Commonwealth of Massachusetts Office of the Comptroller 2022-2026

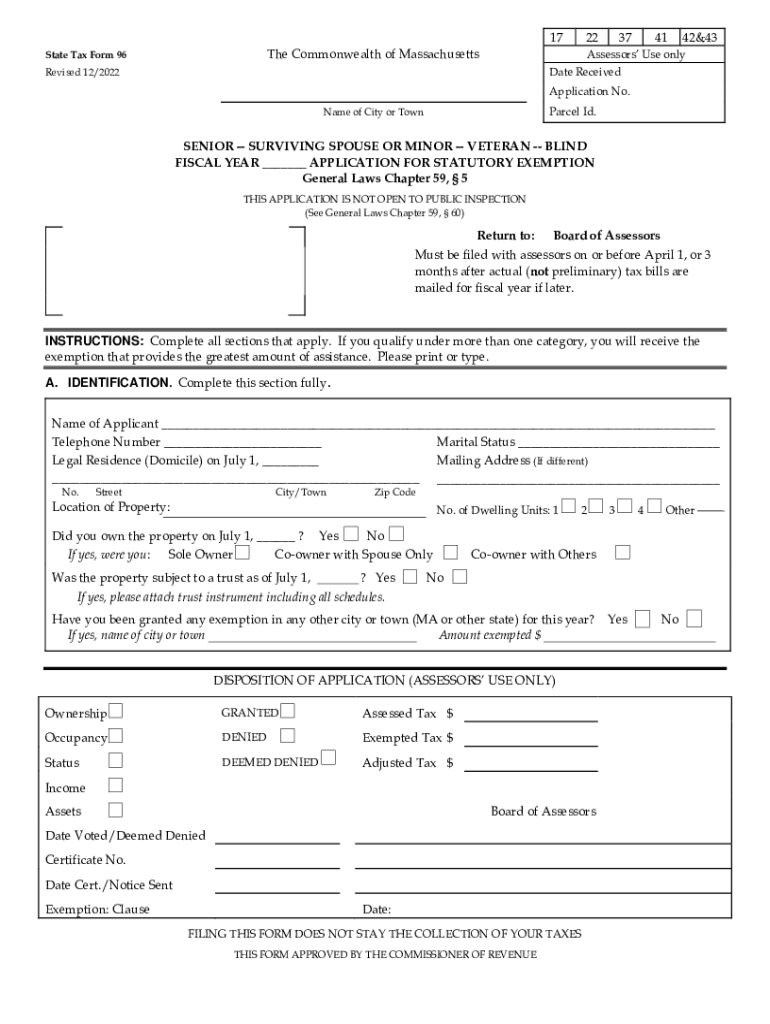

Understanding the Massachusetts State Tax 96 Form

The Massachusetts State Tax 96 Form, also known as the MA Form 96, is primarily used for claiming a tax refund for individuals who qualify as surviving spouses or for certain other specific situations. This form is essential for ensuring that eligible taxpayers receive the appropriate tax benefits and refunds they are entitled to under Massachusetts state tax laws.

Steps to Complete the Massachusetts State Tax 96 Form

Completing the Massachusetts State Tax 96 Form involves several important steps:

- Gather necessary documentation, such as your previous tax returns, income statements, and any relevant information about your spouse if applicable.

- Fill out the form accurately, ensuring that all personal information is correct and that you are using the most recent version of the form.

- Calculate any deductions or credits you may qualify for, as these can significantly impact your refund amount.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mail, following the specific submission guidelines provided by the Massachusetts Department of Revenue.

Eligibility Criteria for the Massachusetts State Tax 96 Form

To qualify for the Massachusetts State Tax 96 Form, you must meet specific eligibility criteria. Generally, this form is intended for surviving spouses who are filing for a refund. Additionally, taxpayers must have filed a Massachusetts income tax return for the year in question and must be able to provide documentation supporting their claim. It is important to review the eligibility requirements carefully to ensure compliance.

Form Submission Methods for the Massachusetts State Tax 96 Form

The Massachusetts State Tax 96 Form can be submitted through various methods:

- Online Submission: Taxpayers can file electronically using the Massachusetts Department of Revenue's e-filing system, which is secure and efficient.

- Mail Submission: If preferred, the completed form can be printed and mailed to the appropriate address provided by the Massachusetts Department of Revenue.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated state tax offices, although this option may require an appointment.

Legal Use of the Massachusetts State Tax 96 Form

The Massachusetts State Tax 96 Form is legally binding when completed and submitted correctly. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or delays in processing. The form must also comply with the Massachusetts tax laws and regulations to be considered valid.

Filing Deadlines for the Massachusetts State Tax 96 Form

Taxpayers should be aware of the filing deadlines associated with the Massachusetts State Tax 96 Form. Generally, the form must be submitted by the same deadline as the Massachusetts income tax return, which is typically April fifteenth of the following year. However, extensions may apply in certain circumstances, so it is advisable to check for any updates or changes to the filing schedule.

Quick guide on how to complete commonwealth of massachusetts office of the comptroller

Effortlessly Create Commonwealth Of Massachusetts Office Of The Comptroller on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the functionalities necessary to generate, modify, and electronically sign your documents quickly and without setbacks. Manage Commonwealth Of Massachusetts Office Of The Comptroller on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Easily Modify and Electronically Sign Commonwealth Of Massachusetts Office Of The Comptroller

- Locate Commonwealth Of Massachusetts Office Of The Comptroller and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as an ink signature.

- Verify all details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming document searches, or errors requiring new printouts. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign Commonwealth Of Massachusetts Office Of The Comptroller while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct commonwealth of massachusetts office of the comptroller

Create this form in 5 minutes!

How to create an eSignature for the commonwealth of massachusetts office of the comptroller

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts State Tax 96 Form?

The Massachusetts State Tax 96 Form is a crucial document used for filing taxes in Massachusetts. It allows individuals and businesses to report their income and calculate their tax liability accurately. Completing the Massachusetts State Tax 96 Form ensures compliance with state tax regulations.

-

How can airSlate SignNow assist with the Massachusetts State Tax 96 Form?

airSlate SignNow provides an easy-to-use platform that enables users to eSign and send the Massachusetts State Tax 96 Form with ease. Our solution allows for secure document management, making it simple to complete and distribute tax forms without any hassle. You can streamline the filing process for the Massachusetts State Tax 96 Form with our powerful tools.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring that your budget is accommodated. Whether you are an individual or a business, you can choose a plan that fits your requirements for managing the Massachusetts State Tax 96 Form and other documents. Visit our pricing page to find the best option for you.

-

Is airSlate SignNow compliant with Massachusetts state tax regulations?

Yes, airSlate SignNow is designed to help users comply with Massachusetts state tax regulations, including the proper handling of the Massachusetts State Tax 96 Form. Our platform ensures that your documents are securely signed and stored, maintaining integrity throughout the filing process. You can trust airSlate SignNow for compliance with state requirements.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers a range of features for document management, including eSignature capabilities, templates for the Massachusetts State Tax 96 Form, and automated workflows. These features simplify the process of managing tax forms and enhance productivity, allowing you to focus on important tasks. Experience these powerful tools with airSlate SignNow.

-

Can I integrate airSlate SignNow with other software for filing the Massachusetts State Tax 96 Form?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications to streamline your tax filing process, including those for the Massachusetts State Tax 96 Form. Our integrations help enhance your efficiency and ensure that all necessary documents are easily accessible for completion and submission.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including the Massachusetts State Tax 96 Form, offers numerous benefits such as increased efficiency, reduced paper usage, and faster turnaround times. By leveraging our platform, you can ensure that your documents are signed securely and stored safely while minimizing bottlenecks in your workflow. Transform your tax filing experience with airSlate SignNow.

Get more for Commonwealth Of Massachusetts Office Of The Comptroller

Find out other Commonwealth Of Massachusetts Office Of The Comptroller

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament