Income & Expenses Form Fisher College 2014-2026

What is the Income & Expenses Form Fisher College

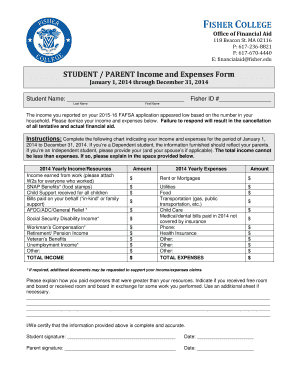

The Income & Expenses Form for Fisher College is a crucial document used by students and their families to report financial information relevant to college funding. This form collects details about income sources, expenses related to education, and other financial obligations. It is essential for determining eligibility for financial aid, scholarships, and grants, ensuring that students receive the support they need to pursue their education.

How to use the Income & Expenses Form Fisher College

Using the Income & Expenses Form for Fisher College involves several straightforward steps. First, gather all necessary financial documents, including tax returns, pay stubs, and any other income verification. Next, complete the form by accurately entering your income and expenses in the designated fields. Ensure that all information is current and reflects your financial situation. Finally, submit the form according to the guidelines provided by the college, either electronically or via mail.

Steps to complete the Income & Expenses Form Fisher College

Completing the Income & Expenses Form for Fisher College can be done effectively by following these steps:

- Gather all relevant financial documents, such as W-2 forms and bank statements.

- Fill out personal information, including your name, student ID, and contact details.

- Detail your income sources, including wages, scholarships, and any other financial support.

- List your education-related expenses, such as tuition, fees, and living costs.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to ensure timely processing.

Key elements of the Income & Expenses Form Fisher College

The Income & Expenses Form for Fisher College includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Personal Information: Student name, ID, and contact information.

- Income Details: Sources of income, including employment and financial aid.

- Expense Breakdown: Detailed listing of educational expenses, such as tuition and books.

- Certification Section: A declaration confirming the accuracy of the information provided.

Legal use of the Income & Expenses Form Fisher College

The Income & Expenses Form for Fisher College must be completed and submitted in compliance with all applicable federal and state regulations. This includes adhering to guidelines set forth by the U.S. Department of Education and ensuring that the information provided is truthful and accurate. Misrepresentation of financial information can lead to penalties, including loss of financial aid eligibility.

Form Submission Methods (Online / Mail / In-Person)

The Income & Expenses Form for Fisher College can typically be submitted through multiple methods to accommodate different preferences. Students may choose to:

- Submit Online: Many colleges offer a secure online portal for electronic submission.

- Mail the Form: Print the completed form and send it via postal service to the designated office.

- In-Person Submission: Deliver the form directly to the financial aid office during business hours.

Quick guide on how to complete 2015 2016 income amp expenses form fisher college

The optimal method to obtain and endorse Income & Expenses Form Fisher College

Across the entirety of an organization, ineffective procedures surrounding document authorization can take up signNow working hours. Signing documents such as Income & Expenses Form Fisher College is an inherent aspect of operations in every sector, which is why the productivity of each agreement’s lifecycle has a critical impact on the organization’s overall performance. With airSlate SignNow, finalizing your Income & Expenses Form Fisher College can be as straightforward and quick as possible. This platform provides you with the latest version of virtually any document. Even better, you can sign it right away without needing to install external software on your computer or printing anything as physical copies.

Steps to obtain and sign your Income & Expenses Form Fisher College

- Explore our repository by category or use the search bar to locate the form you require.

- View the form preview by selecting Learn more to ensure it is the correct one.

- Press Get form to start editing immediately.

- Fill out your form and include any essential details using the toolbar.

- Once finished, click the Sign tool to endorse your Income & Expenses Form Fisher College.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Hit Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to manage your documentation efficiently. You can search for, complete, modify, and even send your Income & Expenses Form Fisher College all within a single tab without any complications. Enhance your procedures with one intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct 2015 2016 income amp expenses form fisher college

FAQs

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do I file taxes and how would I file them into my FAFSA?

First, if you don’t have any income now you don’t need to file taxes. Don’t worry about next year at this time.If you applying for financial aid then you fill out a FAFSA. If you will be attending college in the Fall you are overdue to file FAFSA. You will want to do that now.For FAFSA, first you and one parent should each get a FSA (Federal Studetn Aid) ID and save your login and password as you will need it each year:https://fsaid.ed.gov/npas/index.htmAfter a couple of days you will be able to fill out FAFSA. The student and the parent each fills out their section. If you have no income your section is easy. For the parent section, the parent will use 2015 taxes to fill it out. Here are all the steps to filling it out, including getting the FSA ID.Filling Out the FAFSAFor the 2017–18 school year, you will again use 2015 income figures. This is a one time repition. For 2018–19 use 2016 income. For 2019–20 use 2017 income.Starting this year, the new schedule is that FAFSA will open in October. So sometimes after October, and before you college’s deadline (often Jan to Mar), fill out the FAFSA again. Not much will change this time, because as a one time thing, you will again use your own ;zero’ 2015 income and your parent will use family 2015 income. The only thing that will change is your assets. You report bank accounts and investments as of the day you file.Now if you get a job, you will likely file a 1040EZ form. Very simple. You will get the income statement from your employer by Jan 30 of each year. You should file by April. If you get awarded federal work-study and earn that way, you report that on the FAFSA so you don’t get it counted against you. Regular income may be counted toward your EFC but you have to earn more than 6 thousand a year for it to affect aid. Money in your bank account does affect your aid. Student savings is assessed at 20% but parent savings is assessed at only 6%.I want to add something important. If you taxes are already filed, you can import the data from your tax forms into the FAFSA using the DRT (Data Retrieval Tool). Schools like to see this done as they them know the data matches your taxes. So if you have to enter preliminary, non-final taxes to meet a deadline, do the DRT after you file your taxes. It is usually available for use after a few weeks.Filling Out the FAFSA

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Can I stop my income tax return 2016-17 if I fill my 2015-16 return with 265000 Rs?

Agreed there there will not be any tax liability on income 265000 since you will be eligible for rebate u/s 87. However since your income has exceeded the basic exemption limit of 2.5 lakhs you will be liable to file the returns.Irespective of the fact whether you have filed returns for earlier years or not, you will have to file the returns based on the income earned for that year.

-

Can I fill nil return of income tax for AY 2015-16 and AY 2016-17 in AY 2017-18?

As of now there are no restrictions in regard to filing of income tax returns pertaining to previous assessment yearsI hope that you can file tax returns for the following five assessment years as at present:2017–2018 (Current year)2016–20172015–20162014–20152013–2014However, in case of any refund of excess tax, it will take a long time to get the same in respect of previous years.In the case of shortage of income tax paid , you have to remit the difference amount along with interest as self assessment tax for the concerned assessment year before filing the tax returns

-

Which ITR form should be filled by an NRI having salary income in India for FY 2015 - 2016?

Every individual or HUF whose total income exceeds the maximum amount which is not chargeable to income-tax is obligated to furnish his return of income, The maximum amount not chargeable to income tax in case of different categories of individuals.CategoryAmountResident Individuals whose age is below 60 yearsRs. 2,50,000Resident Individuals whose age is 60 years or more but less than 80 YearsRs. 3,00,000Resident Individuals whose age is 80 years or moreRs. 5,00,000Non-Resident Individual*Rs. 2,50,000*For Non-Resident Individual the benefits of Senior citizen and super senior citizen does not applyITR-1 :- For Salaried IndividualsIndividual who has income only from the following sources can file ITR-1Income from Salary/ Pension orIncome from One House Property (excluding cases where loss is brought forward from previous years) orIncome from Other Sources (excluding winning from lottery and income from Race Horses)Individuals who has any income from the following sources cannot use ITR-1Income from more than one house property orIncome from winnings from lottery or income from Race horses orIncome from short-term capital gains or long-term capital gains from sale of house, plot, shares etc. orAgricultural income in excess of Rs. 5,000 orIncome from Business or Profession orLoss under the head other sources orAny Person claiming relief under section 90 and/or 91If any Resident Individual who has any Income from any source outside India or has any asset outside India or has signing authority in any account located outside India cannot file ITR-1.Note:-Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.Recommended Reading : Income Tax SlabsNo documents needed to be attached while filing the ITR-1 Including from 16, Form 16A, Form 26AS or any other sheets.The ITR-1 Can be filed by any of the following three different waysBy furnishing the return in a paper formBy furnishing the return electronically through online E-FilingBy furnishing the return through UtilityFiling by using Excel Utilty.Filing by using Java UtilityThe ITR-V has to be sent to the following Address for Processing.Post Bag No. 1, Electronic City Office, Bengaluru— 560100, Karnataka.ITR-1 can be downloaded by using the following linksDownload ITR-1 in Paper form for the Year 2016Download ITR-1 in Java Utility for the Year 2016Download ITR-1 in Excel Utility for the Year 2016Steps to File ITR-1Filing by paper modeStep 1:- Download ITR-1 From the above Link or From Incometaxindiaefiling websiteStep 2 :- The ITR is divided in to four parts(Part A, Part B, Part C and Part D). Fill the Downloaded ITR form as FollowsPart AFirst You have fill the Basic Details such as Name, Pan, DOB, Income tax ward/circle etc.. andSelect the status of Tax available from the Part D below i.e., Tax Payable or Tax Refundable or Nil Tax balance andSelect the Residential Status of Individual as Resident or Non-Resident or RBNORSelect the Type of Return Original or Revised Return etc....Part BEnter the Total income From Salary/Pension (Recommended Reading : Calculation of Total Income From Salary)Enter Income from House Property if Loss is there enter the value in negative Figure (Income from House Property)Enter Income From Other SourcesEnter Gross Total Income by adding the Total of above 3 ItemsPart CCalculate deductions under Section 80C to 80U under Income Tax Act (Recommended Reading : Deduction Under Section 80C to 80U Calculation)Enter the value of deduction under each section in the space provided opposite to each section.Part DEnter the Tax Computation by using the Calculator ( Download the Income Tax Calculator )The tax status available i.e., Tax Payable or Tax Refundable or Nil Tax balance is to be entered in the part A Tax StatusStep 3:- Enter the details of the bank account (i.e., IFS Code of the bank, Bank Name , Account Number and Account Type) only if any refund is due.Step 4:- The Assessee has to Self declare that All the Above particulars are True for the best of his knowledge and sign.Step 5 :- Enter the details of the Taxes PaidEnter the details of tax paid as Self assessment tax and Advance Tax paid In the Schedule ITIn the Schedule TDS1 enter the details of TDS deducted from the Salary from Form 16/Form 26ASIn the Schedule TDS2 enter the details of TDS deducted from other than Salary from Form 16A/Form 26ASEnter the details of TCS if any Tax has collected at source.Note:-Use additional Supplementary Schedule for TDS deducted on Salary and TDS deducted on other sources if the TDS is deducted from more than 3 deductors.Step 6 :- If the total Assets and Liabilities at the end of the year is more than 50 Lakhs then the Assessee has to declare the Particulars of the Following AssetsImmovable PropertyLandBuildingMovable PropertyCash In HandJewellery, Bullion etc.,Vehicles etc.,Step 7:- The assessee is also Required to file the ITR-V Acknowledgement also which can be downloaded from the Incometaxindia websiteAfter entering all the above details the assessee can Submit the Income Tax Return (ITR-1) Form along with the filled ITR-V in the Income Tax Office by Physical mode.Read Full Article At Individual Income Tax Return ITR-1 (SAHAJ)

-

How can I fill my income tax for year 2016?

U can file by creating credentials at incometaxindia.gov.in…I see u mentioning 2016 that is FY 2016–2017.The due date for the same is 31.7.2017 however u can file belated return by 31.3.2018.For filing the same U can contact me @ 8892207864…

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

Create this form in 5 minutes!

How to create an eSignature for the 2015 2016 income amp expenses form fisher college

How to make an electronic signature for the 2015 2016 Income Amp Expenses Form Fisher College online

How to make an electronic signature for the 2015 2016 Income Amp Expenses Form Fisher College in Chrome

How to make an eSignature for signing the 2015 2016 Income Amp Expenses Form Fisher College in Gmail

How to make an eSignature for the 2015 2016 Income Amp Expenses Form Fisher College from your mobile device

How to make an eSignature for the 2015 2016 Income Amp Expenses Form Fisher College on iOS devices

How to generate an electronic signature for the 2015 2016 Income Amp Expenses Form Fisher College on Android devices

People also ask

-

What are fisher income expenses and how do they impact tax deductions?

Fisher income expenses are the costs incurred in the process of generating income for fisheries or aquaculture. Understanding these expenses is crucial as they can signNowly reduce taxable income, ultimately leading to lower tax liability. Keeping accurate records of fisher income expenses ensures you can maximize your deductions during tax season.

-

How does airSlate SignNow help manage fisher income expenses documentation?

airSlate SignNow provides a seamless way to eSign and store documents related to fisher income expenses. With easy document management features, you can quickly access, share, and sign financial records, ensuring compliance and organization. This user-friendly solution allows you to focus more on your fishing business rather than paperwork.

-

What features of airSlate SignNow support efficient handling of fisher income expenses?

Key features of airSlate SignNow that benefit users managing fisher income expenses include customizable templates, audit trails, and automated workflows. These tools help streamline the documentation process, making it easier to track and manage your financial records. With these efficiencies, you can save time and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for small fishing businesses managing expenses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small fishing businesses. Its pricing plans are competitive, providing excellent value for the features offered, especially for those needing to manage fisher income expenses efficiently. Investing in airSlate SignNow can help your business save on costs while ensuring proper documentation.

-

Can airSlate SignNow integrate with accounting software for tracking fisher income expenses?

Absolutely! airSlate SignNow easily integrates with various accounting software solutions, making it convenient to track and manage fisher income expenses. By connecting your eSigning processes with your accounting system, you ensure that all your financial documentation is organized and readily accessible.

-

What benefits do I gain by using airSlate SignNow for fisher income expense documentation?

Using airSlate SignNow for fisher income expense documentation provides numerous benefits, including enhanced efficiency, improved accuracy, and secure storage. The ability to quickly sign and share documents helps you manage your expenses without delays. Additionally, the platform ensures compliance, giving you peace of mind.

-

How secure is airSlate SignNow for managing sensitive fisher income expenses data?

airSlate SignNow prioritizes security, ensuring that your sensitive fisher income expenses data is protected at all times. The platform employs robust encryption and secure access controls to safeguard your information. You can confidently use airSlate SignNow knowing that your documents are safe from unauthorized access.

Get more for Income & Expenses Form Fisher College

Find out other Income & Expenses Form Fisher College

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free