Irs Form 8949 2014

What is the Irs Form 8949

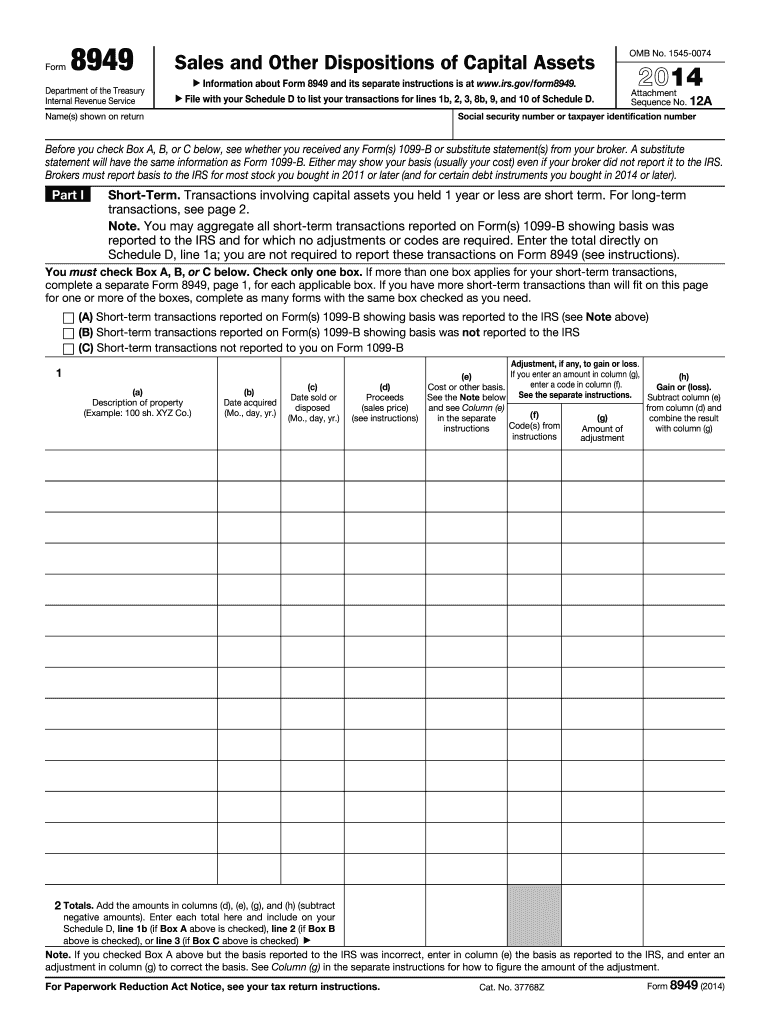

The Irs Form 8949 is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the amount of tax owed on these transactions. It provides a detailed account of each sale, including the date of acquisition, date of sale, proceeds, cost basis, and the resulting gain or loss. The information reported on Form 8949 is then transferred to Schedule D of the individual or business tax return, ensuring that all capital transactions are accounted for in the overall tax calculation.

How to use the Irs Form 8949

Using the Irs Form 8949 involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant information regarding their asset transactions. This includes the purchase and sale dates, amounts received from sales, and the original purchase prices. Once this information is compiled, it is entered into the appropriate sections of the form, categorized by short-term and long-term transactions. Short-term transactions are those held for one year or less, while long-term transactions are held for more than one year. After completing the form, the totals are summarized and carried over to Schedule D for inclusion in the overall tax return.

Steps to complete the Irs Form 8949

Completing the Irs Form 8949 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including records of asset purchases and sales.

- Determine whether each transaction is short-term or long-term based on the holding period.

- Fill in the form by entering the details of each transaction, including dates, proceeds, cost basis, and gain or loss.

- Calculate the totals for both short-term and long-term transactions separately.

- Transfer the totals to Schedule D of your tax return.

Key elements of the Irs Form 8949

The Irs Form 8949 consists of several key elements that taxpayers must understand to complete it accurately. These elements include:

- Date acquired: The date when the asset was purchased.

- Date sold: The date when the asset was sold.

- Proceeds: The amount received from the sale of the asset.

- Cost basis: The original purchase price of the asset, including any associated costs.

- Gain or loss: The difference between proceeds and cost basis, indicating whether the transaction resulted in a profit or a loss.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 8949 align with the overall tax return deadlines. For most individual taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who need additional time can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Legal use of the Irs Form 8949

The legal use of the Irs Form 8949 is crucial for ensuring compliance with tax regulations. It serves as an official record of capital transactions, which the IRS may review during audits. Accurate reporting on this form helps taxpayers avoid penalties for underreporting income or misreporting gains and losses. Additionally, using the form in accordance with IRS guidelines supports the legal validity of the information provided, making it essential for all taxpayers engaging in asset sales.

Quick guide on how to complete 2014 irs form 8949

Effortlessly Prepare Irs Form 8949 on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Irs Form 8949 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Irs Form 8949 effortlessly

- Locate Irs Form 8949 and click on Acquire Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Complete button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Irs Form 8949 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 8949

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 8949

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is IRS Form 8949 and why do I need it?

IRS Form 8949 is used to report sales and other dispositions of capital assets. If you have sold stocks, bonds, or other investments during the tax year, you need to complete IRS Form 8949 to accurately report your gains or losses. Properly filling out this form is essential for ensuring compliance with IRS regulations and maximizing your tax deductions.

-

How can airSlate SignNow assist with IRS Form 8949?

airSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 8949. With our user-friendly interface, you can easily prepare and eSign your tax documents, ensuring they are completed accurately and submitted on time. This streamlines the process, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8949?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs. Whether you are an individual or a large enterprise, you can choose a plan that fits your budget while providing full access to our features for managing documents like IRS Form 8949 efficiently.

-

What features does airSlate SignNow offer for managing IRS Form 8949?

airSlate SignNow offers features like e-signature capabilities, document templates, and secure cloud storage to help you manage IRS Form 8949 and other documents easily. You can track document status, set reminders, and ensure compliance with tax regulations, making your document management process more efficient.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 8949?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to import data directly into IRS Form 8949. This integration saves time and reduces the likelihood of errors, ensuring your tax forms are accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for IRS Form 8949?

Using airSlate SignNow for IRS Form 8949 provides numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive tax information. Our platform ensures that you can complete and submit your forms electronically, making the tax filing process more straightforward and efficient.

-

Is airSlate SignNow secure for handling IRS Form 8949?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IRS Form 8949 and other sensitive documents are protected. We use advanced encryption methods and follow industry standards to safeguard your data, giving you peace of mind when managing your tax forms.

Get more for Irs Form 8949

- Authorization for protected health information phi

- Care penn treaty form

- Patient registration form northside family medicine and urgent care

- New patient intake form please list all current medications

- Tb questionnaire illinois form

- Pcs ambulance form

- Pre authorization form

- Dayton interventional radiology llcpatient registration form

Find out other Irs Form 8949

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now