Publications and Forms for the Self Employed 2023

What is the SA103S Form?

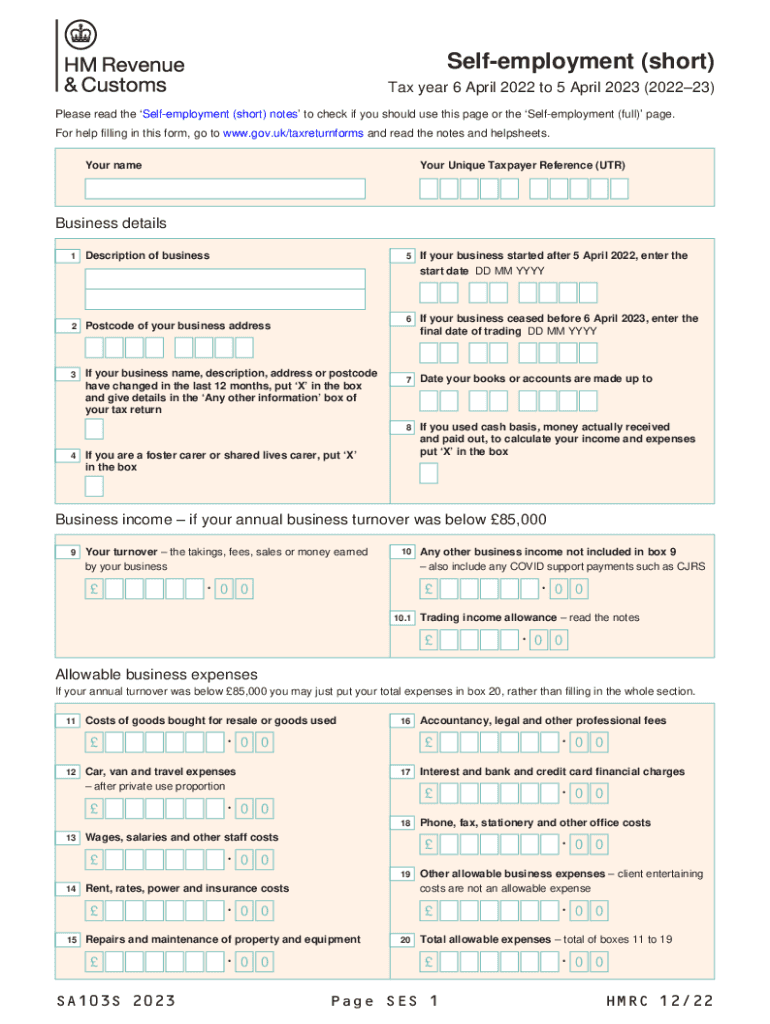

The SA103S form is a self-employment tax return used by individuals in the United States who earn income from self-employment. It is part of the HM Revenue and Customs (HMRC) requirements for reporting earnings and expenses related to self-employment. This form is essential for individuals who need to declare their income and calculate their tax obligations accurately. Completing the SA103S form helps ensure compliance with tax laws and provides a clear overview of one’s financial situation as a self-employed individual.

How to Complete the SA103S Form

Completing the SA103S form involves several key steps. First, gather all necessary financial documents, including records of income, expenses, and any relevant receipts. Next, fill out the form by providing accurate details about your self-employment income and allowable expenses. It is crucial to categorize expenses correctly to maximize deductions. Review the completed form for accuracy before submission to avoid potential penalties or delays in processing.

Key Elements of the SA103S Form

The SA103S form includes several important sections. Key elements consist of personal information, a summary of income, and a detailed breakdown of allowable expenses. Additionally, the form requires information on any other income sources and tax reliefs that may apply. Understanding these elements is vital for ensuring that all information is reported correctly, which can significantly impact tax calculations.

Filing Deadlines for the SA103S Form

Filing deadlines for the SA103S form are critical for compliance. Typically, the deadline for submitting the form is January 31st of the year following the tax year in which the income was earned. For example, for income earned in the tax year 2019, the form must be submitted by January 31, 2020. Missing this deadline can result in penalties and interest on unpaid taxes, so it is essential to stay informed about these dates.

Required Documents for the SA103S Form

To complete the SA103S form accurately, several documents are required. These include records of all self-employment income, bank statements, invoices, and receipts for business expenses. Additionally, any documentation related to other income sources and tax reliefs should be included. Having these documents organized and readily available will streamline the completion process and ensure accuracy in reporting.

Legal Use of the SA103S Form

The SA103S form is legally recognized for reporting self-employment income in the United States. It complies with the regulations set forth by the IRS and is essential for fulfilling tax obligations. Using the form correctly ensures that self-employed individuals meet legal requirements, which helps avoid potential legal issues and penalties associated with non-compliance.

Form Submission Methods for the SA103S Form

The SA103S form can be submitted through various methods. Individuals can file the form online using approved tax software, which often simplifies the process and ensures accuracy. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Choosing the right submission method can affect processing times and the overall efficiency of filing.

Quick guide on how to complete publications and forms for the self employed

Easily Prepare Publications And Forms For The Self Employed on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Publications And Forms For The Self Employed on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Publications And Forms For The Self Employed

- Find Publications And Forms For The Self Employed and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether through email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Publications And Forms For The Self Employed to ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publications and forms for the self employed

Create this form in 5 minutes!

How to create an eSignature for the publications and forms for the self employed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sa103s 2019 and how does it relate to airSlate SignNow?

The sa103s 2019 is a supplementary form used for reporting self-employment income to HMRC. With airSlate SignNow, you can easily eSign and send your sa103s 2019 documents securely and efficiently, ensuring compliance and timely submission.

-

How does airSlate SignNow simplify the completion of the sa103s 2019?

AirSlate SignNow features an intuitive interface that allows users to fill out and sign the sa103s 2019 digitally. This eliminates the need for paper, reducing errors and streamlining the submission process, making it quicker and more efficient.

-

What are the pricing options for using airSlate SignNow for the sa103s 2019?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. Users can choose from monthly or annual subscriptions, which provide unlimited access to features that simplify the completion of documents like the sa103s 2019.

-

Can I integrate airSlate SignNow with other software for managing sa103s 2019 forms?

Yes, airSlate SignNow supports integration with various software solutions, including CRM and accounting tools. This enables a seamless workflow when handling sa103s 2019 forms and ensures that all relevant data is synchronized across platforms.

-

What security measures does airSlate SignNow offer for documents like sa103s 2019?

AirSlate SignNow implements robust security measures, including encryption and two-factor authentication, to safeguard your documents such as the sa103s 2019. This ensures that sensitive information remains protected during the signing and storage processes.

-

Are there templates available for the sa103s 2019 in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for the sa103s 2019 which can greatly speed up the document preparation process. Users can save time and ensure consistency by using these templates tailored for their specific needs.

-

How can airSlate SignNow help improve the efficiency of processing the sa103s 2019?

With airSlate SignNow, you can instantly send, sign, and store your sa103s 2019 forms, signNowly reducing processing time. Additionally, automated reminders and notifications ensure that all parties complete their tasks on schedule, enhancing overall efficiency.

Get more for Publications And Forms For The Self Employed

Find out other Publications And Forms For The Self Employed

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form