plants Carbon Dioxide Credit Coal Conversion Facility Privilege Tax Coa

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile