1096 Form 2013

What is the 1096 Form

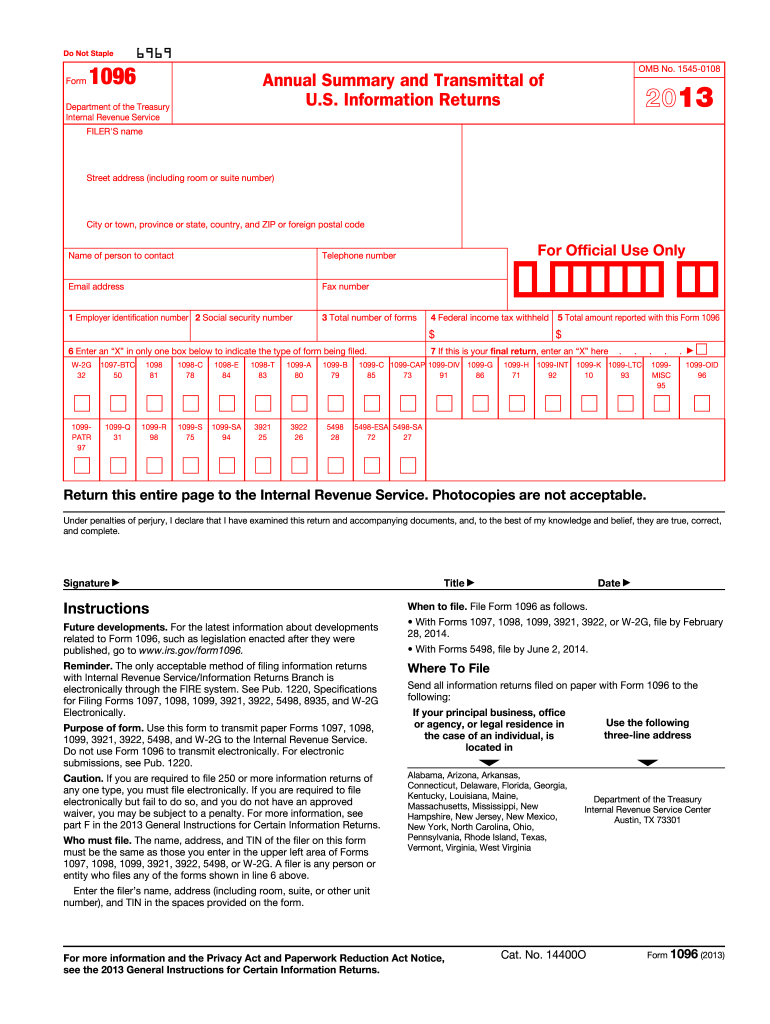

The 1096 Form is a crucial document used by businesses and organizations in the United States to report various types of income to the Internal Revenue Service (IRS). Specifically, it serves as a summary of information returns, such as Forms 1099, that report payments made to non-employees. The 1096 Form consolidates these reports and is typically submitted alongside the related information returns. It is essential for ensuring compliance with IRS regulations and for accurate tax reporting.

How to use the 1096 Form

Using the 1096 Form involves several key steps. First, gather all relevant information returns, such as Forms 1099, that you need to report. Next, fill out the 1096 Form by providing essential details, including your business name, address, and the total amount reported on the accompanying Forms 1099. After completing the form, review it for accuracy. Finally, submit the 1096 Form along with the related information returns to the IRS by the specified deadline.

Steps to complete the 1096 Form

Completing the 1096 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the 1096 Form from the IRS website or through authorized providers.

- Fill in your business name, address, and Employer Identification Number (EIN).

- Indicate the type of form you are summarizing, such as 1099-MISC or 1099-NEC.

- Calculate the total amount reported on all accompanying Forms 1099.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS along with the related information returns.

Legal use of the 1096 Form

The 1096 Form must be used in accordance with IRS guidelines to ensure its legal validity. It is essential to file the form by the required deadlines and to provide accurate information. Failure to comply with these regulations can result in penalties or fines. Additionally, using a reliable digital solution for completing and submitting the form can enhance security and ensure compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1096 Form are critical for compliance. Generally, the form must be submitted to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. It is important to check the IRS website for any updates or changes to these deadlines, as they may vary from year to year. Timely submission helps avoid penalties and ensures that your tax reporting remains in good standing.

Examples of using the 1096 Form

There are various scenarios in which the 1096 Form is utilized. For instance, a small business that hires independent contractors would use the form to report payments made to those contractors via Forms 1099-NEC. Similarly, a corporation that pays dividends to shareholders would summarize those payments on the 1096 Form alongside the relevant 1099-DIV forms. These examples illustrate the form's role in consolidating income reporting for different types of payments.

Quick guide on how to complete 1096 2013 form

Effortlessly Prepare 1096 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Handle 1096 Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-based procedure today.

The simplest way to modify and eSign 1096 Form without hassle

- Obtain 1096 Form and click Get Form to initiate the process.

- Utilize the available tools to complete your form.

- Select important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign 1096 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1096 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1096 2013 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is a 1096 Form and why do I need it?

The 1096 Form is a summary of all 1099 Forms filed with the IRS for the tax year. Businesses need it to report payments made to independent contractors and other non-employees. Using airSlate SignNow, you can easily prepare and eSign your 1096 Forms, ensuring compliance and accuracy.

-

How can airSlate SignNow help with preparing the 1096 Form?

airSlate SignNow simplifies the process of preparing the 1096 Form by providing templates and easy editing tools. It allows users to fill out necessary fields quickly and securely eSign the document. This efficiency helps ensure that you file on time and avoid penalties.

-

Can I integrate airSlate SignNow with other accounting software for the 1096 Form?

Yes, airSlate SignNow offers integrations with various accounting software, facilitating the smooth transfer of data for your 1096 Form. This integration enhances workflow efficiency and reduces the likelihood of errors. You can easily import relevant information to complete your documentation.

-

What are the pricing options for using airSlate SignNow for the 1096 Form?

airSlate SignNow has flexible pricing plans that cater to businesses of all sizes. You can choose a plan based on your specific needs, which includes features for eSigning 1096 Forms and other important documents. The cost-effective solution helps you manage your document processes without breaking the bank.

-

What features does airSlate SignNow offer for managing the 1096 Form?

airSlate SignNow provides features like document templates, real-time collaboration, and audit trails for the 1096 Form. These tools ensure that your documents are accurate and secure, with an easy review process. Enhanced security measures also keep sensitive data protected throughout the signing process.

-

Is it easy to edit the 1096 Form in airSlate SignNow?

Absolutely! Editing the 1096 Form in airSlate SignNow is straightforward thanks to its user-friendly interface. You can quickly make adjustments, save your work, and eSign the document with just a few clicks. This ease of use is particularly beneficial during tax season.

-

How does airSlate SignNow ensure the security of my 1096 Form?

Security is a priority at airSlate SignNow. The platform uses advanced encryption technology to protect your 1096 Form and all related documents. With features like two-factor authentication and secure cloud storage, you can rest assured that your sensitive information remains confidential.

Get more for 1096 Form

- Cea blood test form ontario fullexamscom

- Submit to the office of the dean of the student s home faculty form

- Tphc new pt intake form 140224doc tphc

- Icbc collector form

- Form 1 bpdf the human rights tribunal of ontario

- Power of attorney scotiabank form

- Ubc self declaration form

- Form communicable disease assessment

Find out other 1096 Form

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now