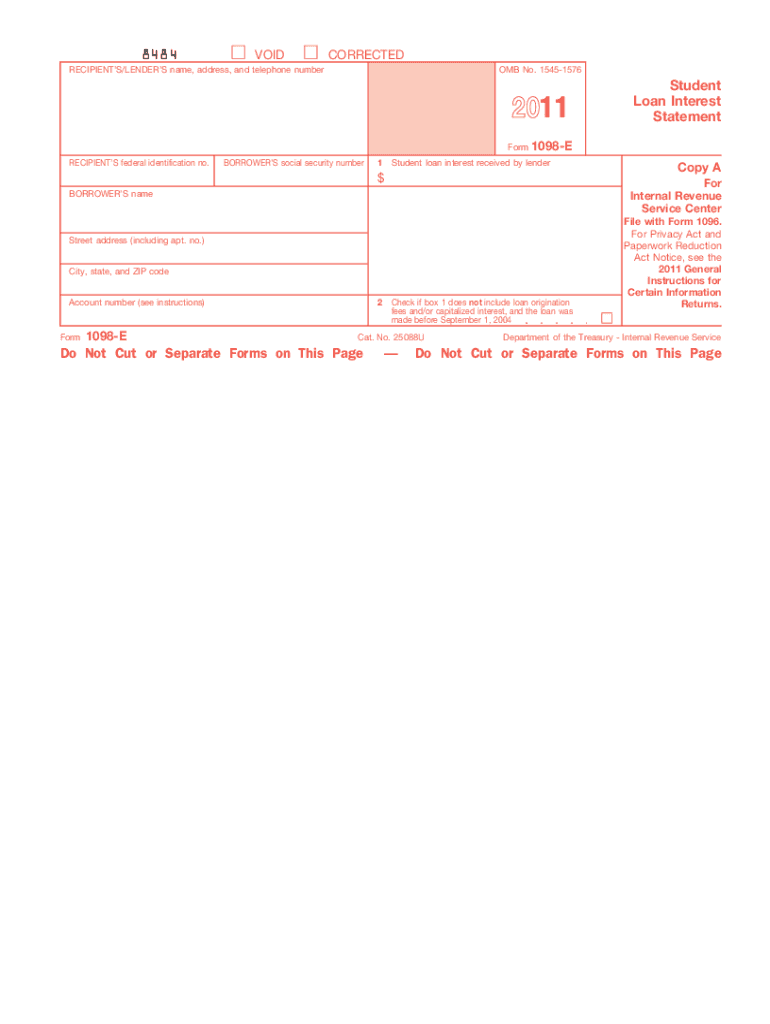

Form 1098 E 2011

What is the Form 1098 E

The Form 1098 E is a tax form used in the United States to report student loan interest paid during the tax year. This form is crucial for taxpayers who have taken out student loans and wish to claim the student loan interest deduction on their federal tax returns. The information reported on this form helps taxpayers determine how much interest they can deduct, potentially lowering their taxable income.

How to obtain the Form 1098 E

Taxpayers can obtain the Form 1098 E from their loan servicer or lender. Most financial institutions that manage student loans are required to send this form to borrowers by the end of January each year, detailing the interest paid in the previous year. Additionally, many lenders provide electronic access to the form through their online portals, allowing borrowers to download it directly.

Steps to complete the Form 1098 E

Completing the Form 1098 E involves several straightforward steps:

- Gather necessary information, including your Social Security number and details of your student loans.

- Review the interest amount reported by your lender on the form.

- Ensure that all information is accurate, including your name and address.

- Use the information from the form to complete your tax return, specifically in the section for student loan interest deductions.

Legal use of the Form 1098 E

The Form 1098 E is legally recognized as a valid document for reporting student loan interest to the IRS. To ensure compliance, taxpayers must accurately report the interest amounts shown on the form when filing their tax returns. Misreporting or failing to include this information can lead to penalties or audits by the IRS.

Key elements of the Form 1098 E

Key elements of the Form 1098 E include:

- Borrower's Information: This section includes the borrower's name, address, and Social Security number.

- Lender's Information: Details about the lender or loan servicer, including their name and contact information.

- Interest Paid: The total amount of interest paid on the student loans during the tax year.

- Loan Type: Information about the type of student loans for which the interest was paid.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines related to the Form 1098 E. The form must be provided to borrowers by the end of January each year. Additionally, taxpayers should ensure they file their tax returns by the April 15 deadline to avoid penalties. Being mindful of these dates helps ensure compliance and maximizes potential tax benefits.

Quick guide on how to complete form 1098 e 2011

Effortlessly Prepare Form 1098 E on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents quickly without any delays. Manage Form 1098 E on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Form 1098 E with Ease

- Find Form 1098 E and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form 1098 E and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1098 e 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1098 e 2011

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is Form 1098 E and why is it important?

Form 1098 E is a tax form used to report interest paid on student loans. It's important because it helps individuals claim a deduction on the interest they've paid during the tax year, potentially lowering their taxable income and improving their financial position.

-

How does airSlate SignNow simplify the process of sending Form 1098 E?

airSlate SignNow streamlines the creation and sending of Form 1098 E by providing easy-to-use templates and e-signature capabilities. With our platform, you can quickly send, sign, and manage your documents without the hassle of printing or mailing.

-

Is there a free trial available for airSlate SignNow when preparing Form 1098 E?

Yes, airSlate SignNow offers a free trial that allows you to explore our features, including the preparation and management of Form 1098 E. This gives you the opportunity to experience our user-friendly platform and see how it can benefit your document workflow.

-

Does airSlate SignNow provide secure storage for completed Form 1098 E documents?

Absolutely! airSlate SignNow ensures that all completed Form 1098 E documents are stored securely in the cloud. Our platform follows best practices for data security and privacy, giving you peace of mind that your sensitive information is protected.

-

What are the integration options available with airSlate SignNow for Form 1098 E?

airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software, to enhance your efficiency when handling Form 1098 E. These integrations enable you to automate processes, reducing manual entry and streamlining document management.

-

Can I customize the Form 1098 E template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Form 1098 E template to fit your specific needs. You can add your branding, modify text fields, and ensure that all necessary information is included, making the document uniquely yours.

-

What is the pricing structure for airSlate SignNow when dealing with Forms like Form 1098 E?

The pricing for airSlate SignNow is flexible and designed to fit various budgets. You can choose from different plans based on your needs, whether you're sending occasional Forms like Form 1098 E or requiring comprehensive document management solutions.

Get more for Form 1098 E

Find out other Form 1098 E

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement