Federal Direct Parent PLUS Loan ApplicationFinancial Aid 2018

What is the Federal Direct Parent PLUS Loan Application Financial Aid

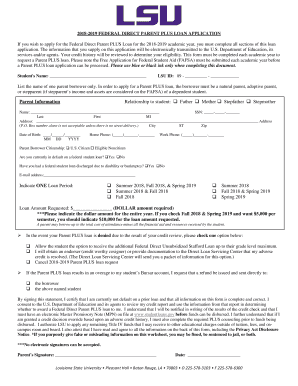

The Federal Direct Parent PLUS Loan Application is a financial aid form that allows parents of dependent undergraduate students to borrow funds to help cover the cost of their child's education. This loan is part of the Direct Loan Program, which is managed by the U.S. Department of Education. The funds can be used for tuition, room and board, and other educational expenses. Unlike other federal loans, the PLUS loan requires a credit check, and the borrower must not have an adverse credit history. Understanding this application is crucial for parents seeking financial support for their children's college education.

Steps to Complete the Federal Direct Parent PLUS Loan Application Financial Aid

Completing the Federal Direct Parent PLUS Loan Application involves several key steps to ensure accuracy and compliance. First, parents must gather necessary information, including their Social Security number, driver's license number, and financial details. Next, they should log into the Federal Student Aid website to access the application form. The application requires parents to provide information about their income and any other financial obligations. After filling out the form, parents must review all entries for accuracy before submitting it electronically. Finally, once submitted, they will receive a confirmation, and the loan will be processed based on the student's financial aid package.

Key Elements of the Federal Direct Parent PLUS Loan Application Financial Aid

Several key elements are essential for the Federal Direct Parent PLUS Loan Application. These include:

- Borrower Information: Personal details of the parent applying for the loan.

- Student Information: Details about the dependent student, including their Social Security number and school information.

- Loan Amount: The specific amount requested to cover educational expenses.

- Credit Check: A review of the borrower's credit history to assess eligibility.

- Loan Terms: Information on interest rates, repayment plans, and loan fees.

Eligibility Criteria for the Federal Direct Parent PLUS Loan Application Financial Aid

To be eligible for the Federal Direct Parent PLUS Loan, certain criteria must be met. The applicant must be a biological or adoptive parent of a dependent undergraduate student who is enrolled at least half-time in an eligible program. Additionally, the borrower must be a U.S. citizen or eligible non-citizen and must not have an adverse credit history. The student must also complete the Free Application for Federal Student Aid (FAFSA) to determine their financial need and eligibility for other forms of aid. Meeting these criteria ensures that parents can access the necessary funds to support their child's education.

How to Use the Federal Direct Parent PLUS Loan Application Financial Aid

Using the Federal Direct Parent PLUS Loan Application is straightforward once the necessary information is gathered. Parents should navigate to the Federal Student Aid website and log in using their FSA ID. After accessing the application, they will fill out the required fields, providing accurate personal and financial information. It is important to ensure that all details are correct to avoid delays in processing. Once the application is completed, parents can submit it electronically. They will then receive notifications regarding the status of the loan, including approval or any additional steps required.

Form Submission Methods for the Federal Direct Parent PLUS Loan Application Financial Aid

The Federal Direct Parent PLUS Loan Application can be submitted through various methods to accommodate different preferences. The primary method is online submission via the Federal Student Aid website, which is the most efficient and secure option. Parents can also print the application and submit it by mail, although this may result in longer processing times. In-person submissions are generally not available, but parents can contact their school's financial aid office for assistance if needed. Choosing the right submission method is crucial for timely processing of the loan application.

Quick guide on how to complete federal direct parent plus loan applicationfinancial aid

The simplest method to locate and endorse Federal Direct Parent PLUS Loan ApplicationFinancial Aid

Across the entirety of a business, ineffective workflows related to paper approvals can take up a signNow amount of work hours. Endorsing documents such as Federal Direct Parent PLUS Loan ApplicationFinancial Aid is an essential aspect of operations in any sector, which is why the productivity of each agreement's lifecycle heavily impacts the overall effectiveness of the company. With airSlate SignNow, endorsing your Federal Direct Parent PLUS Loan ApplicationFinancial Aid is as straightforward and quick as possible. On this platform, you will discover the latest version of virtually any form. Even better, you can sign it instantly without the need for additional software on your computer or printing out hard copies.

How to obtain and endorse your Federal Direct Parent PLUS Loan ApplicationFinancial Aid

- Browse our collection by category or use the search bar to locate the form you require.

- Preview the form by clicking Learn more to confirm it’s the correct one.

- Click Get form to start editing right away.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to endorse your Federal Direct Parent PLUS Loan ApplicationFinancial Aid.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options if necessary.

With airSlate SignNow, you have everything required to handle your documents effectively. You can find, complete, modify, and even send your Federal Direct Parent PLUS Loan ApplicationFinancial Aid all in one tab without any difficulty. Streamline your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct federal direct parent plus loan applicationfinancial aid

FAQs

-

What can I do when a divorced parent refuses to fill out a college financial aid form?

Anything that does not involve going to university and paying for it with loans/grants.Join the service.Get a full time job and take a class at a time and pay with cash.Find an employer that will pay for your schooling.Get married so you can be considered an independent student 9but not from your husband).Jus t get a job. By the time the government lets you file as an independent student(age 24) you may have found an even better pattern that doesn’t involve college at all.

-

How can you get financial aid if your parents won't fill out their part and you don't qualify for third party loans?

In that case, likely the only aid you can get is federal loans limited to 5,500 freshman year and increasing about 1k each year. If you speak to your financial aid office they may be able to arrange that, but they may require that your parents sign a form that they refuse to fill out your aid forms. You will not be able to get any federal Pell Grant or Grants from the college. However, in many cases you would be eligible for Merit Aid or Scholarships that do not depend on family income. If you have good enough test scores there are some colleges around the country that will give a lot of aid for that. They may not always be in the most desirable areas but the important thing is that you will get a college degree.

-

I need $14000 to pay for the rest of college, should I take out private loans or a PLUS loan? I have already maxed the Federal Direct loans and have 28K in grants & scholarships.

Perhaps you need to take out a part time job.Also, you need to get some sort of job connection to what your degree is supposed to be providing. Example. You are majoring in biology. You seek a job that uses your biology training in a part time capacity, like a hospital or lab.By doing this you may also make yourself eligible for company subsidies of your education, and also connect your learning with the real world which should raise your grades.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

My noncustodial parent doesn't want to pay for my tuition (isn't signNowable) but has already filled out a CSS Profile. I was told to contact the financial aid office. How should I appeal for more financial aid and explain my circumstances?

My understanding is that unless there is another extenuating circumstance, your noncustodial parent is expected to provide their part of the expected family contribution. If refusal was an option many parents would simply refuse to pay. If they aren’t signNowable then how do you know they don’t want to pay for your tuition? You must have been in contact when they filled out the Profile, so they have not been out of your life for an extended time. Generally in these cases you will have to find another way to pay the EFC, including your custodial parent’s current income, assets, or parent loans, or more student loans. Or you will need to go to a college that is more affordable. Your custodial parent can try to take your other parent to court to get an order for them to pay, or to enforce an existing custody agreement clause about college payment.I can imagine an extenuating circumstance that would have to be considered. For example, if your parent’s assets were frozen after filling out the Profile (they are under indictment), your parent has been hospitalized in a coma or severe mental health issue (though in that case you might be directed to work with whoever becomes their guardian), or if your parent has become a missing person (not just doesn’t answer the phone when you call) there could be some consideration from the financial aid office. You would need to be able to document the circumstance (police reports, court orders, medical affidavit and so on).You are not the first student to have this problem. Contact the financial aid office and ask for their help. Don’t “appeal for more financial aid” but rather ask their advice in dealing with the situation. They will ask questions to flesh out the details and then if you are lucky advise you on what next steps to take given your circumstances and your parent’s circumstances. Depending on the situation they might refer you to another office for support (for example Student Services or legal aid).

-

Why is financial aid so stingy for upper middle class families? How is it possibly fair to expect my parents, who make $250k per year, to contribute nearly 30% of their pre-tax income to my tuition? They'd need to take out huge loans to pay the EFC.

Although your parents probably should have contributed to a 529 college savings account, the mere fact they make $250k per year doesn’t mean they don’t have high debt. There is a couple of ways to get around this: Scholarship or if you are independent, you won't need to include your parents' information on your FAFSA.

Create this form in 5 minutes!

How to create an eSignature for the federal direct parent plus loan applicationfinancial aid

How to create an eSignature for your Federal Direct Parent Plus Loan Applicationfinancial Aid in the online mode

How to generate an eSignature for the Federal Direct Parent Plus Loan Applicationfinancial Aid in Chrome

How to create an electronic signature for signing the Federal Direct Parent Plus Loan Applicationfinancial Aid in Gmail

How to generate an eSignature for the Federal Direct Parent Plus Loan Applicationfinancial Aid straight from your smartphone

How to make an eSignature for the Federal Direct Parent Plus Loan Applicationfinancial Aid on iOS

How to create an electronic signature for the Federal Direct Parent Plus Loan Applicationfinancial Aid on Android

People also ask

-

What is the Federal Direct Parent PLUS Loan ApplicationFinancial Aid process?

The Federal Direct Parent PLUS Loan ApplicationFinancial Aid process allows parents to apply for loans to help pay for their dependent child's education. This application involves completing the necessary forms through the federal student aid website and providing information about your financial situation. By understanding this process, you ensure that you meet all eligibility requirements for the loan.

-

How do I apply for the Federal Direct Parent PLUS Loan using airSlate SignNow?

To apply for the Federal Direct Parent PLUS Loan using airSlate SignNow, you can digitally complete and eSign your application documents. This platform streamlines the application process by allowing you to manage all required forms and signatures in one place. With airSlate SignNow, you can enhance your application experience with easy document tracking.

-

What are the costs associated with the Federal Direct Parent PLUS Loan ApplicationFinancial Aid?

Applying for a Federal Direct Parent PLUS Loan through airSlate SignNow typically includes minimal costs, primarily related to administrative fees. The interest rates and repayment terms are set by the federal government, making it an affordable financial aid option. Ensure you review all fees when considering this loan for educational expenses.

-

What features does airSlate SignNow offer for the loan application process?

airSlate SignNow offers several features designed to simplify the Federal Direct Parent PLUS Loan ApplicationFinancial Aid process, such as document templates, eSigning capabilities, and secure cloud storage. The platform also provides a user-friendly interface that guides you through each step, ensuring that you never miss critical information. This helps streamline your application and increases your chances of success.

-

What are the benefits of using airSlate SignNow for the Federal Direct Parent PLUS Loan Application?

Using airSlate SignNow for the Federal Direct Parent PLUS Loan ApplicationFinancial Aid provides a convenient and efficient way to manage your application. The ability to eSign documents and collaborate with others makes the process quicker and more organized. Additionally, you can access your documents from anywhere, reducing the stress associated with paperwork.

-

Can I track my Federal Direct Parent PLUS Loan application with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Federal Direct Parent PLUS Loan ApplicationFinancial Aid in real-time. You receive notifications when documents are viewed and signed, which keeps you informed throughout the process. This feature enhances communication and ensures you stay updated on progress.

-

Does airSlate SignNow integrate with other financial aid platforms?

AirSlate SignNow offers integrations with various financial aid platforms, enhancing your experience with the Federal Direct Parent PLUS Loan Application. These integrations often sync your application data, making it easier to manage all aspects of financial aid. Check the airSlate SignNow website for a complete list of available integrations.

Get more for Federal Direct Parent PLUS Loan ApplicationFinancial Aid

- Form w 4 caluedu

- Business sponsorship form

- To whom it may concern letter sample for student form

- Critical incident form bluecross blueshield of tennessee

- Dcu direct deposit authorization form

- Ohio scales for youth parent form concordcounseling

- B mobile application form bank of africa kenya

- Dwc form 022 request for a required medical examination rme

Find out other Federal Direct Parent PLUS Loan ApplicationFinancial Aid

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed