Sales Use Tax Newsletter Minnesota Department of Revenue Revenue State Mn Form

Understanding the Sales Use Tax Newsletter

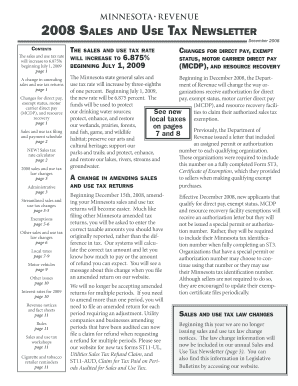

The Sales Use Tax Newsletter from the Minnesota Department of Revenue serves as a vital resource for businesses and individuals navigating tax obligations. This newsletter provides updates on tax rates, changes in legislation, and essential information regarding compliance. It is designed to keep taxpayers informed about their responsibilities and any adjustments that may impact their financial planning.

How to Access the Sales Use Tax Newsletter

To obtain the Sales Use Tax Newsletter, individuals can visit the Minnesota Department of Revenue's official website. The newsletter is typically available for download in PDF format, ensuring easy access for users. Subscribing to the newsletter may also be an option, allowing taxpayers to receive updates directly via email.

Key Components of the Sales Use Tax Newsletter

This newsletter includes several key elements that are essential for understanding sales and use tax in Minnesota. These components often feature:

- Updates on tax rate changes

- Information about new tax laws

- Guidance on compliance and reporting

- Details on exemptions and special cases

These sections are crucial for ensuring that taxpayers remain compliant and informed about their obligations.

Legal Considerations Regarding the Sales Use Tax Newsletter

Understanding the legal implications of the Sales Use Tax Newsletter is important for all taxpayers. The information provided in the newsletter reflects current laws and regulations, which must be adhered to in order to avoid penalties. Taxpayers should regularly review the newsletter to stay updated on any legal changes that may affect their tax responsibilities.

Examples of Practical Applications of the Sales Use Tax Newsletter

Businesses can utilize the Sales Use Tax Newsletter to better understand how tax changes may affect their operations. For instance, a retailer may refer to the newsletter to learn about new exemptions for certain products or services. Additionally, individuals planning to make significant purchases can find guidance on applicable taxes, ensuring they budget appropriately.

Filing Deadlines and Important Dates

The Sales Use Tax Newsletter often highlights critical filing deadlines and important dates relevant to taxpayers. This information is essential for ensuring timely submissions and avoiding late fees. Taxpayers should pay close attention to these dates as outlined in the newsletter to maintain compliance with state regulations.

Quick guide on how to complete sales use tax newsletter minnesota department of revenue revenue state mn

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your preferred device. Alter and eSign [SKS] to ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Sales Use Tax Newsletter Minnesota Department Of Revenue Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the sales use tax newsletter minnesota department of revenue revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales Use Tax Newsletter from the Minnesota Department of Revenue?

The Sales Use Tax Newsletter from the Minnesota Department of Revenue is a comprehensive resource that provides updates and insights on sales and use tax regulations in Minnesota. It is essential for businesses to stay informed about changes that may affect their tax obligations and compliance. Subscribing to this newsletter ensures you receive timely information directly from the Revenue State Mn.

-

How can the Sales Use Tax Newsletter benefit my business?

The Sales Use Tax Newsletter from the Minnesota Department of Revenue offers valuable insights that can help your business navigate complex tax regulations. By staying updated, you can avoid costly penalties and ensure compliance with state tax laws. This resource is particularly beneficial for businesses operating in multiple jurisdictions within Revenue State Mn.

-

Is there a cost associated with the Sales Use Tax Newsletter?

The Sales Use Tax Newsletter from the Minnesota Department of Revenue is typically provided at no cost to subscribers. This makes it an accessible resource for all businesses looking to stay informed about sales and use tax changes in Revenue State Mn. Ensure you sign up to receive the latest updates without any financial commitment.

-

How often is the Sales Use Tax Newsletter published?

The Sales Use Tax Newsletter from the Minnesota Department of Revenue is published regularly, often on a quarterly basis. This frequency allows businesses to receive timely updates on any changes in tax laws or regulations that may impact their operations in Revenue State Mn. Keeping up with these publications is crucial for maintaining compliance.

-

Can I access past issues of the Sales Use Tax Newsletter?

Yes, past issues of the Sales Use Tax Newsletter from the Minnesota Department of Revenue are typically archived on their official website. This allows businesses to review historical information and understand how tax regulations have evolved over time in Revenue State Mn. Accessing these archives can be beneficial for research and compliance purposes.

-

How do I subscribe to the Sales Use Tax Newsletter?

Subscribing to the Sales Use Tax Newsletter from the Minnesota Department of Revenue is a straightforward process. You can visit their official website and fill out the subscription form with your contact information. Once subscribed, you will receive the newsletter directly to your email, keeping you informed about important updates in Revenue State Mn.

-

Are there any specific features of the Sales Use Tax Newsletter I should know about?

The Sales Use Tax Newsletter from the Minnesota Department of Revenue includes features such as detailed articles on tax law changes, FAQs, and tips for compliance. These features are designed to help businesses understand their tax obligations better and navigate the complexities of sales and use tax in Revenue State Mn. It's a valuable tool for any business owner.

Get more for Sales Use Tax Newsletter Minnesota Department Of Revenue Revenue State Mn

Find out other Sales Use Tax Newsletter Minnesota Department Of Revenue Revenue State Mn

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself