1065 Form 2013

What is the 1065 Form

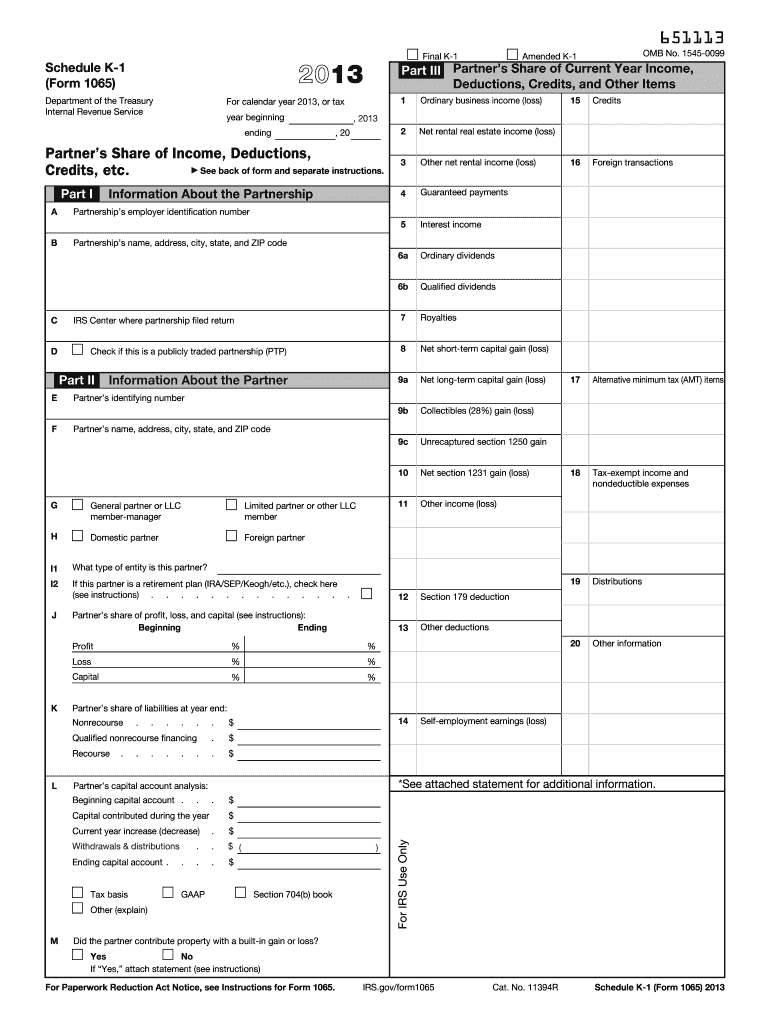

The 1065 Form is an essential tax document used by partnerships to report income, deductions, gains, losses, and other important information to the Internal Revenue Service (IRS). Unlike individual tax returns, the 1065 Form does not calculate tax owed; instead, it provides a comprehensive overview of the partnership's financial activities. Each partner in the partnership receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. This form is crucial for ensuring accurate tax reporting and compliance with federal regulations.

Steps to complete the 1065 Form

Completing the 1065 Form involves several important steps to ensure accuracy and compliance with IRS guidelines. Here is a structured approach:

- Gather necessary information about the partnership, including the legal name, address, and Employer Identification Number (EIN).

- Collect financial data, such as income, expenses, and any deductions the partnership may claim.

- Fill out the main sections of the 1065 Form, ensuring that all income and deductions are accurately reported.

- Complete the Schedule K-1 for each partner, detailing their share of the partnership's income and deductions.

- Review the completed form for accuracy and compliance with IRS requirements.

- Submit the form by the appropriate deadline, ensuring that all partners receive their K-1s in a timely manner.

Legal use of the 1065 Form

The 1065 Form is legally binding when completed accurately and submitted on time. It is essential for partnerships to comply with IRS regulations, as failure to file can result in penalties. The form must be signed by a general partner or authorized member of the partnership, affirming the accuracy of the information provided. Additionally, partnerships must retain copies of the 1065 Form and associated K-1s for their records, as they may be required for future audits or inquiries by the IRS.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines for filing the 1065 Form to avoid penalties. The standard deadline for filing is March 15 of each year, following the end of the tax year. If additional time is needed, partnerships can request a six-month extension, which extends the deadline to September 15. It is important for partnerships to be aware of these dates to ensure timely submission and compliance with tax obligations.

How to obtain the 1065 Form

The 1065 Form can be easily obtained through the IRS website, where it is available for download in PDF format. Additionally, tax preparation software often includes the 1065 Form as part of their offerings, making it convenient for partnerships to complete their tax filings electronically. It is advisable to use the most current version of the form to ensure compliance with any recent tax law changes.

Examples of using the 1065 Form

Partnerships utilize the 1065 Form in various scenarios, including:

- General partnerships, where two or more individuals share ownership and management responsibilities.

- Limited partnerships, which include both general partners and limited partners who have limited control over the business.

- Joint ventures, where two or more parties collaborate on a specific project while sharing profits and losses.

Each of these examples illustrates the importance of the 1065 Form in accurately reporting partnership income and ensuring compliance with tax regulations.

Quick guide on how to complete 1065 2013 form

Complete 1065 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 1065 Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1065 Form with ease

- Locate 1065 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 1065 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1065 2013 form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the 1065 Form and why is it important?

The 1065 Form is a tax form used by partnerships to report income, deductions, gains, and losses. It's essential for ensuring compliance with IRS regulations and facilitates the distribution of K-1 forms to partners. By understanding the 1065 Form, businesses can streamline their tax reporting process.

-

How can airSlate SignNow help with signing the 1065 Form?

airSlate SignNow simplifies the signing process of the 1065 Form by allowing users to eSign documents electronically. This ensures that all signatures are collected efficiently and securely, reducing the time spent on paperwork. Utilizing airSlate SignNow can streamline your partnership's tax filing experience.

-

What features does airSlate SignNow offer for handling the 1065 Form?

airSlate SignNow offers features such as customizable templates, secure storage, and easy document sharing, specifically tailored for forms like the 1065 Form. Users can quickly create, send, and sign documents, ensuring a hassle-free experience. Additionally, the platform integrates seamlessly with other tools to enhance workflow efficiency.

-

Are there any pricing options available for using airSlate SignNow for the 1065 Form?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from monthly or annual subscriptions, depending on your frequency of use for documents like the 1065 Form. Each plan comes with a trial period so you can explore the features at no risk.

-

Can airSlate SignNow integrate with accounting software for the 1065 Form?

Absolutely! airSlate SignNow integrates with various accounting software, making it easier for businesses to manage their 1065 Form and other tax documents. This integration ensures that your data flows seamlessly from one platform to another, enhancing accuracy and reducing manual entry.

-

Is it safe to use airSlate SignNow for the 1065 Form?

Yes, airSlate SignNow prioritizes user security and complies with industry standards to protect sensitive information. The platform employs encryption measures to keep your data confidential while signing the 1065 Form. You can trust airSlate SignNow for secure and compliant document handling.

-

What are the benefits of using airSlate SignNow for the 1065 Form?

Using airSlate SignNow for the 1065 Form can signNowly reduce the time and effort required for document management. With features like electronic signatures and automated reminders, your partnership can ensure timely submissions. Ultimately, this leads to improved productivity and reduced stress during tax season.

Get more for 1065 Form

Find out other 1065 Form

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement