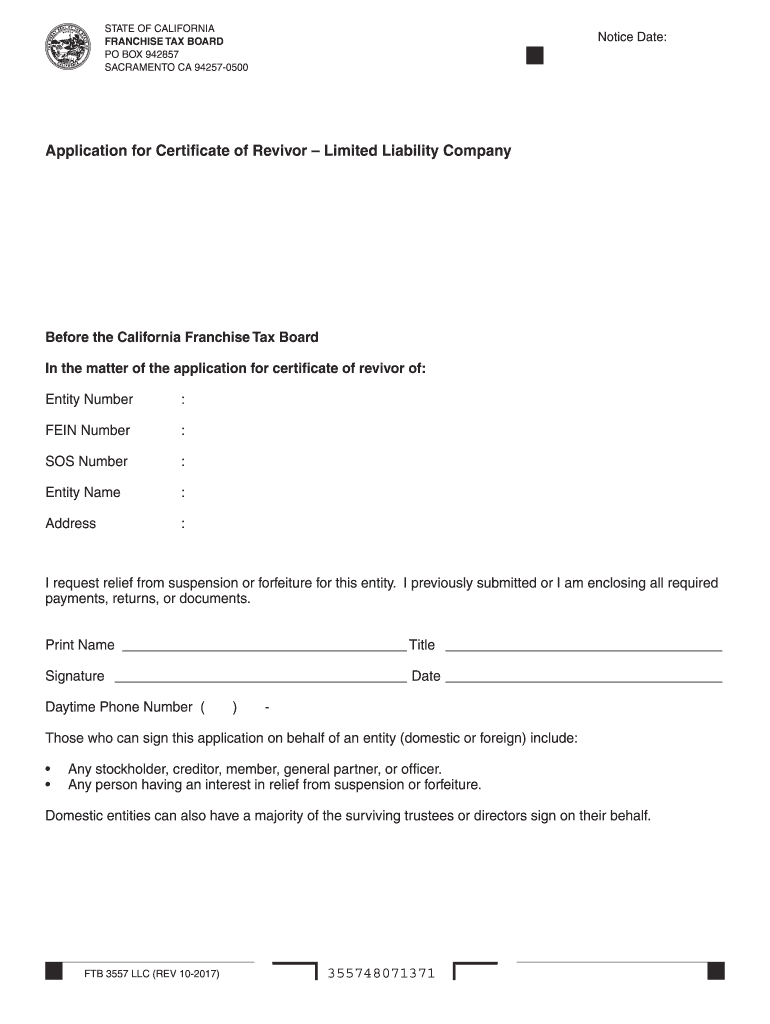

Form 3557 2017-2026

What is the Form 3557

The Form 3557, also known as the FTB Form 3557 LLC, is a document used by limited liability companies (LLCs) in California to report their income and expenses to the Franchise Tax Board (FTB). This form is essential for maintaining compliance with state tax regulations. It allows LLCs to declare their income, deductions, and any applicable credits, ensuring that they meet their tax obligations. The form is specifically designed to cater to the unique needs of LLCs, which may differ from other business entities in terms of taxation and reporting requirements.

Steps to Complete the Form 3557

Completing the Form 3557 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Next, fill out the form by providing your LLC's name, address, and tax identification number. Then, report your total income and allowable deductions in the designated sections. Be sure to double-check all entries for accuracy. After completing the form, sign and date it. Finally, submit the form either electronically or via mail to the FTB, following the specific submission guidelines for your situation.

How to Obtain the Form 3557

The Form 3557 can be easily obtained from the California Franchise Tax Board's official website. It is available in a downloadable PDF format, which allows for easy printing and completion. Additionally, some tax preparation software may include the form, enabling users to fill it out digitally. If you prefer a physical copy, you can request one directly from the FTB or visit their local office to pick one up. Always ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Form 3557

The legal use of the Form 3557 is essential for LLCs to fulfill their tax obligations in California. By accurately completing and submitting this form, LLCs can avoid penalties and ensure they are in good standing with the FTB. The form must be filed annually, and it is crucial to adhere to all relevant state laws and regulations. Additionally, using an eSignature solution can enhance the legal validity of the form, as the FTB accepts electronic signatures under the ESIGN Act, streamlining the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3557 are critical for compliance. Typically, LLCs must submit this form by the 15th day of the fourth month following the close of their tax year. For most LLCs operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances. Marking these dates on your calendar can help ensure timely submission and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

LLCs have several options for submitting the Form 3557. The most efficient method is to file electronically through the FTB's online portal, which allows for quick processing and confirmation of receipt. Alternatively, you can mail the completed form to the FTB's designated address. If you prefer to submit the form in person, you may visit a local FTB office. Regardless of the method chosen, ensure that you keep a copy of the submitted form and any confirmation for your records.

Quick guide on how to complete 3557 llc form 2017 2019

Your assistance manual on how to prepare your Form 3557

If you wish to learn how to complete and submit your Form 3557, here are some concise instructions on how to make tax reporting much more convenient.

To start, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to change information when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Form 3557 in just a few minutes:

- Register your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through editions and schedules.

- Click Get form to open your Form 3557 in our editor.

- Complete the essential fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to higher return errors and prolonged refunds. It goes without saying, before e-filing your taxes, check the IRS website for submission rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct 3557 llc form 2017 2019

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the 3557 llc form 2017 2019

How to make an eSignature for your 3557 Llc Form 2017 2019 online

How to generate an eSignature for the 3557 Llc Form 2017 2019 in Google Chrome

How to create an electronic signature for signing the 3557 Llc Form 2017 2019 in Gmail

How to make an eSignature for the 3557 Llc Form 2017 2019 straight from your mobile device

How to generate an eSignature for the 3557 Llc Form 2017 2019 on iOS

How to generate an eSignature for the 3557 Llc Form 2017 2019 on Android

People also ask

-

What is form 3557 and how can airSlate SignNow help?

Form 3557 is a document used for various legal and administrative purposes. airSlate SignNow provides an easy-to-use platform to electronically sign, send, and manage form 3557 documents securely and efficiently, ensuring compliance and streamlining your workflow.

-

How much does it cost to use airSlate SignNow for form 3557?

airSlate SignNow offers a range of pricing plans suitable for different business needs. You can start with a free trial to assess its features for managing form 3557, and then choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for form 3557?

Yes, airSlate SignNow supports integrations with various applications, allowing you to seamlessly manage form 3557 alongside your other business tools. This helps in enhancing productivity and ensuring that you can efficiently access and utilize your document management system.

-

What features does airSlate SignNow offer for handling form 3557?

airSlate SignNow provides features such as customizable templates, advanced security options, and real-time tracking for form 3557 documents. These features enhance the overall user experience, making it easier to create, send, and sign important documents.

-

Is airSlate SignNow compliant with legal standards for form 3557?

Absolutely! airSlate SignNow adheres to industry regulations and compliance standards, making it a secure choice for handling form 3557. It ensures that your electronic signatures and document transactions are legally binding and trustworthy.

-

What are the benefits of using airSlate SignNow for form 3557?

The primary benefits of using airSlate SignNow for form 3557 include increased efficiency, reduced paper usage, and enhanced security. Businesses can save time and resources by streamlining the signing process, leading to quicker transactions and smoother workflows.

-

How can I track the status of my form 3557 sent via airSlate SignNow?

With airSlate SignNow, you can easily track the status of your sent form 3557 documents in real-time. The platform provides notifications and updates, so you are always informed about when your documents are viewed, signed, or completed.

Get more for Form 3557

- Les automatic bank billing form pdf lincoln electric system

- Medicare adjustment form

- Ecce application form

- Blank court complaint form for court

- Healthport edelivery request letter wellstar form

- Form it 112 1 new york state resident credit against separate tax on lump sum distributions tax year

- Investment fund contract template form

- Investment contract template form

Find out other Form 3557

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe