Form 1042 T Annual Summary and Transmittal of Forms 1042 S 2015

What is the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

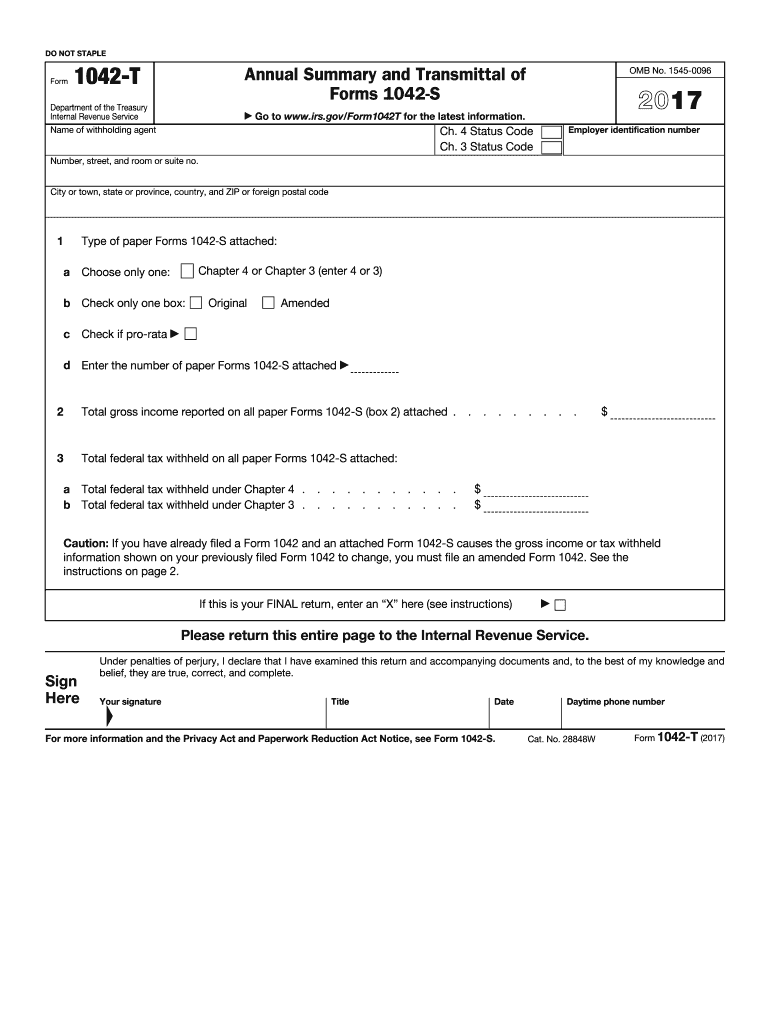

The Form 1042 T Annual Summary and Transmittal of Forms 1042 S is a tax document used by withholding agents to summarize and transmit information regarding payments made to foreign persons. This form is essential for reporting amounts withheld on income paid to non-resident aliens, foreign partnerships, and foreign corporations. It serves as a cover sheet for the accompanying Forms 1042 S, which detail individual payments and the corresponding withholding tax. Understanding this form is crucial for compliance with U.S. tax regulations.

Steps to complete the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

Completing the Form 1042 T involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the payments made to foreign individuals or entities. This includes details from each Form 1042 S that you will be submitting alongside the 1042 T. Next, fill in the identifying information, such as the name and address of the withholding agent, along with the Employer Identification Number (EIN). Ensure that you accurately summarize the total amounts withheld and paid. Finally, review the form for any errors before submitting it to the IRS, either electronically or by mail.

How to obtain the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

The Form 1042 T can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure you are using the most current version of the form to comply with any recent updates or changes in tax regulations. Additionally, tax professionals may have access to the form and can provide assistance in obtaining it.

Legal use of the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

The legal use of the Form 1042 T is governed by IRS regulations, which stipulate that withholding agents must accurately report payments to foreign persons. Failure to file this form or inaccuracies in reporting can lead to penalties and interest charges. The form must be submitted annually, summarizing all relevant payments made during the tax year. It is essential to maintain compliance with all applicable tax laws to avoid legal repercussions.

Filing Deadlines / Important Dates

The filing deadline for the Form 1042 T is typically March 15 of the year following the tax year in which the payments were made. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for withholding agents to be aware of these deadlines to ensure timely submission and avoid penalties for late filing.

Penalties for Non-Compliance

Non-compliance with the requirements for filing the Form 1042 T can result in significant penalties. The IRS may impose fines for failing to file, filing late, or providing incorrect information. These penalties can vary based on the severity of the violation and can accumulate quickly. Therefore, it is advisable for withholding agents to ensure that all forms are completed accurately and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2017 form 1042 t annual summary and transmittal of forms 1042 s

Complete Form 1042 T Annual Summary And Transmittal Of Forms 1042 S effortlessly on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional hardcopy paperwork, as you can access the required form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without interruptions. Handle Form 1042 T Annual Summary And Transmittal Of Forms 1042 S on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 1042 T Annual Summary And Transmittal Of Forms 1042 S seamlessly

- Obtain Form 1042 T Annual Summary And Transmittal Of Forms 1042 S and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure confidential details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1042 T Annual Summary And Transmittal Of Forms 1042 S and ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1042 t annual summary and transmittal of forms 1042 s

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1042 t annual summary and transmittal of forms 1042 s

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

The Form 1042 T Annual Summary And Transmittal Of Forms 1042 S is a tax form used to report income paid to foreign persons and related withholding. This form summarizes the information reported on Forms 1042 S, which reflect the amounts withheld and reported throughout the year. Using airSlate SignNow can simplify the process of preparing and sending these forms electronically.

-

How can airSlate SignNow help with Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

airSlate SignNow provides businesses with a streamlined solution to prepare, sign, and send the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S. With our easy-to-use platform, you can securely manage your documents and ensure compliance with IRS regulations. This feature enhances your productivity and reduces errors in complex tax reporting.

-

What are the pricing options for using airSlate SignNow for Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

airSlate SignNow offers various pricing plans tailored to fit your business needs, including options for individual users and teams. Pricing is competitive and ensures that you have access to essential features for completing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S efficiently. You can start with a free trial to explore our capabilities before committing.

-

Is it easy to integrate airSlate SignNow with existing accounting software for Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

Yes, airSlate SignNow easily integrates with various accounting and business software, allowing seamless data transfer when preparing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S. Integrations help save time and reduce data entry errors, ensuring that you have all necessary information at your fingertips when completing tax forms.

-

What security measures does airSlate SignNow use for documents related to Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

airSlate SignNow employs robust security measures such as encryption, secure access controls, and compliance with industry standards to protect your documents. When working with sensitive information like the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S, you can trust our platform to keep your data confidential and safe from unauthorized access.

-

Can I get support with filing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S through airSlate SignNow?

Absolutely! airSlate SignNow offers customer support services to assist you with any questions related to the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S. Whether you need help with features or filing processes, our support team is dedicated to ensuring your compliance and success, providing timely assistance whenever you need it.

-

What features does airSlate SignNow provide for managing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S?

Our platform includes features such as document templates, electronic signatures, and tracking capabilities that simplify managing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S. These tools enhance collaboration and make it easier to finalize and distribute tax documents securely and efficiently.

Get more for Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

- Petition for name change of a minor form 3 eforms

- Filing for dissolution divorce oregon judicial form

- Linn county oregon fapa form

- Notice of general judgment of name change form 6 eforms

- Oregon judicial department lane home lane county form

- Filing for separation oregon judicial department form

- Contractors final payment affidavit pdf form

- Pa cover lancaster form

Find out other Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile