E 1040 Form 2014

What is the E 1040 Form

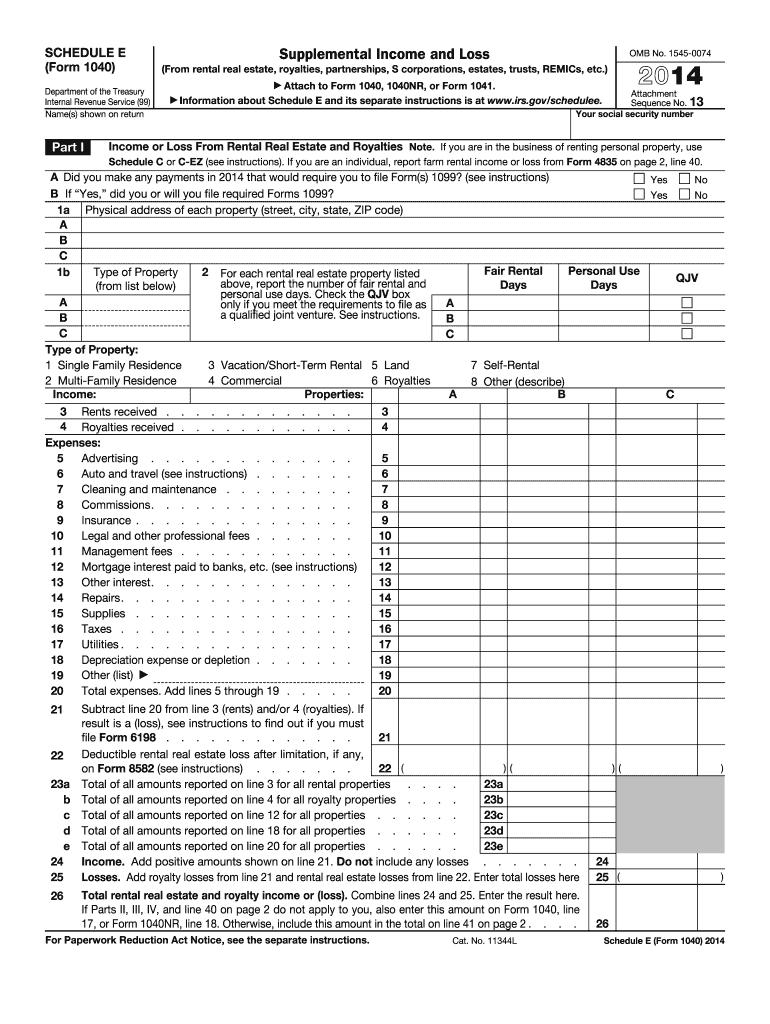

The E 1040 Form is a crucial document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating tax obligations and determining eligibility for various tax credits and deductions. The E 1040 Form is commonly used by taxpayers to ensure compliance with federal tax laws and to facilitate the accurate assessment of their financial responsibilities.

How to use the E 1040 Form

Using the E 1040 Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all income, deductions, and credits are accurately reported. It's important to double-check calculations to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on personal preference and the specific requirements of the IRS.

Steps to complete the E 1040 Form

Completing the E 1040 Form requires a systematic approach:

- Gather documentation: Collect all relevant income statements and receipts for deductions.

- Fill out personal information: Provide your name, address, and Social Security number.

- Report income: Enter all sources of income, including wages, interest, and dividends.

- Claim deductions and credits: Identify applicable deductions and tax credits to reduce taxable income.

- Calculate tax liability: Use the IRS tax tables to determine the amount owed or refund due.

- Sign and date the form: Ensure the form is signed to validate the information provided.

Legal use of the E 1040 Form

The E 1040 Form is legally binding when filled out correctly and submitted to the IRS. It serves as an official record of a taxpayer's income and tax obligations. To ensure its legal validity, the form must be signed, and all information must be accurate and complete. Failure to comply with tax laws can result in penalties, including fines or audits by the IRS.

Filing Deadlines / Important Dates

Timely filing of the E 1040 Form is essential to avoid penalties. The standard deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, allowing an extra six months to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The E 1040 Form can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online submission: Many taxpayers choose to e-file using tax preparation software, which often simplifies the process and speeds up refunds.

- Mail submission: The form can be printed and mailed to the appropriate IRS address, depending on the taxpayer's location and whether a payment is included.

- In-person filing: Some individuals may opt to file in person at designated IRS offices or during tax assistance events.

Quick guide on how to complete 2014 e 1040 form

Complete E 1040 Form with ease on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage E 1040 Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign E 1040 Form effortlessly

- Obtain E 1040 Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Select important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, via email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misfiled documents, tedious searching for forms, or errors that require you to print new copies. airSlate SignNow addresses your document management needs in just a few clicks from the device of your choice. Edit and electronically sign E 1040 Form to ensure excellent communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 e 1040 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 e 1040 form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the E 1040 Form?

The E 1040 Form is a standardized tax form used for reporting individual income tax in the United States. It is essential for taxpayers to accurately complete this form to comply with federal regulations and avoid penalties.

-

How can airSlate SignNow help me with the E 1040 Form?

airSlate SignNow simplifies the process of completing and eSigning the E 1040 Form by providing an easy-to-use digital platform. You can fill out your forms online, securely store them, and send them for electronic signatures, streamlining your tax filing process.

-

Is airSlate SignNow cost-effective for managing E 1040 Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing the E 1040 Form and other documents. With competitive pricing plans, you can easily access features that enhance your document workflows without breaking the bank.

-

What features does airSlate SignNow offer for the E 1040 Form?

airSlate SignNow provides a range of features designed for the E 1040 Form, including customizable templates, real-time collaboration, and secure eSigning. These features ensure that you can efficiently complete and sign your tax documents with peace of mind.

-

Can I integrate airSlate SignNow with other software for handling the E 1040 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and document management software, making it easy to manage your E 1040 Form alongside other financial documents. This integration enhances your workflow and saves you time.

-

What are the benefits of using airSlate SignNow for the E 1040 Form?

Using airSlate SignNow for the E 1040 Form offers several benefits, including reduced paperwork, enhanced security, and faster processing times. You'll enjoy a more efficient tax filing experience with less hassle and the ability to track your document status in real time.

-

Is airSlate SignNow user-friendly for completing the E 1040 Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the E 1040 Form. The intuitive interface ensures that users, regardless of tech-savviness, can navigate the platform and fulfill their tax obligations effortlessly.

Get more for E 1040 Form

- Piedmont graphics 021916 patient registration form

- Form snf

- Getting to know your infant happy house daycare happyhousedaycare form

- Tawuniya claim form

- Co prescription drug prior authorization request form co prescription drug prior authorization request form

- Anxiety assessment scale form

- Ma 105 cmr form

- Dr kellys mobile surgical unitaffordable pet surgery form

Find out other E 1040 Form

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template