Lowellma Gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 the COMMONWEALTH of MASSACHUSETTS 2019

What is the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

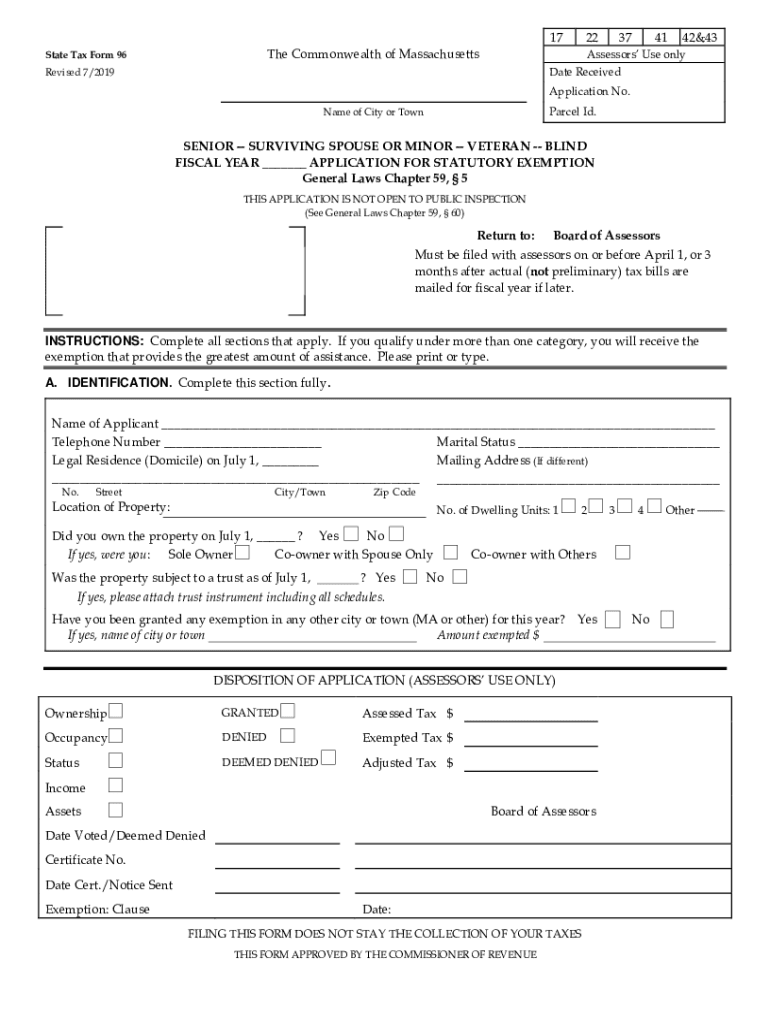

The Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 is a specific tax form used within the Commonwealth of Massachusetts. This form is essential for individuals and businesses seeking to comply with state tax regulations. It serves various purposes, including the reporting of income and deductions, and is crucial for determining tax liabilities. Understanding this form is key for ensuring accurate tax filings and avoiding potential penalties.

How to use the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

Using the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 involves several steps. First, ensure you have the latest version of the form, which can typically be downloaded from the Massachusetts Department of Revenue website. Next, gather all necessary documentation, such as income statements and previous tax returns. Fill out the form accurately, ensuring all information is complete and correct. Finally, submit the form according to the guidelines provided, either electronically or via mail.

Steps to complete the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

Completing the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 requires careful attention to detail. Follow these steps:

- Download the form from the official Massachusetts Department of Revenue website.

- Gather required documents, including W-2s, 1099s, and any other relevant income documentation.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any deductions or credits applicable to your situation.

- Review the completed form for errors or omissions before submission.

- Submit the form by the designated deadline, following the submission guidelines provided.

Legal use of the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

The Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 is legally binding when completed and submitted according to Massachusetts state laws. To ensure its legal validity, it is essential to follow all instructions carefully and provide accurate information. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Key elements of the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

Key elements of the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 include:

- Taxpayer identification information, such as name and Social Security number.

- Income reporting sections for various sources of income.

- Deductions and credits that may apply to the taxpayer.

- Signature line for the taxpayer to affirm the accuracy of the information provided.

- Instructions for submission, including deadlines and acceptable methods.

Filing Deadlines / Important Dates

Filing deadlines for the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 are crucial for compliance. Typically, individual tax returns are due on April fifteenth each year. However, it is important to verify specific dates as they may vary based on weekends or holidays. Late submissions may incur penalties, so being aware of these deadlines is essential for timely filing.

Quick guide on how to complete lowellmagov196572023 clause 17 applicationstate tax form 96 6 the commonwealth of massachusetts

Complete Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow offers all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS seamlessly

- Locate Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS and click on Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lowellmagov196572023 clause 17 applicationstate tax form 96 6 the commonwealth of massachusetts

Create this form in 5 minutes!

People also ask

-

What is the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

The Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS is a specific state tax form used for various taxation applications in Massachusetts. This form allows users to apply for specific tax exemptions and considerations outlined under Clause 17. Knowing the details of this form is essential for those navigating Massachusetts tax laws.

-

How can airSlate SignNow help me manage the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

airSlate SignNow provides a seamless platform for managing the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS. Our solution allows you to easily upload, eSign, and securely share this form with stakeholders, streamlining the application process. This functionality enhances efficiency, ensuring compliance and timely submission.

-

What features does airSlate SignNow offer for the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

airSlate SignNow comes equipped with features like eSignature, document templates, and automated workflows, all tailored for handling the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS. Users can customize their forms, add signers, and track document status in real-time, making tax season efficient. These features are designed to enhance productivity and simplify the documentation process.

-

Is airSlate SignNow cost-effective for managing tax forms like the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for individuals and businesses managing tax forms such as the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS. With competitive rates, you can access incredible functionality without breaking the bank. This makes it a great option for businesses looking to streamline their tax processes affordably.

-

Can I track the status of my Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS submissions using airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS in real-time. You can see when documents are viewed, signed, or completed, ensuring you stay informed about the progress of your applications. This transparency helps reduce uncertainties during the submission process.

-

What integrations does airSlate SignNow support for the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

airSlate SignNow integrates with numerous applications and software, enhancing the workflow for the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS. Whether you use CRM systems, project management tools, or cloud storage, our platform connects seamlessly to optimize your document management. This ensures all your tools work harmoniously to manage your tax applications effectively.

-

What are the benefits of using airSlate SignNow for my tax processes involving the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS?

Using airSlate SignNow for the Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance with filing requirements. Our platform enables quick eSigning and secure document sharing, leading to faster processing times. Overall, it simplifies your tax processes, making your life easier during tax season.

Get more for Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

- Mississippi promissory 497315650 form

- Mississippi installments fixed rate promissory note secured by personal property mississippi form

- Mississippi note 497315652 form

- Notice of option for recording mississippi form

- Life documents planning package including will power of attorney and living will mississippi form

- Ms attorney form

- Essential legal life documents for baby boomers mississippi form

- Revocation of general durable power of attorney mississippi form

Find out other Lowellma gov196572023 Clause 17 ApplicationSTATE TAX FORM 96 6 THE COMMONWEALTH OF MASSACHUSETTS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors