KPI, Partner's Share of Income, Credits and Modifications Revenue State Mn Form

Understanding the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

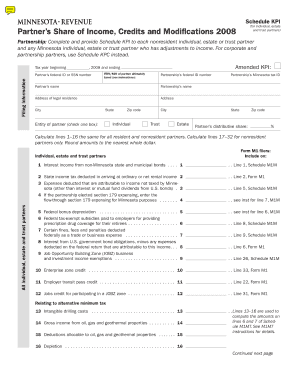

The KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is a crucial form used for reporting income and modifications related to partnerships in Minnesota. This form helps partners accurately reflect their share of income, deductions, and credits on their tax returns. It is essential for ensuring compliance with state tax regulations and for calculating the correct amount of taxes owed. Understanding the details of this form is vital for partners to maintain transparency and accuracy in their financial reporting.

Steps to Complete the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Completing the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and previous tax returns.

- Determine your share of the partnership’s income, deductions, and credits based on the partnership agreement.

- Fill out the form accurately, ensuring all figures are correct and reflect your share of the partnership’s financial activity.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Key Elements of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Several key elements are included in the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn:

- Partner Identification: Details of each partner, including names and identification numbers.

- Income Reporting: Total income earned by the partnership and each partner's share.

- Deductions: Any allowable deductions that can be claimed by the partners.

- Credits: Tax credits applicable to the partnership that can benefit individual partners.

- Modifications: Any adjustments that need to be made to the reported income or deductions.

Legal Use of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

The legal use of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is essential for compliance with Minnesota tax laws. Partners must use this form to report their share of income accurately to avoid legal repercussions. Misreporting or failing to file this form can lead to penalties, interest on unpaid taxes, and potential audits by the state tax authority. Therefore, understanding the legal implications and ensuring accurate reporting is vital for all partners involved.

Filing Deadlines for the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Filing deadlines for the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn are crucial for compliance. Typically, the form must be submitted by the same deadline as the partnership's tax return. It is essential to check for any specific state requirements or changes in deadlines, as these can vary year by year. Partners should plan ahead to ensure timely submission and avoid any potential penalties.

Examples of Using the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Examples of using the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn can provide clarity on its practical application. For instance:

- A partner in a real estate investment partnership uses the form to report rental income and associated deductions.

- A partner in a consulting firm reports income earned from client contracts and claims applicable business expenses.

- Partners in a manufacturing business utilize the form to report their share of profits and any tax credits for equipment purchases.

Quick guide on how to complete kpi partners share of income credits and modifications revenue state mn 11331782

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the kpi partners share of income credits and modifications revenue state mn 11331782

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn in business operations?

The KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is crucial for understanding how income is distributed among partners and how modifications can impact revenue. This metric helps businesses assess their financial health and make informed decisions regarding partnerships and income allocation.

-

How does airSlate SignNow support tracking KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow provides tools that allow businesses to easily track and manage their KPIs, including the Partner's Share Of Income, Credits And Modifications Revenue State Mn. With our platform, users can create and manage documents that reflect these metrics, ensuring accurate reporting and compliance.

-

What features does airSlate SignNow offer to enhance the management of KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Our platform offers features such as customizable templates, automated workflows, and real-time collaboration, which are essential for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. These tools streamline the documentation process, making it easier to track and modify revenue-related agreements.

-

Is airSlate SignNow cost-effective for small businesses looking to manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn without breaking the bank.

-

Can airSlate SignNow integrate with other tools to help manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your ability to manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. This integration allows for better data synchronization and improved workflow efficiency.

-

What benefits can businesses expect from using airSlate SignNow for KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

By using airSlate SignNow, businesses can expect improved accuracy in tracking their KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. Additionally, our platform enhances collaboration and speeds up the document signing process, ultimately leading to better financial management.

-

How does airSlate SignNow ensure compliance when managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow ensures compliance by providing secure and legally binding eSignatures, along with audit trails for all documents. This feature is particularly important for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn, as it helps maintain transparency and accountability.

Get more for KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Find out other KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT