Foreign Operating Corporation FOC FOC Attachment #6 Calculation of Deemed Dividend Name of Corporationdesignated Filer FEIN Minn Form

Understanding the Foreign Operating Corporation FOC Attachment #6

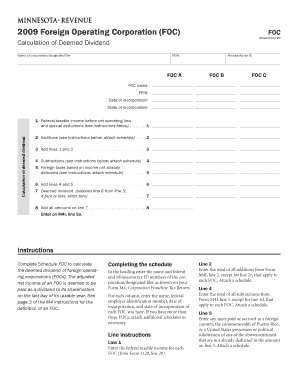

The Foreign Operating Corporation (FOC) Attachment #6 is a crucial document for corporations operating outside the United States. This form is specifically designed to calculate deemed dividends for foreign corporations, which can affect tax obligations. It requires detailed information about the corporation, including the name, designated filer, Federal Employer Identification Number (FEIN), and Minnesota Tax ID. Understanding this form is essential for compliance with federal and state tax regulations.

How to Use the FOC Attachment #6 for Deemed Dividend Calculations

To effectively use the FOC Attachment #6, you need to gather all necessary information about your corporation. This includes the corporation's name, FEIN, and incorporation details. Once you have this information, you can proceed to fill out the form accurately. It is important to ensure that all calculations are based on the most current tax laws to avoid any discrepancies. Proper usage of this form can help in accurately reporting deemed dividends and ensuring compliance with tax requirements.

Steps to Complete the FOC Attachment #6

Completing the FOC Attachment #6 involves several key steps:

- Gather necessary corporate information, including the name, FEIN, and incorporation details.

- Calculate the deemed dividends based on the corporation's financial data.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified guidelines.

Key Elements of the FOC Attachment #6

Several key elements must be included in the FOC Attachment #6 to ensure its validity:

- Name of the corporation and designated filer.

- Federal Employer Identification Number (FEIN) and Minnesota Tax ID.

- Details of deemed dividends calculation.

- Date of incorporation and state of incorporation.

Legal Use of the FOC Attachment #6

The FOC Attachment #6 serves a legal purpose in the context of tax compliance for foreign corporations. Properly completing and submitting this form is essential for meeting federal and state tax obligations. Failure to comply can result in penalties or additional scrutiny from tax authorities. Therefore, understanding the legal implications of this form is crucial for any corporation operating abroad.

Filing Deadlines for the FOC Attachment #6

Filing deadlines for the FOC Attachment #6 may vary based on the corporation's tax year and specific circumstances. It is important to be aware of these deadlines to avoid late filing penalties. Generally, corporations should aim to submit the form by the due date of their federal tax return. Keeping track of these deadlines ensures that corporations remain compliant with tax regulations.

Required Documents for the FOC Attachment #6

When preparing to submit the FOC Attachment #6, several documents may be required:

- Corporate financial statements.

- Documentation supporting deemed dividend calculations.

- Previous tax returns, if applicable.

Quick guide on how to complete foreign operating corporation foc foc attachment 6 calculation of deemed dividend name of corporationdesignated filer fein

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document processes today.

The simplest method to edit and eSign [SKS] effortlessly

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize specific sections of the documents or redact sensitive data with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, boring form navigation, or mistakes that necessitate the printing of new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minn

Create this form in 5 minutes!

How to create an eSignature for the foreign operating corporation foc foc attachment 6 calculation of deemed dividend name of corporationdesignated filer fein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Foreign Operating Corporation (FOC)?

A Foreign Operating Corporation (FOC) is a corporation that operates outside of its country of incorporation. Understanding the implications of FOC is crucial for businesses, especially when it comes to tax obligations and compliance. The Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal is essential for accurate reporting.

-

How does airSlate SignNow assist with FOC documentation?

airSlate SignNow provides a streamlined platform for managing FOC documentation, including the Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal. Our solution simplifies the eSigning process, ensuring that all necessary documents are completed efficiently and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for FOC management?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all designed to facilitate the management of Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal. These tools help streamline your documentation process and enhance compliance.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow efficiency. This includes tools that may be relevant for managing Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal, allowing for a more cohesive operational experience.

-

What are the benefits of using airSlate SignNow for FOC documentation?

Using airSlate SignNow for your FOC documentation offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform is designed to simplify the process of handling Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal, making it easier for businesses to stay compliant.

-

Is airSlate SignNow secure for handling sensitive FOC information?

Absolutely, airSlate SignNow prioritizes the security of your sensitive information. Our platform employs advanced encryption and security protocols to protect all data related to Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minnesota Tax ID FOC A FOC B FOC C FOC Name FEIN Date Of Incorporation State Of Incorporation 1 Federal, ensuring your documents are safe and secure.

Get more for Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minn

Find out other Foreign Operating Corporation FOC FOC Attachment #6 Calculation Of Deemed Dividend Name Of Corporationdesignated Filer FEIN Minn

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure