Www Irs Govself Employment TaxSelf Employment TaxInternal Revenue Service 2022

Understanding Self Employment Tax

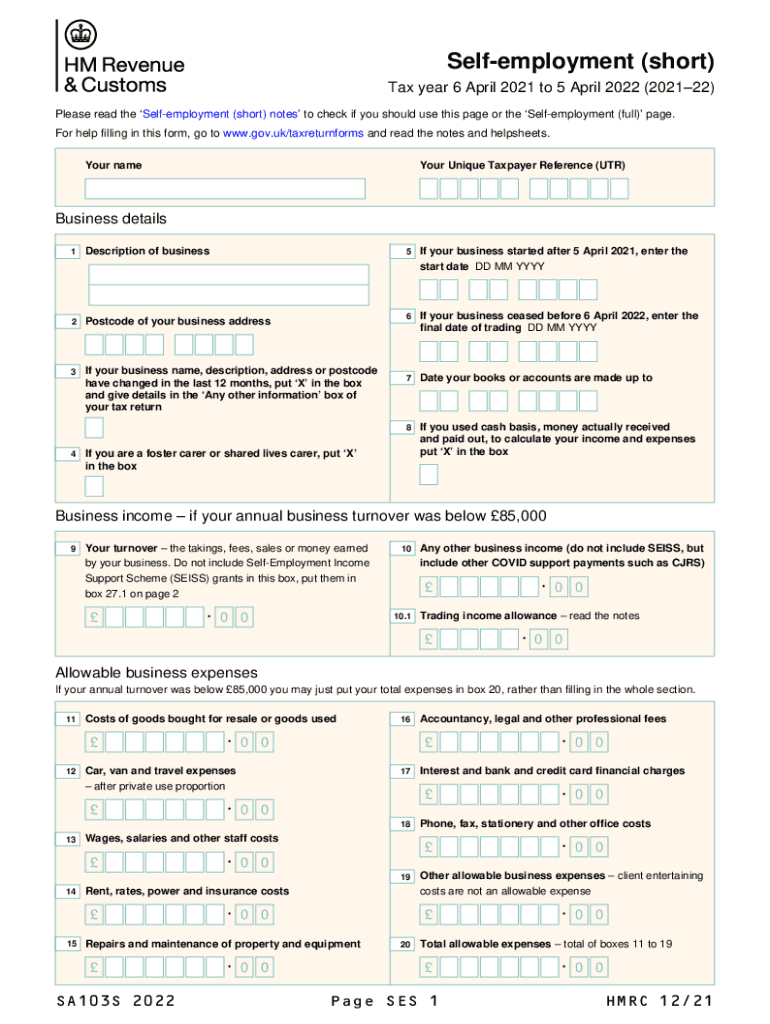

The self-employment tax is a crucial aspect for individuals who work for themselves in the United States. This tax primarily consists of Social Security and Medicare taxes, which are typically withheld from employees' paychecks. However, self-employed individuals must pay these taxes directly. The Internal Revenue Service (IRS) requires self-employed individuals to report their earnings using the appropriate forms, such as the SA103S for self-employment income. Understanding the self-employment tax helps ensure compliance with federal tax laws and avoids potential penalties.

Steps to Complete the Self Assessment Form Online

Filling out the self-assessment form online can be a straightforward process when approached step-by-step. Here are the essential steps:

- Gather necessary information, including your income details, expenses, and any relevant tax documents.

- Access the online platform where you can complete the self-assessment form.

- Enter your personal information accurately, ensuring that all details align with your official documents.

- Fill in your income and expenses using the appropriate sections of the form.

- Review your entries for accuracy before submitting the form to avoid any errors.

- Submit the completed self-assessment form electronically, ensuring you receive confirmation of submission.

Required Documents for Self Assessment

To complete the self-assessment form accurately, certain documents are essential. These typically include:

- Records of all income received during the tax year, including invoices and bank statements.

- Receipts for any business-related expenses, such as supplies, travel, and marketing costs.

- Previous year’s tax return, which can provide a reference for your current filing.

- Any relevant tax forms, such as the SA103S, if applicable.

IRS Guidelines for Self Employment Tax

The IRS provides specific guidelines regarding self-employment tax, which are vital for compliance. These guidelines outline how to calculate your self-employment income, the applicable tax rates, and the deadlines for filing your taxes. Understanding these guidelines helps ensure that you not only file your taxes correctly but also take advantage of any deductions available to self-employed individuals.

Filing Deadlines and Important Dates

Being aware of filing deadlines is crucial for self-employed individuals. Typically, the deadline for submitting your self-assessment form is April 15 of the following tax year. However, if you are filing online, you may have until October 15 to submit your form. Marking these dates on your calendar can help you avoid late fees and penalties associated with missed deadlines.

Penalties for Non-Compliance

Failing to comply with self-employment tax regulations can lead to significant penalties. The IRS may impose fines for late submissions, underreporting income, or failing to pay the required taxes. Understanding these penalties emphasizes the importance of accurate and timely filing, ensuring that you remain compliant with federal tax laws.

Quick guide on how to complete wwwirsgovself employment taxself employment taxinternal revenue service

Complete Www irs govself employment taxSelf Employment TaxInternal Revenue Service effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Www irs govself employment taxSelf Employment TaxInternal Revenue Service on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign Www irs govself employment taxSelf Employment TaxInternal Revenue Service with ease

- Obtain Www irs govself employment taxSelf Employment TaxInternal Revenue Service and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Www irs govself employment taxSelf Employment TaxInternal Revenue Service and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovself employment taxself employment taxinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovself employment taxself employment taxinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to complete self assessment form online using airSlate SignNow?

To complete a self assessment form online with airSlate SignNow, you need to upload your document, add the necessary fields for signatures and information, and then share it with the required parties. The platform streamlines the process, allowing for quick eSigning and completion. Once all parties have reviewed and signed the document, you will receive a copy for your records.

-

Is there a cost associated with completing a self assessment form online?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose from a subscription model that best fits your requirements and budget. The affordable pricing makes it easy for businesses to complete self assessment forms online without breaking the bank.

-

What features does airSlate SignNow offer for completing self assessment forms online?

airSlate SignNow provides features such as customizable templates, real-time tracking of document status, and cloud storage. These features are designed to enhance user experience when completing a self assessment form online. You can also take advantage of in-app notifications to keep track of your document’s progress.

-

How does airSlate SignNow ensure the security of my self assessment form online?

Security is a top priority for airSlate SignNow. When you complete self assessment forms online, your data is encrypted and securely stored in the cloud. Additionally, the platform complies with industry standards, ensuring that your sensitive information remains protected throughout the process.

-

Can I integrate airSlate SignNow with other tools I use for completing self assessment forms online?

Absolutely! airSlate SignNow offers integrations with various popular applications like Google Workspace, Salesforce, and Microsoft Office. This allows for a seamless workflow where you can complete self assessment forms online without having to switch between different tools and platforms.

-

What are the benefits of completing a self assessment form online with airSlate SignNow?

Completing a self assessment form online with airSlate SignNow saves time and reduces manual errors associated with paper forms. The platform automates the eSigning process, making it efficient and user-friendly. You can also save on printing costs while maintaining a professional appearance.

-

Is there customer support available while completing a self assessment form online?

Yes, airSlate SignNow provides extensive customer support to assist you while completing your self assessment form online. You can access help through live chat, email, or a comprehensive help center. Their support team is dedicated to ensuring you have a smooth experience.

Get more for Www irs govself employment taxSelf Employment TaxInternal Revenue Service

- Letter tenant rental 497324533 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant pennsylvania form

- Pa landlord notice form

- Pa cease form

- Temporary lease agreement to prospective buyer of residence prior to closing pennsylvania form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497324538 form

- Letter from landlord to tenant returning security deposit less deductions pennsylvania form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return pennsylvania form

Find out other Www irs govself employment taxSelf Employment TaxInternal Revenue Service

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy