1099 Oid Form 2015

What is the 1099 Oid Form

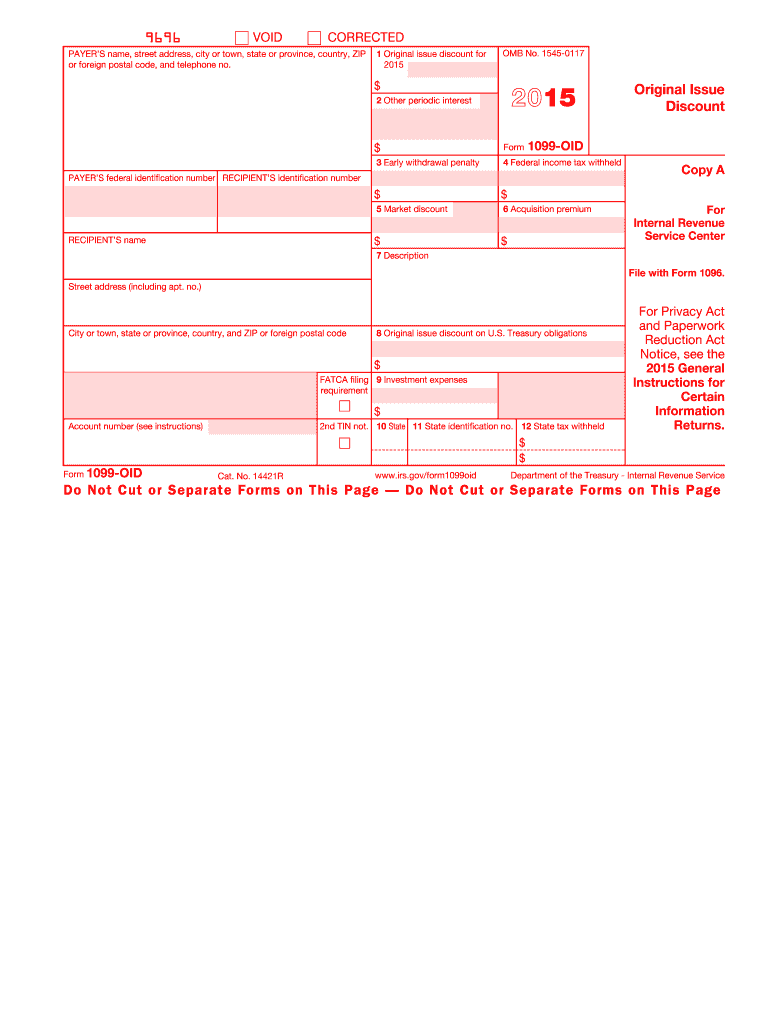

The 1099 OID Form, officially known as the Original Issue Discount (OID) Form, is a tax document used in the United States to report original issue discount income. This form is essential for taxpayers who receive interest income from debt instruments, such as bonds or notes, that were issued at a discount. The OID represents the difference between the face value of the debt instrument and its issue price. Taxpayers must report this income to the Internal Revenue Service (IRS) to ensure compliance with federal tax regulations.

How to use the 1099 Oid Form

Using the 1099 OID Form involves several steps to ensure accurate reporting of income. Taxpayers should first gather all relevant financial documents, including any statements from financial institutions that detail the OID income received. Next, the taxpayer must fill out the form with accurate information, including the issuer's details, the amount of OID income, and any other required data. Once completed, the form should be submitted to the IRS along with the taxpayer's annual tax return. It's important to keep a copy of the form for personal records.

Steps to complete the 1099 Oid Form

Completing the 1099 OID Form requires careful attention to detail. Follow these steps for accuracy:

- Obtain the latest version of the 1099 OID Form from the IRS website or your tax software.

- Enter the payer's name, address, and taxpayer identification number (TIN).

- Fill in your name, address, and TIN in the recipient section.

- Report the total OID income received in the appropriate box.

- Include any additional information as required by the form.

- Review the completed form for accuracy before submission.

Legal use of the 1099 Oid Form

The legal use of the 1099 OID Form is governed by IRS regulations. Taxpayers must use this form to report any OID income accurately to avoid penalties. Failure to report this income can lead to audits and potential fines. It is essential to ensure that all information provided on the form is truthful and complete. The IRS requires that the form be submitted by the deadline, typically by January thirty-first of the following year, to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 OID Form are crucial for taxpayers to note. The form must be submitted to the IRS by January thirty-first of the year following the tax year in which the OID income was received. If the form is filed electronically, the deadline may extend to March thirty-first. Taxpayers should also ensure they provide copies to recipients by the same deadlines to avoid any compliance issues.

Who Issues the Form

The 1099 OID Form is typically issued by financial institutions, such as banks or brokerage firms, that handle debt instruments. These institutions are responsible for calculating the OID amount and providing the necessary documentation to the taxpayer. If you receive OID income, it is essential to check with the issuer to ensure you receive the correct form and information for your tax reporting.

Quick guide on how to complete 2015 1099 oid form

Complete 1099 Oid Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 1099 Oid Form on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric workflow today.

The simplest way to edit and electronically sign 1099 Oid Form with ease

- Obtain 1099 Oid Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and electronically sign 1099 Oid Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 oid form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 oid form

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is a 1099 Oid Form and why is it important?

The 1099 Oid Form is a tax document used to report original issue discount income for bondholders in the United States. This form is essential for tax reporting purposes, as it helps individuals and businesses accurately report interest income received from OID bonds. Understanding the 1099 Oid Form can help prevent potential tax liabilities and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 1099 Oid Form process?

airSlate SignNow streamlines the process of managing the 1099 Oid Form by allowing users to easily create, send, and eSign required documents. Our platform ensures a secure and efficient workflow, reducing the time spent on paperwork and enhancing overall productivity. Simplifying this process helps businesses stay organized while they focus on what truly matters.

-

What features does airSlate SignNow offer for handling the 1099 Oid Form?

airSlate SignNow provides several features that facilitate the handling of the 1099 Oid Form, including customizable templates, robust eSigning capabilities, and automated reminders for pending signatures. Users can also track the status of their documents in real-time, ensuring a smooth transaction process. These features save time and reduce errors associated with manual document management.

-

Is there a cost associated with using airSlate SignNow for the 1099 Oid Form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs for handling the 1099 Oid Form. Each plan provides essential features, and users can select a package that best fits their budget and requirements. With our cost-effective solution, businesses can efficiently manage their document workflows without overspending.

-

Can I integrate airSlate SignNow with other software for processing the 1099 Oid Form?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing seamless processing of the 1099 Oid Form with your existing tools. Whether you use accounting software or CRM systems, our platform can enhance your workflow without disrupting your current processes. Integration simplifies data management and boosts overall efficiency.

-

How secure is airSlate SignNow when handling sensitive information like the 1099 Oid Form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information, such as the 1099 Oid Form. Our platform employs advanced encryption protocols and follows industry standards to protect user data. Moreover, access controls ensure that only authorized individuals can view or modify documents, keeping your information safe.

-

How do I get started with airSlate SignNow for the 1099 Oid Form?

Getting started with airSlate SignNow for the 1099 Oid Form is easy. Simply sign up for an account on our website, choose a suitable pricing plan, and begin creating your documents using our user-friendly interface. Our helpful resources and customer support are also available to assist you throughout the process of eSigning and managing your 1099 Oid Forms.

Get more for 1099 Oid Form

Find out other 1099 Oid Form

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form