the Long Version of the Self Employment Page for Sole 2024-2026

What is the SA103S Form for Self-Employed Individuals?

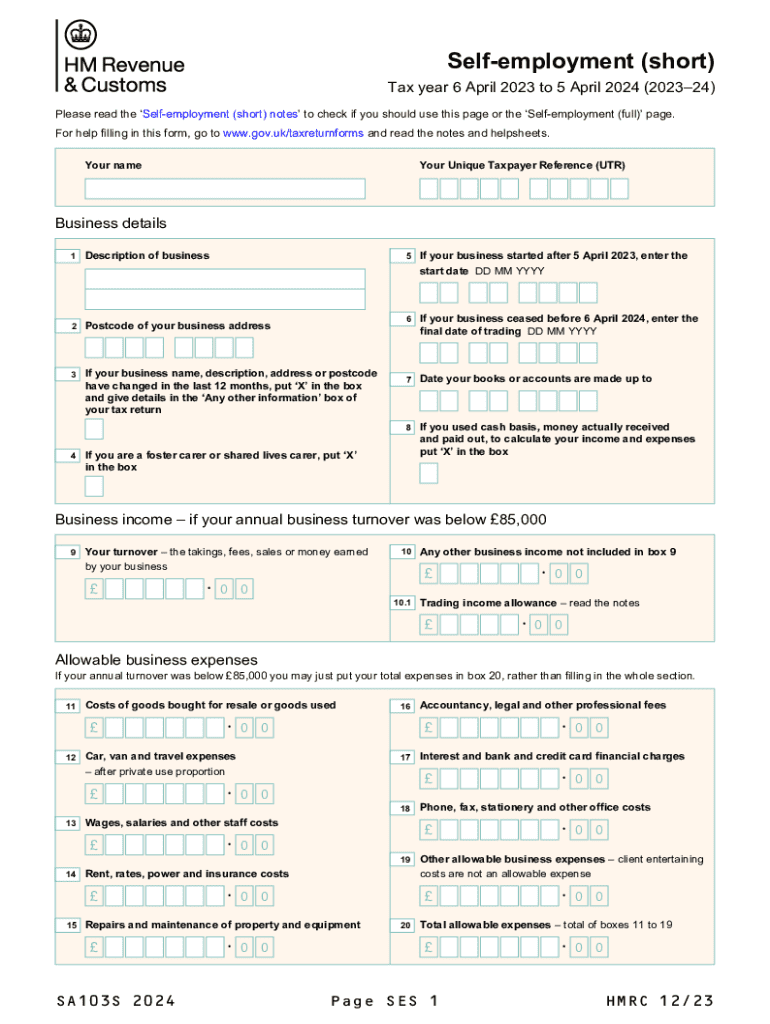

The SA103S form is a specific tax document used by self-employed individuals in the United Kingdom to report their income and expenses. This form is particularly relevant for those whose annual turnover does not exceed the VAT threshold, allowing for a simpler reporting process. The SA103S is part of the Self Assessment tax system, which requires individuals to declare their earnings to HM Revenue and Customs (HMRC). By using this form, self-employed individuals can accurately report their financial activities and calculate the tax owed based on their net profits.

Steps to Complete the SA103S Form

Completing the SA103S form involves several key steps:

- Gather all relevant financial documents, including income statements, receipts, and invoices.

- Fill in personal details, including your name, address, and National Insurance number.

- Report your total income from self-employment, ensuring all figures are accurate and supported by documentation.

- List allowable business expenses, which can reduce your taxable income. Common expenses include office supplies, travel costs, and professional fees.

- Calculate your net profit by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Filing Deadlines for the SA103S Form

It is crucial to be aware of the filing deadlines associated with the SA103S form to avoid penalties. Typically, the deadline for submitting the SA103S form is January 31st following the end of the tax year. For example, for the tax year ending April 5, 2021, the deadline would be January 31, 2022. If you are filing your return online, ensure you allow enough time to gather all necessary information and complete the form accurately before the deadline.

Required Documents for Completing the SA103S Form

To complete the SA103S form effectively, you will need several documents, including:

- Income statements from your business activities.

- Receipts for business expenses that you plan to claim.

- Bank statements that reflect your business transactions.

- Any previous tax returns or correspondence with HMRC that may be relevant.

Having these documents organized will help streamline the process and ensure that all information provided is accurate.

IRS Guidelines for Self-Employment Reporting

While the SA103S form is specific to the UK, understanding IRS guidelines for self-employment in the United States is essential for American taxpayers. The IRS requires self-employed individuals to report their income using Schedule C (Form 1040), where they detail their earnings and expenses. It is important to familiarize yourself with IRS regulations, including allowable deductions and record-keeping requirements, to ensure compliance and accurate reporting.

Penalties for Non-Compliance with the SA103S Form

Failing to submit the SA103S form on time or providing inaccurate information can lead to significant penalties. Common consequences include:

- Late filing penalties, which can increase over time.

- Interest on unpaid taxes, accumulating until the balance is settled.

- Potential investigations or audits by HMRC if discrepancies are found.

To avoid these penalties, it is advisable to file the form accurately and on time, ensuring all financial records are properly maintained.

Quick guide on how to complete the long version of the self employment page for sole

Prepare The Long Version Of The Self employment Page For Sole effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly, without any delays. Handle The Long Version Of The Self employment Page For Sole on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign The Long Version Of The Self employment Page For Sole seamlessly

- Find The Long Version Of The Self employment Page For Sole and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign The Long Version Of The Self employment Page For Sole to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the long version of the self employment page for sole

Create this form in 5 minutes!

How to create an eSignature for the the long version of the self employment page for sole

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sa103s form and why is it important?

The sa103s form is a self-assessment tax return specifically designed for small businesses and sole traders in the UK. It is crucial for reporting income and expenses to HMRC, ensuring compliance with tax regulations. Properly completing the sa103s form can help you avoid penalties and maximize your allowable deductions.

-

How can airSlate SignNow help with the sa103s form?

airSlate SignNow simplifies the process of completing and submitting the sa103s form by allowing you to eSign and send documents securely. Our platform provides templates and tools that streamline the preparation of your tax documents, ensuring accuracy and efficiency. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

Is there a cost associated with using airSlate SignNow for the sa103s form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage your documents, including the sa103s form, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the sa103s form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking to enhance your experience with the sa103s form. These tools allow you to create, edit, and manage your tax documents efficiently. Additionally, our platform ensures that your data is protected with top-notch security measures.

-

Can I integrate airSlate SignNow with other software for the sa103s form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your sa103s form alongside your financial records. This seamless integration helps streamline your workflow, ensuring that all your documents are in one place and easily accessible.

-

What are the benefits of using airSlate SignNow for the sa103s form?

Using airSlate SignNow for the sa103s form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit your tax documents quickly, saving you time and effort. Additionally, the eSigning feature ensures that your documents are legally binding and secure.

-

How secure is airSlate SignNow when handling the sa103s form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the sa103s form. Our platform is designed to keep your sensitive information safe from unauthorized access. You can trust that your documents are secure while using our services.

Get more for The Long Version Of The Self employment Page For Sole

- Missouri compromise map activity pdf form

- Bloom ball template pdf form

- Lap counter sheet 5000 meters on a 400 meter track usatf usatf form

- Bill nye light optics worksheet 514071049 form

- Trombone slide chart 404798001 form

- Park reservation form cibemidjimnus

- Controlled exotic wildlife permit application form

- Minnesota department of public safety alcohol and gambling enforcement division brand label registration application form

Find out other The Long Version Of The Self employment Page For Sole

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms