Ca 540 Tax Form 2017

What is the Ca 540 Tax Form

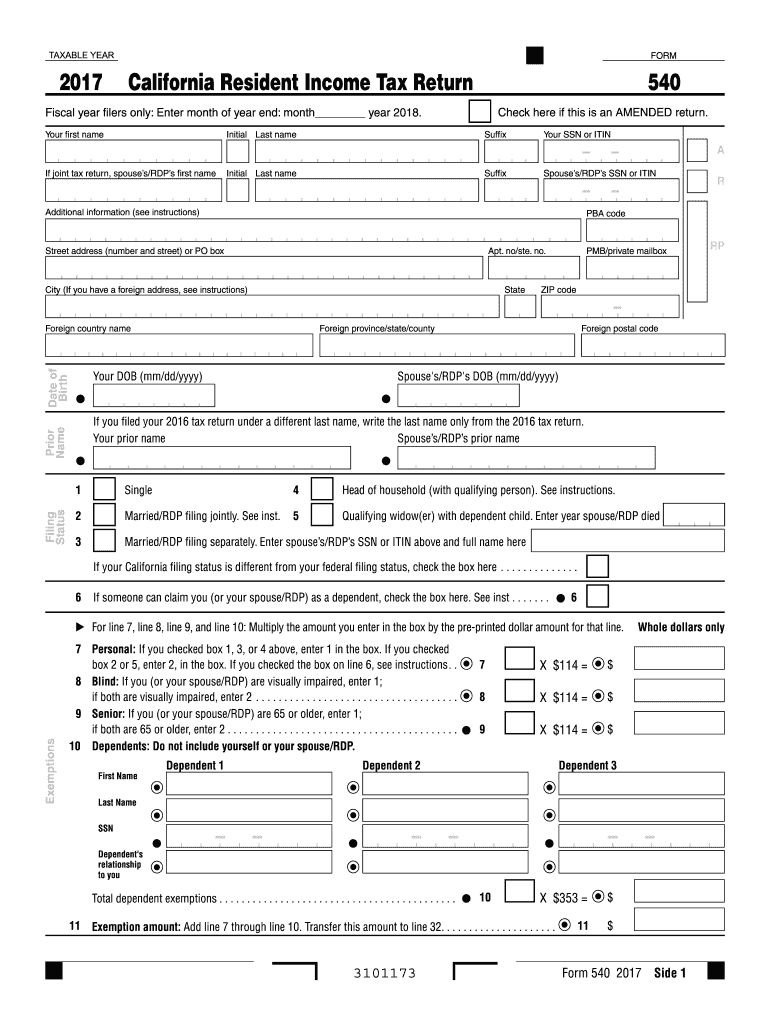

The Ca 540 Tax Form is the primary income tax return form used by residents of California to report their income to the state. This form is essential for individuals who need to calculate their state tax liability based on their earnings during the tax year. The Ca 540 is designed for residents who meet specific criteria, including income thresholds and residency status. It allows taxpayers to claim deductions, credits, and exemptions applicable to their financial situation.

How to use the Ca 540 Tax Form

Using the Ca 540 Tax Form involves several steps to ensure accurate reporting of income and tax liability. Taxpayers begin by gathering necessary documentation, such as W-2 forms, 1099s, and records of any other income. Next, they fill out the form, providing details about their income, deductions, and credits. After completing the form, individuals must review it for accuracy before submitting it to the California Franchise Tax Board. It is important to keep copies of all submitted documents for personal records.

Steps to complete the Ca 540 Tax Form

Completing the Ca 540 Tax Form requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, including income statements and receipts for deductible expenses.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim applicable deductions, such as those for mortgage interest, medical expenses, and state taxes paid.

- Calculate the total tax liability using the provided tax tables or software.

- Review the completed form for any errors before signing and dating it.

- Submit the form electronically or via mail to the appropriate state tax authority.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Ca 540 Tax Form. Typically, the deadline for filing is April 15 of the following year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Extensions may be available, but they do not extend the time to pay any taxes owed. It is crucial to stay informed about any changes to deadlines, especially during tax season, to avoid penalties and interest on late payments.

Required Documents

To accurately complete the Ca 540 Tax Form, taxpayers need to gather several key documents, including:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest.

- Any prior year tax returns that may provide useful information.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Ca 540 Tax Form through various methods, providing flexibility based on personal preference. The options include:

- Online submission through the California Franchise Tax Board's website, which is often the fastest method.

- Mailing a printed version of the completed form to the designated address provided in the form instructions.

- In-person submission at designated tax offices, although this option may be limited due to location and availability.

Quick guide on how to complete ca 540 tax form 2017

Your instructional manual on preparing your Ca 540 Tax Form

If you are looking to understand how to complete and transmit your Ca 540 Tax Form, here are some concise guidelines to facilitate the tax submission process.

To begin, simply create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly user-friendly and effective document platform that enables you to edit, generate, and finalize your income tax papers effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to modify answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the steps below to complete your Ca 540 Tax Form swiftly:

- Establish your account and begin working on PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Ca 540 Tax Form in our editor.

- Complete the necessary fillable fields with your data (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to increased errors and delays in refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ca 540 tax form 2017

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the ca 540 tax form 2017

How to make an electronic signature for your Ca 540 Tax Form 2017 in the online mode

How to make an eSignature for the Ca 540 Tax Form 2017 in Google Chrome

How to create an eSignature for signing the Ca 540 Tax Form 2017 in Gmail

How to create an electronic signature for the Ca 540 Tax Form 2017 from your smartphone

How to generate an electronic signature for the Ca 540 Tax Form 2017 on iOS

How to make an electronic signature for the Ca 540 Tax Form 2017 on Android devices

People also ask

-

What is the CA 540 Tax Form?

The CA 540 Tax Form is a personal income tax return used by California residents to report their income and calculate their tax liabilities. It allows taxpayers to claim deductions and credits to potentially reduce their tax owed. Understanding how to accurately fill out the CA 540 Tax Form is crucial for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the CA 540 Tax Form?

airSlate SignNow simplifies the process of eSigning the CA 540 Tax Form, ensuring an efficient and legally binding signature collection. With its user-friendly interface, you can easily send your documents for signatures. This enables faster tax processing and enhances the overall efficiency of document management.

-

What are the pricing options for using airSlate SignNow with the CA 540 Tax Form?

airSlate SignNow offers various pricing plans that cater to all business sizes, making it a cost-effective solution for handling documents like the CA 540 Tax Form. Plans are designed to fit different needs, from basic functionalities to advanced features for high-volume users. You can choose the one that best suits your budget and requirements.

-

Is airSlate SignNow secure for eSigning the CA 540 Tax Form?

Yes, airSlate SignNow prioritizes security, ensuring that your CA 540 Tax Form and other documents are protected with advanced encryption and compliance with data protection regulations. The platform provides secure access and a complete audit trail, giving you peace of mind when handling sensitive tax information.

-

Can I integrate airSlate SignNow with other software for managing the CA 540 Tax Form?

Absolutely! airSlate SignNow supports seamless integrations with various software tools such as Google Drive, Salesforce, and more. This integration allows you to streamline your document management process, making it easier to retrieve, sign, and store your CA 540 Tax Form with other essential documents.

-

What are the benefits of using airSlate SignNow for the CA 540 Tax Form?

Using airSlate SignNow for your CA 540 Tax Form offers numerous benefits, including faster turnaround times, improved accuracy, and a simplified signing process. The platform reduces the need for physical paperwork and offers templates that can further enhance your efficiency. Overall, it helps you manage your tax documents effectively.

-

How quickly can I send and receive the CA 540 Tax Form with airSlate SignNow?

With airSlate SignNow, you can send and receive your CA 540 Tax Form almost instantly. The platform is designed for quick electronic document flow, allowing you to eSign and return documents without delays. This helps you meet your tax deadlines effectively and keeps your processes running smoothly.

Get more for Ca 540 Tax Form

Find out other Ca 540 Tax Form

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement