Schedule M1R Sequence #11 Age 65 or OlderDisabled Subtraction Before You Complete This Schedule, Read the Instructions on the Ba Form

Understanding Schedule M1R Sequence #11 for Individuals Aged 65 or Older

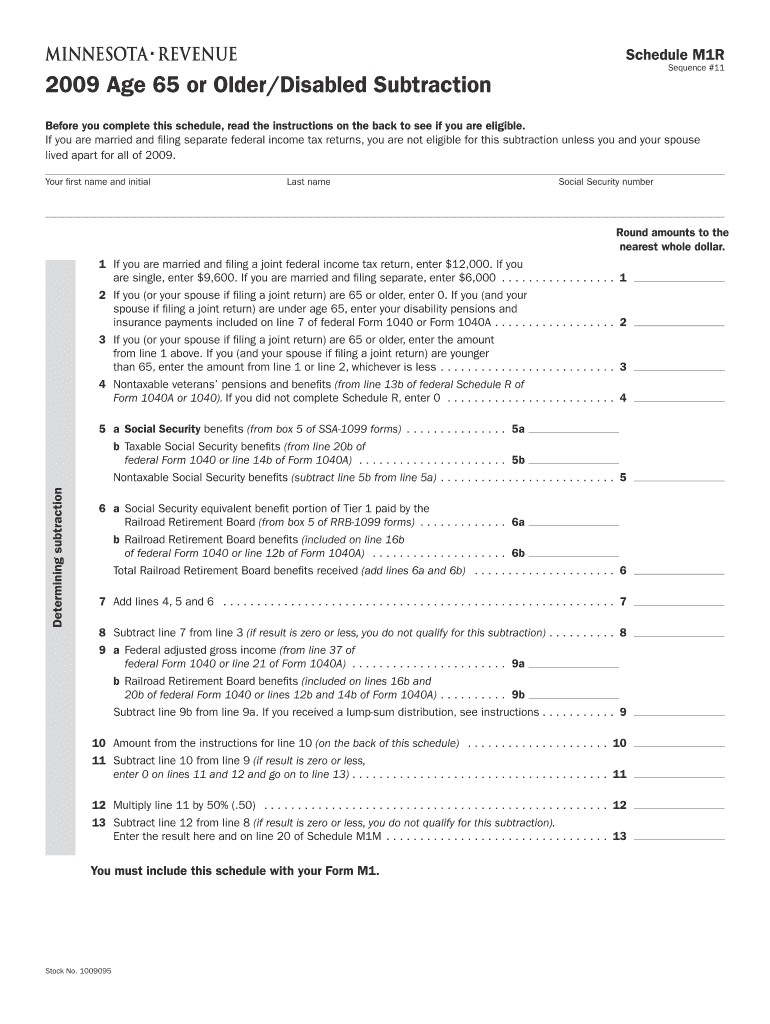

The Schedule M1R Sequence #11 is a vital form for taxpayers aged 65 or older who may qualify for a disabled subtraction on their state tax return. This form allows eligible individuals to reduce their taxable income, potentially resulting in a lower tax liability. Before completing this schedule, it is essential to read the instructions provided on the back of the form to determine eligibility. The criteria may include specific income limits, residency requirements, and documentation of disability status.

How to Complete Schedule M1R Sequence #11

Completing the Schedule M1R Sequence #11 involves several steps. First, gather all necessary documents, including proof of age and disability. Next, accurately fill out the form by entering relevant personal information and financial details. Ensure that you follow the instructions carefully to avoid errors that could delay processing. After completing the form, review it for accuracy before submission to ensure compliance with state tax regulations.

Eligibility Criteria for Schedule M1R Sequence #11

To qualify for the Schedule M1R Sequence #11, individuals must meet specific eligibility criteria. Generally, applicants must be aged 65 or older and provide documentation of their disability. Income thresholds may also apply, which can vary by state. It is crucial to check the instructions on the back of the form for detailed eligibility requirements, as these can affect the ability to claim the disabled subtraction.

Required Documents for Schedule M1R Sequence #11

When preparing to submit the Schedule M1R Sequence #11, certain documents are necessary to support your claim. These typically include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of disability, which may include medical records or a disability determination letter.

- Financial documents that detail income sources and amounts.

Having these documents ready will facilitate a smoother application process and help ensure that you meet all requirements.

Submission Methods for Schedule M1R Sequence #11

The Schedule M1R Sequence #11 can be submitted through various methods, depending on state regulations. Common submission options include:

- Online submission through the state tax department's website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices or community centers.

It is important to verify the preferred submission method for your state to ensure timely processing of your form.

Potential Penalties for Non-Compliance

Failing to comply with the requirements for the Schedule M1R Sequence #11 can lead to penalties. These may include fines, interest on unpaid taxes, or disqualification from claiming the disabled subtraction in future tax years. To avoid these consequences, it is essential to adhere to all instructions, meet deadlines, and provide accurate information when submitting the form.

Quick guide on how to complete schedule m1r sequence 11 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The Easiest Way to Modify and Electronically Sign [SKS]

- Obtain [SKS] and click on Get Form to begin.

- Use the features we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

Create this form in 5 minutes!

How to create an eSignature for the schedule m1r sequence 11 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction?

The Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction is a tax form that allows eligible individuals to subtract certain amounts from their taxable income. Before you complete this schedule, read the instructions on the back to see if you are eligible. This subtraction can signNowly reduce your tax liability if you meet the criteria.

-

How can airSlate SignNow help me with the Schedule M1R Sequence #11?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents related to the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. Our solution streamlines the process, ensuring you can complete your tax forms efficiently. With our service, you can focus on your eligibility and benefits without the hassle of paperwork.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, which are essential for managing tax documents like the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. These features help you organize your documents and ensure compliance with tax regulations. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our services, especially when dealing with important documents like the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. We also provide a free trial to help you evaluate our platform before committing.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow when dealing with the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. This integration allows you to import and export documents easily, ensuring that all your tax-related information is in one place. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction, offers numerous benefits. You can save time with our efficient eSigning process, reduce paper clutter, and ensure your documents are securely stored. Our platform also enhances collaboration, making it easier to share documents with tax professionals.

-

How do I ensure I am eligible for the Schedule M1R Sequence #11?

To ensure eligibility for the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction, it is crucial to read the instructions on the back of the schedule carefully. The instructions outline the specific criteria you must meet to qualify for the subtraction. If you have any doubts, consider consulting a tax professional for personalized advice.

Get more for Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

Find out other Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online