Form 1065 2015

What is the Form 1065

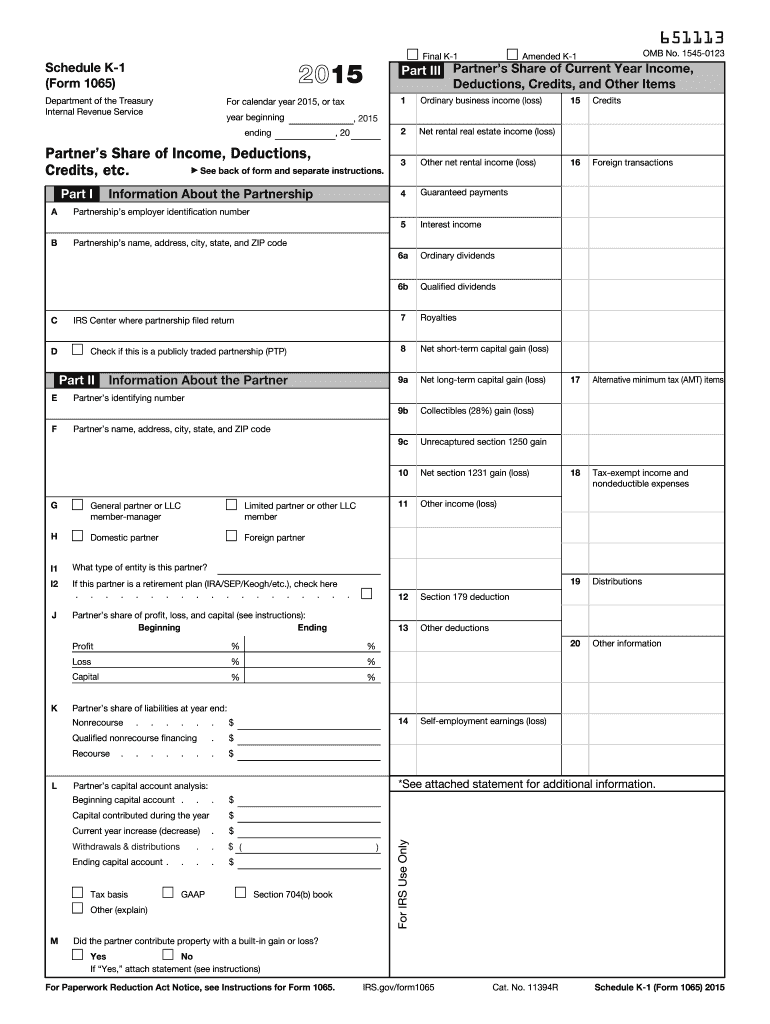

The Form 1065 is a U.S. tax document used by partnerships to report income, gains, losses, deductions, and credits. This form is essential for partnerships as it provides the Internal Revenue Service (IRS) with a comprehensive overview of the partnership's financial activities. Each partner receives a Schedule K-1, detailing their share of the partnership's income, which they then report on their individual tax returns. Understanding the Form 1065 is crucial for maintaining compliance with federal tax regulations.

How to use the Form 1065

Using the Form 1065 involves several key steps. Partnerships must gather all relevant financial information, including income, expenses, and distributions. The form requires the partnership to report its total income and deductions, which will ultimately determine the taxable income passed through to each partner. Accurate completion is vital, as errors can lead to penalties or delays in processing. Once filled out, the form must be submitted to the IRS along with the appropriate schedules and supporting documents.

Steps to complete the Form 1065

Completing the Form 1065 requires a systematic approach:

- Gather financial records, including income statements and expense reports.

- Fill in the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income on the designated lines, including ordinary business income and other income sources.

- Detail all deductions, such as salaries, rent, and utilities, to arrive at the partnership's net income.

- Complete the Schedule K and K-1 for each partner, which outlines their share of income and deductions.

- Review the form for accuracy and ensure all required signatures are obtained.

Legal use of the Form 1065

The legal use of the Form 1065 is governed by IRS regulations. It must be filed annually by partnerships, and failure to do so can result in penalties. The form serves as a declaration of the partnership's income and expenses, ensuring transparency and compliance with tax laws. Partnerships must also adhere to the deadlines set by the IRS to avoid additional fines. Understanding the legal implications of this form is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 1065. The standard due date is March 15 for calendar year partnerships. If additional time is needed, partnerships can file for an extension, which typically provides an additional six months. However, it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties. Keeping track of these deadlines is crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 1065 can be submitted through various methods. Partnerships have the option to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the IRS, although this method may result in longer processing times. In-person submissions are generally not applicable for Form 1065, as it is primarily a document for tax reporting rather than an application or request. Choosing the right submission method can enhance efficiency and compliance.

Quick guide on how to complete form 1065 2015

Effortlessly Prepare Form 1065 on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form 1065 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign Form 1065 with ease

- Obtain Form 1065 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the document or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), an invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 1065 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1065 2015

Create this form in 5 minutes!

How to create an eSignature for the form 1065 2015

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1065, and why is it important for businesses?

Form 1065 is an IRS tax form used by partnerships to report their income, gains, losses, deductions, and credits. Understanding how to complete Form 1065 is essential for businesses to ensure compliance with tax laws and to accurately report their financial performance. Using airSlate SignNow can streamline the signing process for Form 1065, making it easier for partners to eSign and submit their documents.

-

How can airSlate SignNow help with the completion of Form 1065?

airSlate SignNow provides an easy-to-use platform for sending and eSigning Form 1065 and other important documents. With features like templates and document tracking, businesses can simplify the process of collecting signatures from multiple partners. This not only saves time but also reduces the likelihood of errors in the completion of Form 1065.

-

What are the pricing options for using airSlate SignNow for Form 1065?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial for new users. These plans include features specifically designed for document management and eSigning, which are beneficial for handling Form 1065. Check the website for the latest pricing details and options tailored to your partnership's requirements.

-

Is airSlate SignNow secure for signing sensitive documents like Form 1065?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive documents such as Form 1065. The platform complies with various regulations to ensure that your data remains confidential and secure. You can confidently eSign and manage your Form 1065 without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other software for managing Form 1065?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including accounting and financial tools, to enhance your workflow related to Form 1065. This allows you to streamline data sharing and document management, making the entire process more efficient. Check the integration options available on the airSlate SignNow website.

-

How does airSlate SignNow improve collaboration when preparing Form 1065?

airSlate SignNow enhances collaboration by allowing multiple users to access and eSign Form 1065 in real-time. This feature is particularly useful for partnerships, as it enables quick communication and approval among all partners involved in the tax filing process. With notifications and tracking, everyone stays informed about the status of the document.

-

What features should I look for in airSlate SignNow for handling Form 1065?

When using airSlate SignNow for Form 1065, look for features like customizable templates, automated reminders, and real-time document tracking. These tools simplify the eSigning process and ensure that all partners can easily complete and submit the form on time. User-friendly navigation and mobile access are also key features that enhance productivity.

Get more for Form 1065

Find out other Form 1065

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation