State Massachusetts Filing Injured Spouse Form Federal Return 2017

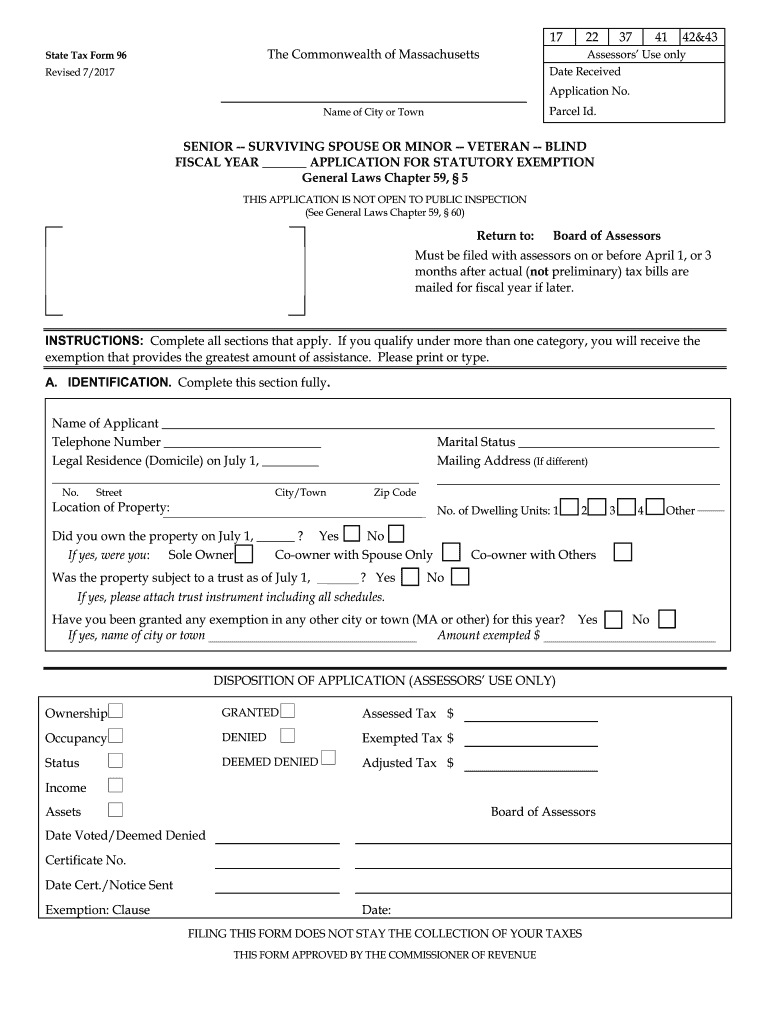

What is the ma form veteran?

The ma form veteran is a specific tax form used by veterans in Massachusetts to report their income and claim certain benefits. This form is designed to ensure that veterans receive the appropriate tax deductions and credits available to them under state law. It is crucial for veterans to understand the eligibility requirements and benefits associated with this form to maximize their tax return.

Key elements of the ma form veteran

The ma form veteran includes several key elements that are essential for accurate completion. These elements typically consist of personal identification information, income details, and specific sections dedicated to veteran-related deductions. Important components may include:

- Personal information, such as name, address, and Social Security number.

- Income sources, including wages, pensions, and other earnings.

- Veteran-specific deductions, which may include exemptions for disability or service-related expenses.

Steps to complete the ma form veteran

Completing the ma form veteran requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and proof of veteran status.

- Fill out personal identification information accurately.

- Report all income sources, ensuring to include any veteran benefits received.

- Claim any applicable deductions by providing the required documentation.

- Review the completed form for accuracy before submission.

Eligibility criteria for the ma form veteran

To qualify for the ma form veteran, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of Massachusetts.

- Having served in the armed forces and possessing the necessary documentation to prove veteran status.

- Meeting income thresholds that may affect eligibility for certain deductions.

Form submission methods for the ma form veteran

The ma form veteran can be submitted through various methods, providing flexibility for veterans. These methods include:

- Online submission through the Massachusetts Department of Revenue's website.

- Mailing a completed paper form to the appropriate tax office.

- In-person submission at designated tax offices or veteran service centers.

Penalties for non-compliance with the ma form veteran

Failing to comply with the requirements of the ma form veteran can lead to penalties. These may include:

- Fines for late submission or inaccuracies in reporting income.

- Loss of potential tax benefits or deductions.

- Increased scrutiny from tax authorities, leading to audits or additional inquiries.

Quick guide on how to complete state tax form 96 massgov mass

Your assistance manual on how to prepare your State Massachusetts Filing Injured Spouse Form Federal Return

If you wish to learn how to create and submit your State Massachusetts Filing Injured Spouse Form Federal Return, here are a few concise instructions to make tax processing signNowly simpler.

First, you need to sign up for your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceedingly user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can switch between text, checkboxes, and eSignatures and return to adjust details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your State Massachusetts Filing Injured Spouse Form Federal Return within moments:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through different versions and schedules.

- Select Get form to open your State Massachusetts Filing Injured Spouse Form Federal Return in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to increased return errors and delays in reimbursements. Naturally, before e-filing your taxes, consult the IRS website for declaring regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state tax form 96 massgov mass

FAQs

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Is it smart to include a few out-of-state untaxed purchases on your Mass tax return?

I wouldnt offer Anything to the IRS. The way things are going over there the risk of an audit is lower than ever. If you did get audited how would they know?

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the state tax form 96 massgov mass

How to create an eSignature for the State Tax Form 96 Massgov Mass online

How to create an electronic signature for your State Tax Form 96 Massgov Mass in Google Chrome

How to generate an electronic signature for signing the State Tax Form 96 Massgov Mass in Gmail

How to generate an eSignature for the State Tax Form 96 Massgov Mass from your mobile device

How to generate an electronic signature for the State Tax Form 96 Massgov Mass on iOS

How to create an eSignature for the State Tax Form 96 Massgov Mass on Android OS

People also ask

-

What is the ma form veteran and how does it work?

The ma form veteran is an essential document for veterans, streamlining the process of accessing benefits and services. With airSlate SignNow, this form can be easily uploaded, sent, and signed electronically, ensuring a efficient and secure workflow for all parties involved.

-

How can I use airSlate SignNow to fill out the ma form veteran?

Using airSlate SignNow to fill out the ma form veteran is simple. Just upload the form to the platform, fill in the necessary fields using our intuitive interface, and invite others to eSign. This reduces paperwork and speeds up the submission process.

-

What are the pricing options for airSlate SignNow when using the ma form veteran?

airSlate SignNow offers competitive pricing plans designed to fit various budgets, making it ideal for veterans and organizations alike. Whether you are a small business or a large enterprise, you'll find a plan that allows easy management of the ma form veteran without breaking the bank.

-

Is it safe to use airSlate SignNow for ma form veteran document signing?

Yes, it is completely safe to use airSlate SignNow for signing the ma form veteran. We employ advanced encryption and security measures to protect your sensitive information, ensuring that your signed documents are secure and compliant with regulations.

-

What features does airSlate SignNow offer for the ma form veteran?

airSlate SignNow includes a variety of features that enhance the process of managing the ma form veteran. These features include personalized templates, automated reminders, and real-time tracking of document status, making it easier to stay organized and efficient.

-

Can I integrate airSlate SignNow with other applications while using the ma form veteran?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of applications, making it easy to connect with your existing tools. This allows you to manage the ma form veteran alongside other important business processes effortlessly.

-

What are the benefits of using airSlate SignNow for managing the ma form veteran?

Using airSlate SignNow to manage the ma form veteran provides numerous benefits, including faster processing times and reduced paperwork. The user-friendly interface ensures that veterans and organizations can easily navigate the signing process, enhancing overall efficiency and satisfaction.

Get more for State Massachusetts Filing Injured Spouse Form Federal Return

- Request to vale ashes at punt road oval aflcom form

- Director credential renewal application tym the trainer form

- Plea by mail request form click to download colorado fifth da5

- Iora innovation fellowship application form 2015 2016docx

- Sikaran the fighting art of the filipino farmer original balangkas of sikaran order form

- Fill nri undertaking lettet form

- Interactions 1 reading answer form

- Microfinance loan application form

Find out other State Massachusetts Filing Injured Spouse Form Federal Return

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form