V Payment Form 2019

What is the V Payment Form

The California Form V, commonly referred to as the V Payment Form, is a tax document used by individuals and businesses to report and make payments for various tax obligations. This form is essential for ensuring compliance with state tax regulations and helps facilitate the timely payment of taxes owed to the California Franchise Tax Board (FTB). The V Payment Form is particularly relevant for those who need to submit estimated tax payments or make payments associated with their tax returns.

How to use the V Payment Form

Using the California Form V involves several straightforward steps. First, you need to determine if you are required to make a payment using this form based on your tax situation. Once confirmed, you can obtain the form from the California Franchise Tax Board's website or through authorized tax preparation software. After filling out the necessary information, including your personal details and payment amount, you can submit the form either electronically or by mail. It's important to keep a copy of the completed form for your records.

Steps to complete the V Payment Form

Completing the California Form V requires careful attention to detail. Follow these steps:

- Download the form from the California Franchise Tax Board's website or access it through tax software.

- Fill in your name, address, and taxpayer identification number accurately.

- Indicate the payment amount and the tax year for which the payment is being made.

- Review the form for any errors or omissions before submission.

- Choose your submission method: electronic filing or mailing the form to the appropriate address.

Legal use of the V Payment Form

The California Form V is legally recognized for making tax payments to the state. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions, such as penalties or interest on late payments. The form must comply with the guidelines set forth by the California Franchise Tax Board and should be used in accordance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the California Form V are crucial to adhere to in order to avoid penalties. Typically, estimated tax payments are due quarterly, with specific deadlines throughout the year. For the most accurate and up-to-date information on filing dates, it is advisable to consult the California Franchise Tax Board's official calendar or guidelines. Mark these dates on your calendar to ensure timely submission of your payments.

Form Submission Methods

The California Form V can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer to file electronically through the California Franchise Tax Board's online portal, which offers a secure and efficient way to submit payments.

- Mail: Taxpayers can also print the completed form and send it via postal mail to the designated address provided by the FTB.

- In-Person: Some individuals may choose to deliver the form in person at a local FTB office, ensuring immediate processing.

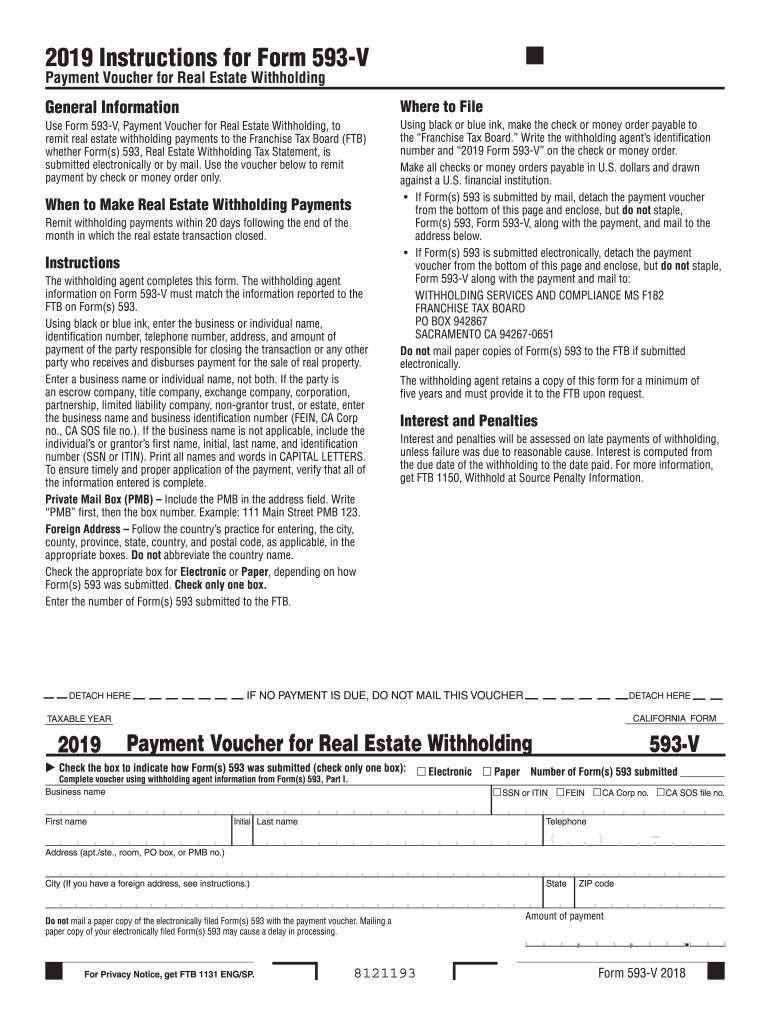

Quick guide on how to complete 2019 california form 593 v payment voucher for real estate withholding 2019 california form 593 v payment voucher for real

Your assistance manual on how to prepare your V Payment Form

If you’re curious about how to generate and send your V Payment Form, here are some brief guidelines on how to facilitate tax processing.

To begin, you only need to register your airSlate SignNow profile to transform the way you manage documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and return to make adjustments as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps outlined below to complete your V Payment Form in just a few minutes:

- Establish your account and start managing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Select Get form to access your V Payment Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save alterations, print your copy, send it to your recipient, and download it onto your device.

Use this manual to file your taxes electronically with airSlate SignNow. Kindly be aware that submitting on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct 2019 california form 593 v payment voucher for real estate withholding 2019 california form 593 v payment voucher for real

Create this form in 5 minutes!

How to create an eSignature for the 2019 california form 593 v payment voucher for real estate withholding 2019 california form 593 v payment voucher for real

How to create an eSignature for the 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real online

How to create an electronic signature for your 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real in Google Chrome

How to create an electronic signature for putting it on the 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real in Gmail

How to create an eSignature for the 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real from your smart phone

How to make an electronic signature for the 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real on iOS

How to make an eSignature for the 2019 California Form 593 V Payment Voucher For Real Estate Withholding 2019 California Form 593 V Payment Voucher For Real on Android

People also ask

-

What is California Form V and how can airSlate SignNow assist with it?

California Form V is a required document for certain legal and tax purposes within the state. airSlate SignNow provides a user-friendly platform that allows businesses to effortlessly fill out, send, and eSign California Form V, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for processing California Form V?

airSlate SignNow offers competitive pricing plans that are designed to cater to businesses of all sizes. You'll be able to handle California Form V efficiently without breaking your budget, making eSigning and document management cost-effective.

-

What features does airSlate SignNow offer for California Form V?

airSlate SignNow provides a range of features that streamline the completion of California Form V, including templates, automated reminders, and advanced security measures. These features enhance usability and ensure that your documents are processed securely and quickly.

-

Is airSlate SignNow suitable for small businesses handling California Form V?

Absolutely! airSlate SignNow is tailored for businesses of all sizes, including small businesses. Its intuitive interface and affordable pricing make it an ideal solution for efficiently managing California Form V and other essential documents.

-

Can I integrate airSlate SignNow with other software for California Form V?

Yes, airSlate SignNow supports various integrations with popular software applications, enhancing your workflow when managing California Form V. Whether you use CRM systems, account software, or cloud storage, airSlate SignNow can connect seamlessly.

-

How secure is the signing process for California Form V in airSlate SignNow?

The signing process for California Form V in airSlate SignNow is highly secure, utilizing industry-standard encryption and compliance with regulations. This ensures that both your data and signed documents remain protected throughout the entire process.

-

What are the benefits of using airSlate SignNow for California Form V?

Using airSlate SignNow for California Form V offers numerous benefits including faster processing times, reduced paperwork, and enhanced collaboration. Moreover, you can track document status and get real-time notifications, boosting productivity.

Get more for V Payment Form

- Ociece form

- Media accreditation form cev pallavolo lugano

- Watch repair form for usa only relic

- Replacement diploma order form university of central arkansas uca

- Form 5 20 application for imrf pension dps109 dps109

- Dwaynes photo order form black and white

- Fairfaxhighsports form

- Internship learn contract template form

Find out other V Payment Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document