2290 Form 2012

What is the 2290 Form

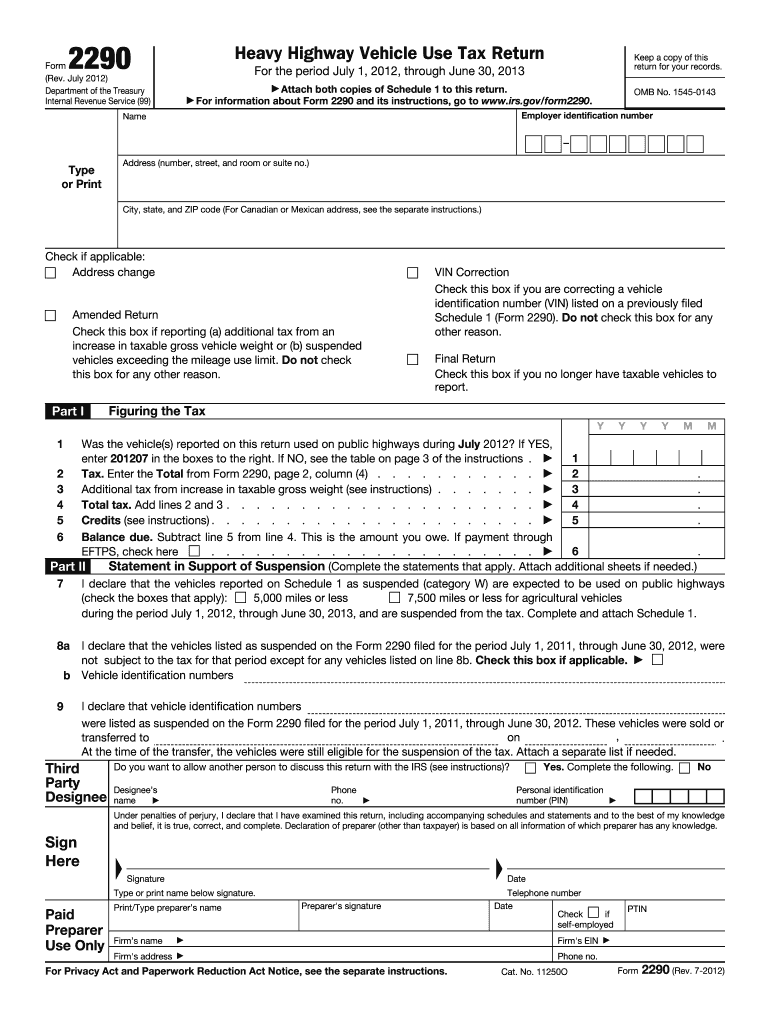

The 2290 Form, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by businesses and individuals who operate heavy vehicles on public highways in the United States. This form is primarily used to report and pay the federal highway use tax imposed on vehicles with a gross weight of 55,000 pounds or more. The tax helps fund the construction and maintenance of highways and roads. It is essential for owners of heavy vehicles to understand their obligations regarding this form to remain compliant with federal tax laws.

Steps to complete the 2290 Form

Completing the 2290 Form involves several steps to ensure accuracy and compliance. Here is a brief outline of the process:

- Gather necessary information, including the vehicle identification number (VIN), gross weight, and business details.

- Determine the tax amount based on the vehicle's weight and the applicable tax rate.

- Fill out the 2290 Form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS, along with any payment due.

Using an electronic signature solution can streamline this process, making it easier to fill out and submit the form securely.

How to obtain the 2290 Form

The 2290 Form can be obtained directly from the IRS website or through authorized e-filing services. Here are the steps to acquire the form:

- Visit the IRS website and navigate to the forms section.

- Search for "Form 2290" to find the downloadable PDF version.

- Alternatively, choose an e-filing service that offers the ability to complete and submit the form electronically.

Obtaining the form is straightforward, but ensure that you are using the latest version to comply with current tax regulations.

Legal use of the 2290 Form

The legal use of the 2290 Form is governed by federal tax laws. When submitting this form, it is crucial to ensure that all information is accurate and complete. The IRS requires that the form be filed annually, and failure to do so can result in penalties. Additionally, electronic signatures on the form are considered legally binding, provided they meet the requirements set forth by the ESIGN Act and other relevant laws. Utilizing a trusted electronic signature platform can enhance the legal validity of your submissions.

Filing Deadlines / Important Dates

Timely filing of the 2290 Form is essential to avoid penalties. The IRS requires that the form be filed by the last day of the month following the end of the tax period. Typically, this means that if you are filing for the tax year that begins on July first, the form must be submitted by August thirty-first. Additionally, if you acquire a new vehicle during the tax year, you must file the form within a specific timeframe. Keeping track of these deadlines helps ensure compliance and avoid unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The 2290 Form can be submitted through various methods, providing flexibility for users. The primary submission methods include:

- Online: E-filing through authorized providers is the most efficient method, allowing for immediate processing and confirmation.

- Mail: The form can be printed and mailed to the IRS, but this method may result in longer processing times.

- In-Person: While less common, some taxpayers may choose to deliver the form directly to an IRS office.

Choosing the right submission method can help streamline the filing process and ensure timely compliance with tax obligations.

Quick guide on how to complete 2290 form 2012

Prepare 2290 Form effortlessly on any device

Online document management has gained immense popularity among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage 2290 Form on any device utilizing the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 2290 Form with ease

- Locate 2290 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign 2290 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2290 form 2012

Create this form in 5 minutes!

How to create an eSignature for the 2290 form 2012

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 2290 Form and why do I need it?

The 2290 Form is used to report and pay the federal heavy vehicle use tax. Businesses that operate heavy vehicles with a gross weight of 55,000 pounds or more must file this form annually. Understanding the 2290 Form is essential to ensure compliance with IRS regulations and avoid penalties.

-

How can airSlate SignNow help me with my 2290 Form?

airSlate SignNow simplifies the process of completing and eSigning your 2290 Form. Our platform allows users to fill out, sign, and send documents securely, making it easier to manage tax filings. With robust features, you can efficiently handle all your necessary forms, including the 2290 Form.

-

Is there a cost associated with using airSlate SignNow for the 2290 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, including the 2290 Form. Our pricing plans are designed to fit various business needs, providing access to essential features at competitive rates. You can explore our pricing page to find a plan that best suits your requirements.

-

What features does airSlate SignNow offer for the 2290 Form?

airSlate SignNow includes features like secure eSigning, document templates, and collaboration tools to streamline the process of filing your 2290 Form. This platform also offers mobile access, allowing you to manage your documents from anywhere. With easy-to-use tools, preparing your 2290 Form becomes stress-free.

-

Can I integrate airSlate SignNow with other software for the 2290 Form?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing you to enhance your workflow when preparing the 2290 Form. Whether you're using CRM systems or accounting software, our integrations ensure that you can manage documents effectively without interruptions.

-

How secure is airSlate SignNow for handling my 2290 Form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your documents, including the 2290 Form, ensuring your sensitive information remains confidential. You can trust our platform to handle your tax-related documents securely.

-

What are the benefits of using airSlate SignNow for the 2290 Form?

Using airSlate SignNow for your 2290 Form offers numerous benefits, including increased efficiency and reduced paperwork. Our user-friendly interface allows for quicker document processing, saving you valuable time during tax season. Additionally, our flexible features help ensure that you stay compliant and organized.

Get more for 2290 Form

- Bond waiver state of connecticut pc 280 rev 713 form

- Connecticut requestorder waiver of fees petitioner form

- Connecticut affidavit re change of name minor form

- Affidavit form 5522112

- Turn off on request form city of wilmington delaware

- Full text of ampquota history of wilkes barr luzerne county form

- History of the early settlers of sangamon county illinois form

- Delaware new castle county name change instructions form

Find out other 2290 Form

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online