Schedule ND 1CR North Dakota Office of State Tax Commissioner Calculation of Credit for Income Tax Paid to Another State Attach Form

What is the Schedule ND 1CR?

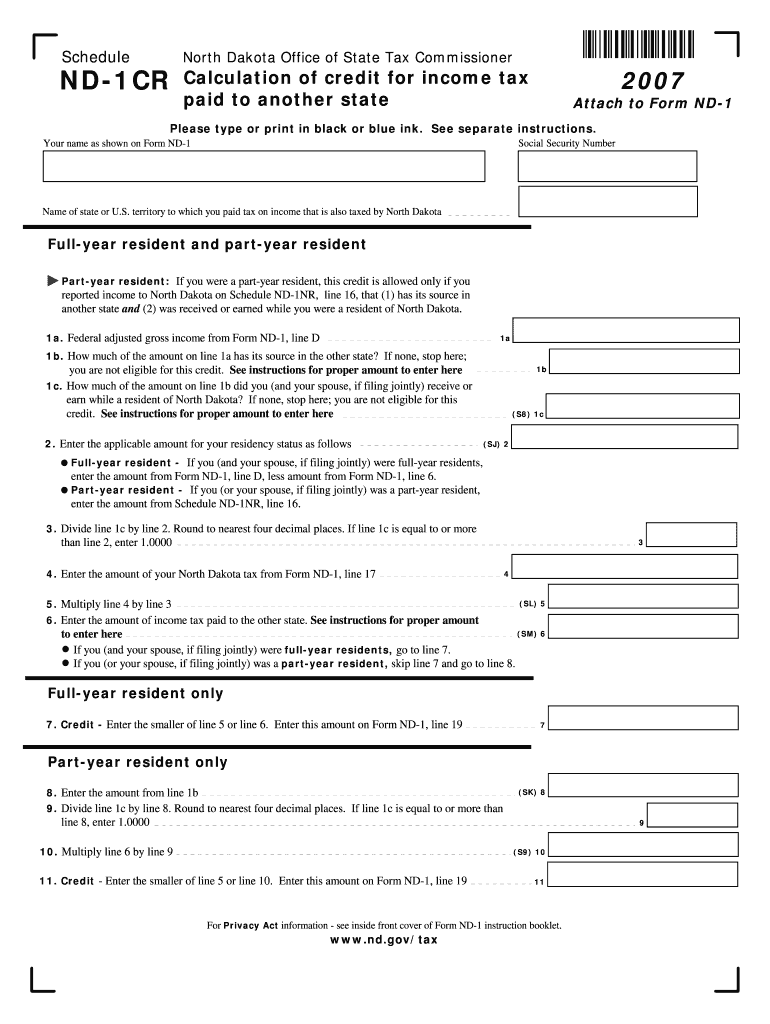

The Schedule ND 1CR is a form used by taxpayers in North Dakota to calculate the credit for income tax paid to another state. This form is essential for individuals who have earned income in states outside of North Dakota and have paid taxes to those states. By completing the Schedule ND 1CR, taxpayers can claim a credit that helps to reduce their North Dakota income tax liability, ensuring they do not pay double taxes on the same income.

How to use the Schedule ND 1CR

To effectively use the Schedule ND 1CR, taxpayers must first gather information regarding the income earned in another state and the taxes paid to that state. The form requires details such as the name of the other state, the amount of income earned there, and the total tax paid. After filling out the necessary information, the completed Schedule ND 1CR must be attached to Form ND 1 when filing your North Dakota tax return. Ensure that the form is filled out clearly using black or blue ink, as specified.

Steps to complete the Schedule ND 1CR

Completing the Schedule ND 1CR involves a series of steps:

- Gather your tax documents, including W-2s and any other income statements from the other state.

- Fill in your personal information at the top of the form, including your name and Social Security number.

- Provide details about the income earned in the other state and the taxes paid.

- Calculate the credit amount based on the instructions provided on the form.

- Review your entries for accuracy before signing and dating the form.

- Attach the completed Schedule ND 1CR to your Form ND 1 when submitting your tax return.

Key elements of the Schedule ND 1CR

Several key elements are essential for accurately completing the Schedule ND 1CR:

- Personal Information: Ensure that your name and Social Security number are correctly entered.

- Income Details: Clearly state the amount of income earned in the other state.

- Tax Paid: Include the total tax amount paid to the other state.

- Credit Calculation: Follow the provided guidelines to determine the appropriate credit amount.

State-specific rules for the Schedule ND 1CR

North Dakota has specific rules regarding the use of Schedule ND 1CR. Taxpayers must ensure that the income being reported is taxable in both North Dakota and the other state. Furthermore, the credit cannot exceed the amount of North Dakota tax attributable to the income earned in the other state. It is important to consult the North Dakota Office of State Tax Commissioner’s guidelines for any updates or changes to these rules.

Eligibility Criteria

To be eligible to use the Schedule ND 1CR, taxpayers must meet certain criteria:

- You must be a resident of North Dakota.

- You must have earned income in another state and paid income tax to that state.

- The income must be subject to North Dakota income tax.

Quick guide on how to complete schedule nd 1cr north dakota office of state tax commissioner calculation of credit for income tax paid to another state attach

Complete Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The simplest way to edit and eSign Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach with ease

- Locate Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach and click Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule nd 1cr north dakota office of state tax commissioner calculation of credit for income tax paid to another state attach

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State?

The Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State is a form used by taxpayers in North Dakota to calculate and claim a credit for income taxes paid to another state. This form must be attached to Form ND 1 when filing your North Dakota tax return. It ensures that taxpayers do not pay double taxes on the same income.

-

How do I fill out the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State?

To fill out the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State, you need to provide details about the income earned in another state and the taxes paid there. Make sure to type or print in black or blue ink for clarity. Follow the instructions carefully to ensure accurate calculations.

-

What are the benefits of using airSlate SignNow for submitting the Schedule ND 1CR?

Using airSlate SignNow for submitting the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State streamlines the eSigning process, making it quick and efficient. Our platform allows you to securely send and sign documents online, reducing the time spent on paperwork. Additionally, it is a cost-effective solution for businesses and individuals alike.

-

Is there a fee for using airSlate SignNow to file the Schedule ND 1CR?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The fees are competitive and provide access to a range of features that simplify the process of submitting the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing you to seamlessly manage your documents and filings. This integration can enhance your workflow, especially when dealing with forms like the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State. Check our integration options to find the best fit for your needs.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a range of features for document management, including eSigning, document templates, and secure storage. These features are designed to simplify the process of preparing and submitting forms like the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State. You can easily track the status of your documents and ensure compliance.

-

How secure is airSlate SignNow for filing sensitive tax documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your sensitive information, including documents like the Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State. You can trust that your data is safe while using our platform.

Get more for Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach

- 136011 form

- Washingtonstateparksdisabilitypass form

- Aventa application form

- Point of view worksheet 15 answer key form

- Sidemount tec log book ai sergio destro diving instructor form

- Va indebtedness disclosure form

- Www customs govt nzglobalassetsdocumentsnew zealand passenger arrival card new zealand customs service form

- Tc563657 pdf form

Find out other Schedule ND 1CR North Dakota Office Of State Tax Commissioner Calculation Of Credit For Income Tax Paid To Another State Attach

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple