101 Form

What is the 101 Form

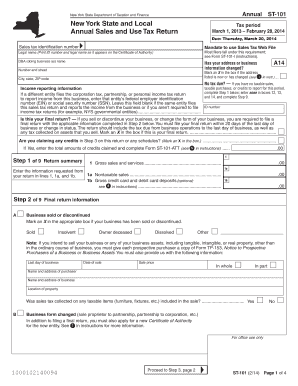

The NY ST 101 form, commonly referred to as the 101 form, is a crucial document used for reporting and paying sales tax in New York State. This form is specifically designed for businesses and individuals who need to report their sales tax liability on a quarterly or annual basis. The NY 101 form helps ensure compliance with state tax regulations and provides a systematic way to document taxable sales, exempt sales, and the corresponding tax due. Understanding the purpose and structure of this form is essential for accurate tax reporting.

How to use the 101 Form

Using the NY ST 101 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including sales receipts and tax-exempt certificates. Next, fill out the form by entering your total sales, taxable sales, and any exemptions. Be sure to calculate the total sales tax due based on the applicable rates. Once completed, review the information for accuracy before submitting it to the New York State Department of Taxation and Finance. This process can be streamlined by utilizing digital tools that allow for easy form filling and eSigning.

Steps to complete the 101 Form

Completing the NY ST 101 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant sales records and documentation.

- Enter your total sales amount in the designated section.

- Identify and report any exempt sales to ensure accurate tax calculations.

- Calculate the total sales tax due based on the provided rates.

- Review all entries for accuracy to avoid errors.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Legal use of the 101 Form

The NY ST 101 form is legally binding when completed and submitted according to New York State regulations. To ensure its legal validity, it must be filled out accurately and submitted within the designated filing deadlines. Utilizing a reliable eSignature solution can enhance the legal standing of the form by providing a digital certificate and ensuring compliance with the ESIGN Act and UETA. This is particularly important for businesses that rely on digital documentation for their transactions.

Filing Deadlines / Important Dates

Filing deadlines for the NY ST 101 form vary based on the reporting period. Typically, businesses must file the form quarterly or annually, depending on their sales volume. Quarterly filers should be aware of the deadlines at the end of each quarter, while annual filers need to submit by the specified date in the following year. Staying informed about these deadlines is crucial to avoid penalties and ensure compliance with state tax laws.

Required Documents

When completing the NY ST 101 form, several documents are necessary to support your entries. These include:

- Sales receipts and invoices that detail total sales.

- Tax-exempt certificates for any exempt sales.

- Previous tax filings for reference and accuracy.

- Records of any adjustments or corrections to prior filings.

Having these documents readily available will facilitate a smoother filing process and help ensure compliance with tax regulations.

Quick guide on how to complete 101 form

Complete 101 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 101 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to adjust and electronically sign 101 Form with ease

- Obtain 101 Form and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal authenticity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign 101 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 101 form

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the form 101a pdf and how can it be used?

The form 101a pdf is an important document used for various administrative purposes, often required for compliance. With airSlate SignNow, you can easily fill out, edit, and eSign your form 101a pdf, streamlining your workflow and saving time. Our platform ensures that your documents are secure and accessible at all times.

-

How do I create a form 101a pdf using airSlate SignNow?

Creating a form 101a pdf is simple with airSlate SignNow. You can start from a blank document or upload an existing template, then utilize our intuitive editing tools to customize it. Once completed, you can easily share it for eSignature with colleagues or clients.

-

Is there a cost associated with using airSlate SignNow to manage my form 101a pdf?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including affordable options for managing documents like the form 101a pdf. You can review our pricing page to find a plan that suits your usage and budget, ensuring you receive the best value for your new eSignature solution.

-

Can I access my form 101a pdf on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access your form 101a pdf from any device. Our app is available on both iOS and Android platforms, ensuring that you can fill out and eSign documents on the go with ease.

-

What features does airSlate SignNow offer for signing my form 101a pdf?

airSlate SignNow provides a range of features for signing your form 101a pdf, including customizable signing workflows, reminders, and options for in-person signing. These tools enhance the overall document signing experience, ensuring that you can manage your workflow efficiently and securely.

-

Does airSlate SignNow integrate with other tools I use for managing my form 101a pdf?

Yes, airSlate SignNow offers seamless integrations with various tools such as Google Drive, Dropbox, and other document management systems. This connectivity allows you to easily import and export your form 101a pdf across different applications, making document management a breeze.

-

What are the benefits of using airSlate SignNow for my form 101a pdf?

Using airSlate SignNow for your form 101a pdf provides signNow benefits, including enhanced security, reduced turnaround times, and improved collaboration among team members. Our platform automates the signing process, helping you focus on what matters most while ensuring compliance and accuracy.

Get more for 101 Form

- Mv53 form

- Dci 600f form

- Wildlife intake form wildlife rehabilitators of nc ncwildliferehab

- Request north carolina ged form

- Fillable online b 202a application for state privilege license web form

- Ged transcripts nc form

- Contest registration form central north carolina eastern surfing cnc surfesa

- Nc lottery claim office in asheville nc form

Find out other 101 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors