8582 Form 2011

What is the 8582 Form

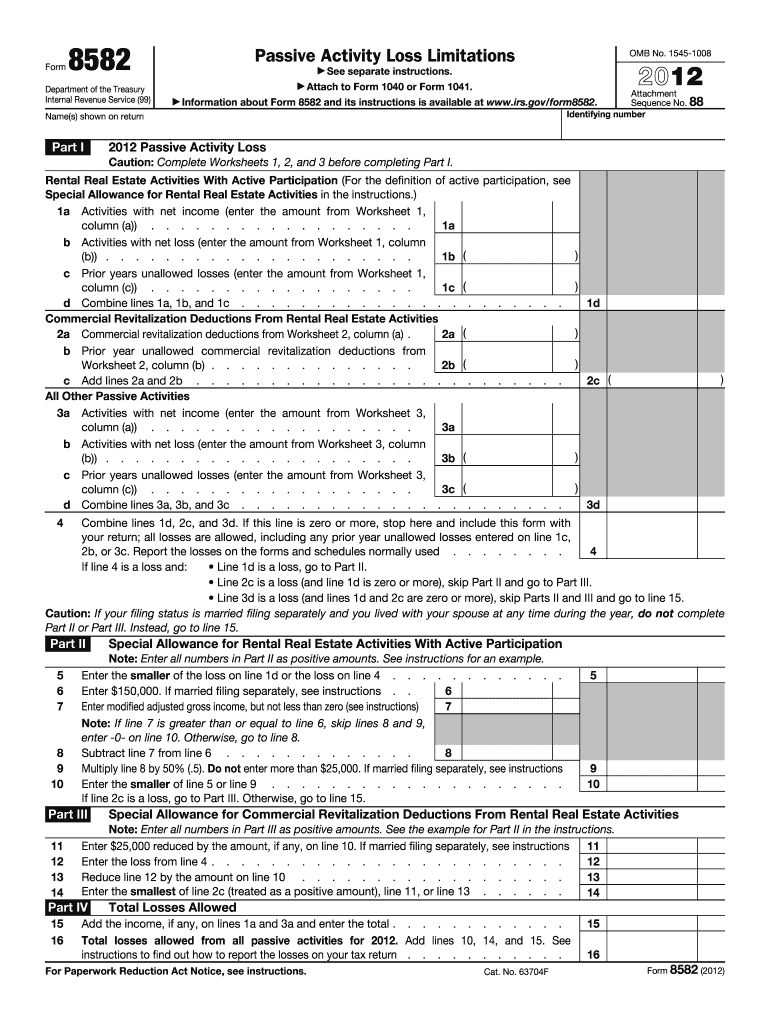

The 8582 Form, officially known as the "Passive Activity Loss Limitations," is a tax form utilized by individuals and entities to report passive activity losses and credits. This form is primarily relevant for taxpayers who have rental real estate activities or other passive investments. The IRS requires this form to ensure that taxpayers accurately report their passive income and losses, adhering to the limitations set forth in the tax code.

How to use the 8582 Form

Using the 8582 Form involves several key steps. Taxpayers must first identify their passive activities, which can include rental properties or limited partnerships. Next, they need to calculate their total passive income and losses, ensuring they understand the limitations on deducting these losses against other types of income. The form guides users through reporting these figures, allowing them to determine their allowable passive losses for the tax year.

Steps to complete the 8582 Form

Completing the 8582 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial information regarding your passive activities.

- Calculate your total passive income and losses for the year.

- Fill out the form, starting with your identification information and the total amounts calculated.

- Complete the sections detailing each passive activity, including any losses and credits.

- Review the form for accuracy before submission.

Legal use of the 8582 Form

The legal use of the 8582 Form is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their passive activity losses and adhere to the limitations set by the IRS. Proper completion of the form is essential, as incorrect reporting can lead to penalties or audits. Utilizing electronic signatures through platforms like signNow can enhance the legitimacy of the submitted form, ensuring it meets legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the 8582 Form align with the general tax filing deadlines for individuals. Typically, the form must be submitted by April 15 of the tax year, unless an extension is filed. It is important to keep track of any changes in deadlines, especially if filing electronically or if the taxpayer qualifies for special circumstances, such as military service or natural disasters.

Examples of using the 8582 Form

Examples of using the 8582 Form include scenarios such as a taxpayer who owns multiple rental properties and needs to report losses from one property while offsetting gains from another. Another example is a partner in a limited partnership who has passive losses that need to be reported to ensure compliance with IRS regulations. Each example illustrates the importance of accurately reporting passive activities to maximize tax benefits.

Quick guide on how to complete 2011 8582 form

Complete 8582 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle 8582 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign 8582 Form with ease

- Find 8582 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign 8582 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8582 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8582 form

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 8582 Form and how can I use it with airSlate SignNow?

The 8582 Form is a tax form used to report passive activity losses and credits. With airSlate SignNow, you can easily upload, eSign, and send your 8582 Form securely, ensuring that all necessary signatures are collected quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 8582 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that fits your budget while enjoying the benefits of eSigning and managing documents like the 8582 Form seamlessly.

-

What features does airSlate SignNow provide for completing the 8582 Form?

airSlate SignNow provides features such as customizable templates, document sharing, and real-time status tracking, making it easier to manage your 8582 Form. You can also automate reminders for signers, ensuring timely completion.

-

Can I integrate airSlate SignNow with other applications when working with the 8582 Form?

Absolutely! airSlate SignNow integrates with a variety of applications like Google Drive, Salesforce, and Microsoft Office. This integration allows you to streamline your workflow and efficiently manage your 8582 Form alongside other business processes.

-

How secure is my information when using airSlate SignNow for the 8582 Form?

Security is a top priority at airSlate SignNow. When you eSign and send the 8582 Form, your data is protected with bank-level encryption, ensuring that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the 8582 Form over traditional methods?

Using airSlate SignNow for the 8582 Form offers numerous benefits, including faster turnaround times, reduced paper usage, and enhanced convenience. You can manage all your signing needs from anywhere, which saves time and boosts productivity.

-

How do I get started with airSlate SignNow for my 8582 Form?

Getting started with airSlate SignNow for your 8582 Form is simple. Sign up for an account, upload your document, and start eSigning right away. The user-friendly interface makes it easy for anyone to navigate and complete their forms.

Get more for 8582 Form

- Ga counterclaim county form

- Georgia affidavit diligent search form

- Gpcsf 11 supreme court of georgia form

- Tax id ssn federal tax id form

- 2005 t 7 form

- Small claims court stipulated installment payment stipulated installment payment guamselfhelp form

- Petition to compromise doubtful claim of minor form

- 470 5526 authorized representative for managed care appeals form

Find out other 8582 Form

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking