982 Form 2011

What is the 982 Form

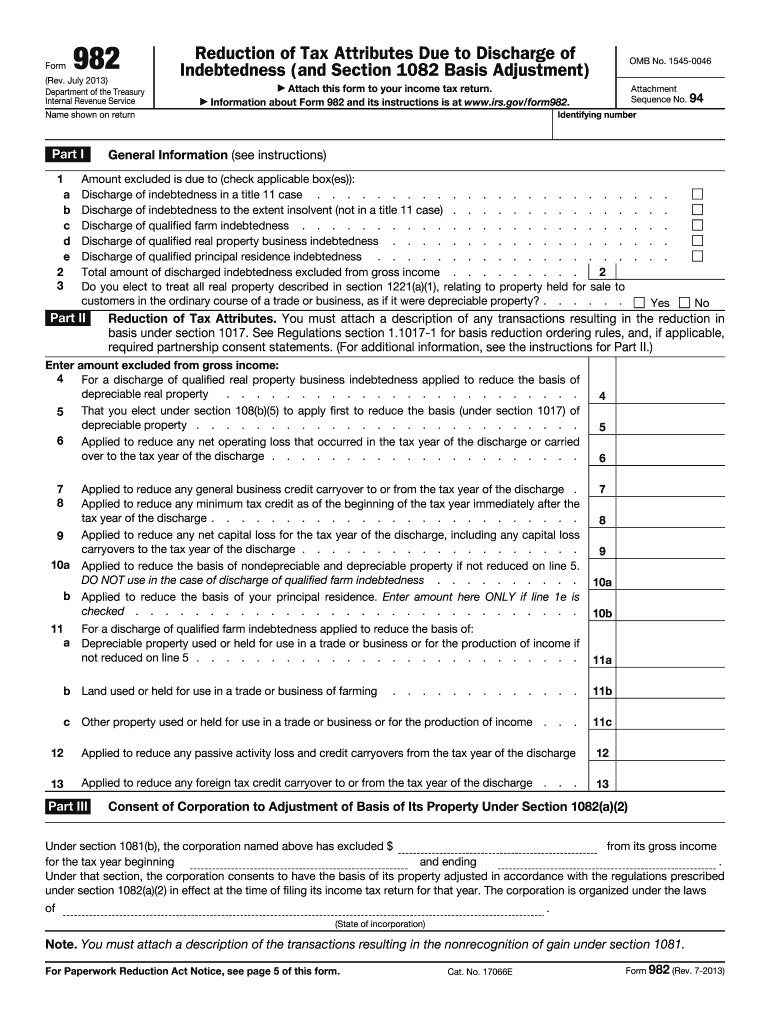

The 982 Form is an official document used in the United States primarily for tax purposes. It is utilized to claim a reduction of tax attributes due to discharge of indebtedness. This form is crucial for taxpayers who have had debts forgiven or canceled, as it allows them to report this information accurately to the Internal Revenue Service (IRS). Understanding the 982 Form is essential for ensuring compliance with tax regulations and for accurately reflecting one’s financial situation.

How to use the 982 Form

Using the 982 Form involves several steps to ensure that the information provided is accurate and complete. Taxpayers should begin by gathering all necessary documentation related to the debt that has been discharged. This includes any cancellation of debt notices received from creditors. Once the required information is collected, the taxpayer can fill out the form, indicating the amount of debt discharged and the specific tax attributes being reduced. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties.

Steps to complete the 982 Form

Completing the 982 Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents, including notices of debt cancellation.

- Fill out your personal information at the top of the form.

- Indicate the amount of debt that has been discharged in the appropriate section.

- Specify the tax attributes that are being reduced, such as net operating losses or credits.

- Review the form for accuracy and completeness before submission.

After completing the form, it should be attached to your tax return when filing.

Legal use of the 982 Form

The legal use of the 982 Form is governed by IRS regulations. It is essential for taxpayers to understand that this form must be filed accurately to avoid legal repercussions. The form serves as a declaration of the taxpayer’s financial situation regarding discharged debts and the corresponding tax implications. Filing the 982 Form correctly helps ensure that taxpayers do not face unexpected tax liabilities in the future.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 982 Form. It is important for taxpayers to refer to the most recent IRS publications and instructions related to this form. These guidelines outline the necessary information to include, the eligibility criteria for using the form, and any deadlines for submission. Adhering to these guidelines is crucial for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 982 Form coincide with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If additional time is needed, taxpayers may file for an extension, but it is important to ensure that the 982 Form is submitted by the deadline to avoid penalties. Staying informed about these dates is essential for timely compliance.

Quick guide on how to complete 2011 982 form

Complete 982 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly, without delays. Manage 982 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 982 Form with ease

- Obtain 982 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 982 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 982 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 982 form

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a 982 Form and why is it important?

The 982 Form is a crucial document used for various financial and tax purposes. It helps taxpayers apply for relief and accurately report certain tax deductions, making it essential for compliance and maximizing financial benefits. Understanding the 982 Form is vital for effective financial planning.

-

How can airSlate SignNow assist with the 982 Form?

airSlate SignNow provides a user-friendly platform for sending and eSigning the 982 Form quickly and efficiently. With our solution, users can easily manage their documents, ensuring secure and expedited processing. This simplifies compliance and helps avoid delays in submission.

-

What are the pricing options for airSlate SignNow’s services?

airSlate SignNow offers a range of pricing plans tailored to fit different business needs, including options for single users and teams. Our plans provide flexibility and affordability, ensuring everyone can manage their 982 Form and other documents effectively. Review our pricing page for detailed options and features.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you can enjoy features like custom templates, electronic signatures, and real-time tracking for your 982 Form and other documents. Our platform also offers robust collaboration tools for team editing and approval processes, enhancing overall workflow efficiency.

-

Is airSlate SignNow compliant with legal requirements for the 982 Form?

Yes, airSlate SignNow is fully compliant with legal requirements for electronic signatures, ensuring that your 982 Form meets all necessary regulations. Our platform uses advanced security measures to protect your documents and maintain compliance with federal guidelines.

-

Can I integrate airSlate SignNow with other software for managing my 982 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, enhancing your ability to manage the 982 Form and other documents. This interoperability allows you to streamline your workflows and keep all your business processes connected.

-

What are the benefits of using airSlate SignNow for electronic signing?

Using airSlate SignNow for electronic signing provides numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security for your 982 Form and other documents. It enables you to complete transactions faster, thus saving time and resources for your business.

Get more for 982 Form

- Court of common pleas for the state of delaware form

- Delaware power of attorney form pdf

- Delaware new castle county form letter for parent of minor child

- Florida postponement form

- Florida form bar application

- Complaint for unlawful detainer hernando clerk form

- Form 2 learning disability verification floridabarexam

- Form 3 attention deficithyperactivity disorder

Find out other 982 Form

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF