Irs Form 944 for 2013

What is the IRS Form 944 For

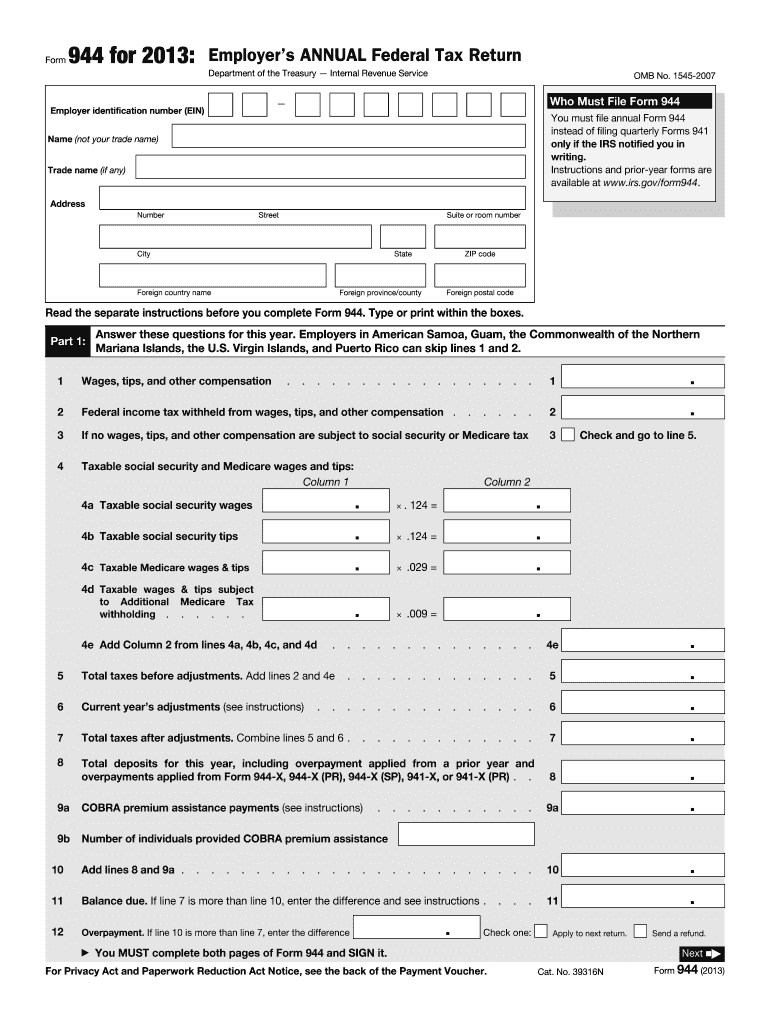

The IRS Form 944 is specifically designed for small employers to report their annual payroll taxes. This form allows eligible businesses to report their federal income tax withheld, Social Security tax, and Medicare tax. Unlike the more commonly used Form 941, which is filed quarterly, Form 944 simplifies the process for businesses with a lower volume of payroll, making it easier to manage tax obligations on an annual basis.

Steps to Complete the IRS Form 944

Completing the IRS Form 944 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form accurately, ensuring all fields are completed, including the total tax liability for the year.

- Double-check all calculations to avoid errors that could lead to penalties.

- Sign and date the form, confirming that the information provided is true and accurate.

How to Obtain the IRS Form 944

The IRS Form 944 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, if you are an eligible employer, the IRS may automatically send you the form each year. It is important to ensure you have the correct version for the tax year you are filing.

Filing Deadlines / Important Dates

For most employers, the deadline to file the IRS Form 944 is January 31 of the following year. This deadline applies to the tax year for which you are reporting. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to file on time to avoid penalties and interest on unpaid taxes.

Legal Use of the IRS Form 944

The IRS Form 944 is legally binding once it is signed and submitted to the IRS. It must be filled out accurately to reflect the employer's payroll tax obligations. Failure to comply with the requirements can result in penalties, including fines and interest on unpaid taxes. Employers should keep copies of their submitted forms and any supporting documentation for their records.

Key Elements of the IRS Form 944

Key elements of the IRS Form 944 include:

- Employer Identification Number (EIN)

- Total wages paid to employees

- Federal income tax withheld

- Social Security and Medicare taxes

- Signature and date of the employer or authorized representative

Quick guide on how to complete irs form 944 for 2013

Manage Irs Form 944 For effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Access Irs Form 944 For across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Irs Form 944 For without hassle

- Obtain Irs Form 944 For and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with features designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you want to share your form, be it via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 944 For and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 944 for 2013

Create this form in 5 minutes!

How to create an eSignature for the irs form 944 for 2013

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is IRS Form 944 for and who needs to file it?

IRS Form 944 is specifically designed for small employers who owe less than $1,000 in employment taxes annually. This form allows eligible businesses to report their payroll taxes on an annual basis instead of quarterly. Understanding when and how to file IRS Form 944 is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with IRS Form 944 for businesses?

airSlate SignNow streamlines the process of sending and electronically signing IRS Form 944 for your business. Our platform allows you to quickly prepare, send, and collect signatures on important tax forms, ensuring that your submissions are timely and secure. This efficiency helps you focus on growing your business rather than paperwork.

-

What features does airSlate SignNow offer for IRS Form 944 for small businesses?

airSlate SignNow provides a range of features tailored for IRS Form 944 for small businesses, including customizable templates, audit trails, and secure storage. These tools simplify the signing process, keep your documents organized, and enhance your compliance efforts. Plus, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for IRS Form 944 for my business?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing IRS Form 944 for your business, including unlimited document signing. With competitive pricing, you can choose the best option that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for handling IRS Form 944 for my business?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage IRS Form 944 for your business efficiently. Whether it's your accounting software or customer relationship management (CRM) system, our integrations enhance your workflow and ensure that all your tools work harmoniously.

-

What are the benefits of using airSlate SignNow for IRS Form 944 for payroll processing?

Using airSlate SignNow for IRS Form 944 offers numerous benefits, including faster document turnaround times and improved accuracy in payroll processing. Our electronic signature solution reduces the risk of errors and ensures compliance with IRS regulations. Plus, it saves you time and resources that can be better spent on other critical business activities.

-

How secure is airSlate SignNow when handling IRS Form 944 for my business?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like IRS Form 944 for your business. We utilize advanced encryption and secure cloud storage to protect your information. Additionally, our compliance with industry standards ensures that your documents remain confidential and secure throughout the signing process.

Get more for Irs Form 944 For

Find out other Irs Form 944 For

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple