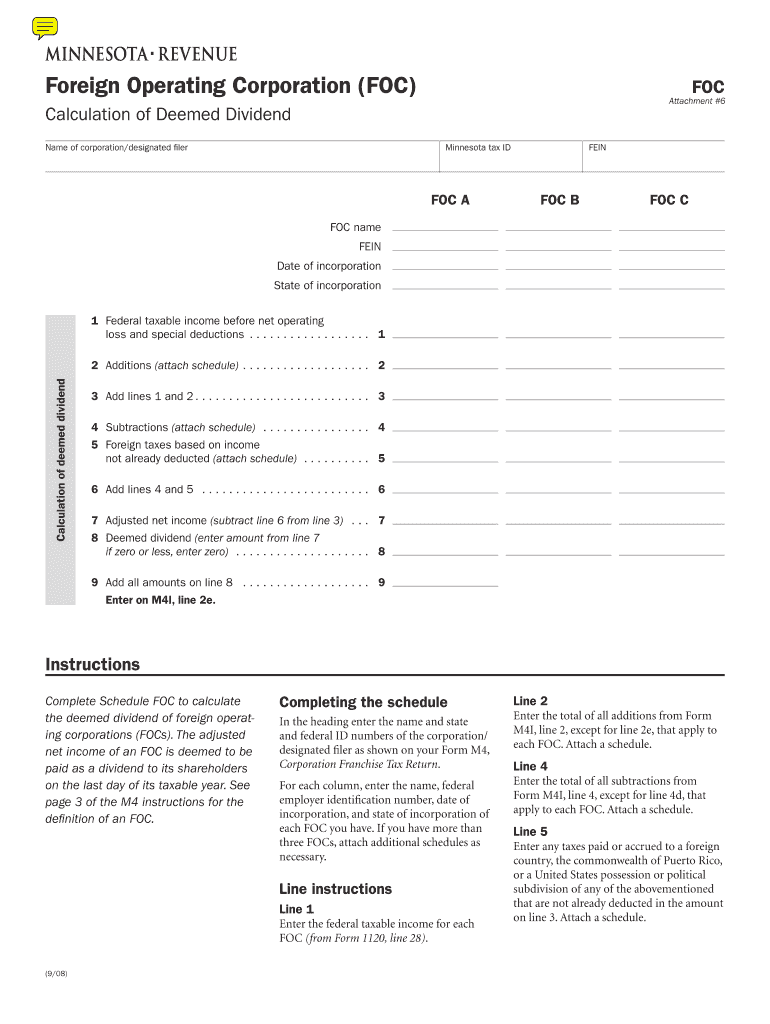

FOC, Foreign Operating Corporation, Calculation of Deemed Dividend Form

What is the FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend

The FOC, or Foreign Operating Corporation, Calculation Of Deemed Dividend is a tax-related process that determines the amount of deemed dividends a U.S. shareholder must report from a foreign corporation. This calculation is essential for U.S. tax compliance, particularly for individuals and businesses with foreign investments. It involves assessing the earnings and profits of the foreign corporation and determining how much of that is subject to U.S. taxation. Understanding this calculation helps taxpayers accurately report income and avoid potential penalties.

Key elements of the FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend

Several key elements are crucial in the calculation of deemed dividends from a Foreign Operating Corporation. These include:

- Earnings and Profits: The total earnings and profits of the foreign corporation need to be established, as they form the basis for the deemed dividend calculation.

- U.S. Shareholder Status: Only U.S. shareholders of the foreign corporation are subject to the deemed dividend rules, which means identifying shareholder status is essential.

- Tax Rate Application: The applicable U.S. tax rate on deemed dividends must be determined, which can vary based on the taxpayer's income level and the nature of the income.

- Currency Conversion: If the foreign corporation operates in a different currency, converting earnings and profits into U.S. dollars is necessary for accurate reporting.

Steps to complete the FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend

Completing the calculation of deemed dividends involves a series of steps to ensure accuracy and compliance. The steps include:

- Gather financial statements from the foreign corporation to determine total earnings and profits.

- Identify the U.S. shareholders and their respective ownership percentages in the foreign corporation.

- Calculate the deemed dividend by applying the appropriate tax rate to the earnings and profits attributable to U.S. shareholders.

- Convert the calculated amount into U.S. dollars if necessary, using the current exchange rate.

- Report the deemed dividend on the appropriate U.S. tax forms, ensuring all information is accurate and complete.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the calculation of deemed dividends from foreign corporations. These guidelines outline the reporting requirements, the necessary forms to use, and the penalties for non-compliance. Taxpayers should refer to IRS publications and instructions related to international taxation to ensure they are following the latest rules and regulations. This includes understanding how to report foreign income and the implications of tax treaties that may affect the deemed dividend calculation.

Required Documents

To complete the FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend, several documents are typically required. These include:

- Financial statements from the foreign corporation, including balance sheets and income statements.

- Ownership documentation to verify U.S. shareholder status and ownership percentages.

- Tax forms related to foreign income reporting, such as Form 5471 or Form 8865, depending on the structure of the foreign entity.

- Currency conversion documentation if applicable, to support the conversion of foreign earnings into U.S. dollars.

Penalties for Non-Compliance

Failure to accurately calculate and report deemed dividends can result in significant penalties for U.S. shareholders. The IRS imposes fines for late filings, incorrect information, and failure to report foreign income. These penalties can vary based on the severity of the non-compliance and may include monetary fines, interest on unpaid taxes, and potential audits. It is essential for taxpayers to understand these risks and ensure compliance to avoid costly repercussions.

Quick guide on how to complete foc foreign operating corporation calculation of deemed dividend

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foc foreign operating corporation calculation of deemed dividend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FOC and how does it relate to the Calculation Of Deemed Dividend?

An FOC, or Foreign Operating Corporation, is a corporation that operates outside the United States. Understanding the Calculation Of Deemed Dividend is crucial for businesses with FOCs, as it determines the tax implications of distributions made to U.S. shareholders. This calculation helps ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with FOC documentation?

airSlate SignNow provides a streamlined platform for managing documents related to FOCs. With features like eSigning and document tracking, businesses can efficiently handle the necessary paperwork for the Calculation Of Deemed Dividend. This simplifies compliance and enhances operational efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with FOCs. Each plan includes features that support the Calculation Of Deemed Dividend, ensuring you have the tools necessary for effective document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for FOC-related processes?

Key features of airSlate SignNow include customizable templates, secure eSigning, and automated workflows. These tools are particularly beneficial for businesses calculating deemed dividends for their FOCs, as they streamline the documentation process and reduce the risk of errors.

-

How does airSlate SignNow ensure compliance with FOC regulations?

airSlate SignNow is designed to help businesses maintain compliance with FOC regulations, including the Calculation Of Deemed Dividend. The platform provides audit trails and secure storage, ensuring that all documents are properly managed and accessible for regulatory review.

-

Can airSlate SignNow integrate with other software for FOC management?

Yes, airSlate SignNow offers integrations with various software solutions that can enhance FOC management. These integrations facilitate the Calculation Of Deemed Dividend by allowing seamless data transfer and document sharing between platforms, improving overall efficiency.

-

What benefits does airSlate SignNow provide for businesses with FOCs?

Using airSlate SignNow, businesses with FOCs can enjoy increased efficiency, reduced costs, and improved compliance. The platform simplifies the Calculation Of Deemed Dividend process, allowing teams to focus on strategic initiatives rather than administrative tasks.

Get more for FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend

Find out other FOC, Foreign Operating Corporation, Calculation Of Deemed Dividend

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word