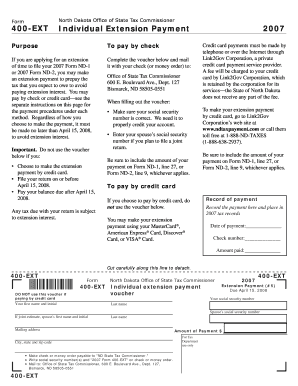

Form 400 EXT Individual Extension Payment State of North Dakota

What is the Form 400 EXT Individual Extension Payment State Of North Dakota

The Form 400 EXT is a tax form used by individuals in North Dakota to request an extension for filing their state income tax return. This form allows taxpayers to extend their filing deadline, providing additional time to complete their tax returns without incurring penalties for late submission. It is important to note that while the form extends the filing deadline, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and submit any payment due by the original filing deadline to avoid interest and penalties.

How to use the Form 400 EXT Individual Extension Payment State Of North Dakota

To use the Form 400 EXT, individuals should first gather their financial information, including income, deductions, and credits. After estimating their tax liability, they will complete the form by providing their personal information, such as name, address, and Social Security number. The form requires taxpayers to indicate the amount of tax they expect to owe and any payment they are submitting along with the form. Once completed, the form can be submitted either online or via mail, depending on the taxpayer's preference.

Steps to complete the Form 400 EXT Individual Extension Payment State Of North Dakota

Completing the Form 400 EXT involves several straightforward steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Estimate your total tax liability for the year.

- Fill out the form with your personal information and estimated tax amount.

- Calculate any payment due and include it with your submission.

- Review the completed form for accuracy.

- Submit the form either electronically or by mailing it to the appropriate state department.

Filing Deadlines / Important Dates

For the Form 400 EXT, the filing deadline typically aligns with the original due date for state income tax returns, which is usually April fifteenth. However, taxpayers should be aware of specific deadlines for submitting the extension request and any payments due. It is advisable to check the North Dakota Department of Revenue website for the most current deadlines and any changes that may occur from year to year.

Required Documents

When completing the Form 400 EXT, individuals should have the following documents ready:

- Previous year’s tax return for reference.

- W-2 forms and 1099s for income verification.

- Records of any deductions or credits you plan to claim.

- Bank account information if opting for electronic payment.

Penalties for Non-Compliance

Failing to file the Form 400 EXT by the deadline can result in penalties and interest on any unpaid taxes. If a taxpayer does not submit the form and does not file their return on time, they may face a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes from the original due date until the tax is paid in full. It is crucial to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete form 400 ext individual extension payment state of north dakota

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed papers, enabling you to obtain the necessary template and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest way to adjust and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow manages all your document administration needs with just a few clicks from whichever device you prefer. Adjust and eSign [SKS] and guarantee exceptional communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 400 EXT Individual Extension Payment State Of North Dakota

Create this form in 5 minutes!

How to create an eSignature for the form 400 ext individual extension payment state of north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 400 EXT Individual Extension Payment State Of North Dakota?

The Form 400 EXT Individual Extension Payment State Of North Dakota is a tax form used by individuals to request an extension for filing their state income tax returns. This form allows taxpayers to make a payment towards their estimated tax liability while extending their filing deadline. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Form 400 EXT Individual Extension Payment State Of North Dakota?

airSlate SignNow simplifies the process of completing and submitting the Form 400 EXT Individual Extension Payment State Of North Dakota. With our platform, you can easily fill out the form, eSign it, and send it directly to the state tax authority. This streamlines your tax filing process and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow for the Form 400 EXT Individual Extension Payment State Of North Dakota?

airSlate SignNow offers flexible pricing plans that cater to different needs, including individual users and businesses. Our plans are cost-effective, allowing you to manage your Form 400 EXT Individual Extension Payment State Of North Dakota without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

Are there any features specifically designed for the Form 400 EXT Individual Extension Payment State Of North Dakota?

Yes, airSlate SignNow includes features tailored for the Form 400 EXT Individual Extension Payment State Of North Dakota, such as customizable templates and automated reminders. These features help ensure that you complete and submit your form accurately and on time. Additionally, our platform provides secure storage for your documents.

-

What are the benefits of using airSlate SignNow for tax forms like the Form 400 EXT Individual Extension Payment State Of North Dakota?

Using airSlate SignNow for the Form 400 EXT Individual Extension Payment State Of North Dakota offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document sharing, which saves you time and effort. Moreover, it enhances the security of your sensitive tax information.

-

Can I integrate airSlate SignNow with other software for managing the Form 400 EXT Individual Extension Payment State Of North Dakota?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Form 400 EXT Individual Extension Payment State Of North Dakota alongside your other business tools. This integration helps streamline your workflow and keeps all your documents organized in one place.

-

Is airSlate SignNow compliant with state regulations for the Form 400 EXT Individual Extension Payment State Of North Dakota?

Yes, airSlate SignNow is designed to comply with state regulations, including those pertaining to the Form 400 EXT Individual Extension Payment State Of North Dakota. Our platform adheres to the necessary legal standards for electronic signatures and document submissions, ensuring that your filings are valid and secure.

Get more for Form 400 EXT Individual Extension Payment State Of North Dakota

Find out other Form 400 EXT Individual Extension Payment State Of North Dakota

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free