940 Schedule a Form 2010

What is the 940 Schedule A Form

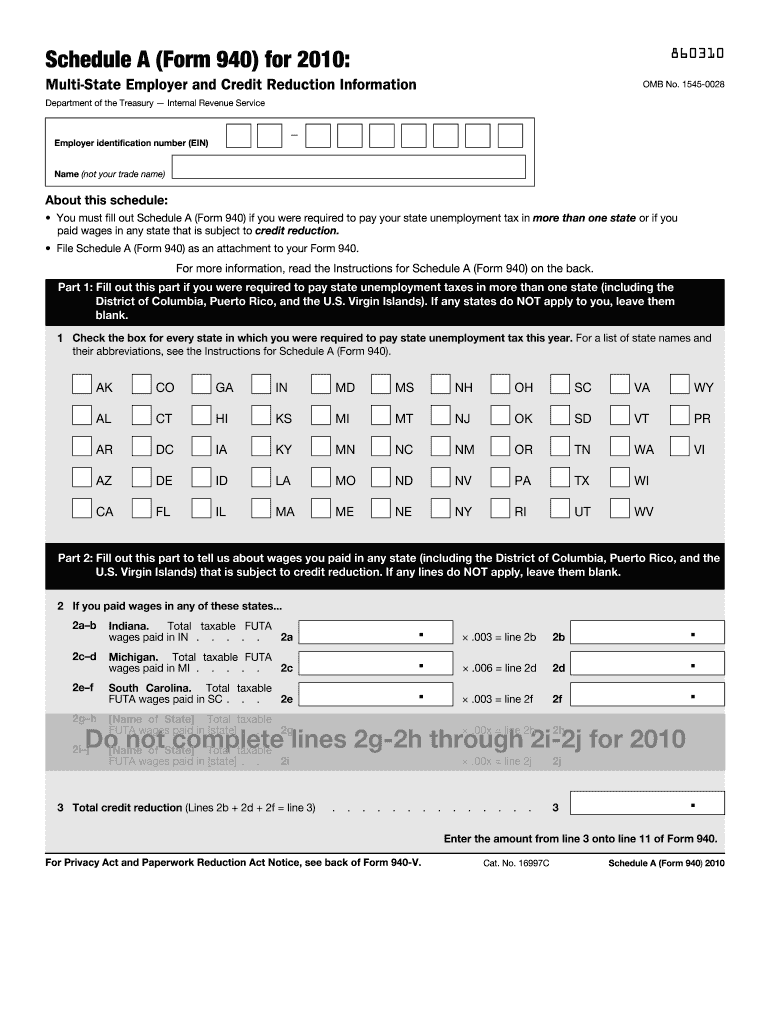

The 940 Schedule A Form is a tax document used by employers in the United States to report their annual Federal Unemployment Tax Act (FUTA) tax liability. This form is essential for businesses that pay unemployment taxes, as it helps determine the amount owed to the federal government. Employers must complete this form to provide a clear account of their taxable wages and any adjustments made throughout the year.

How to use the 940 Schedule A Form

Using the 940 Schedule A Form involves several steps. First, employers need to gather information about their total taxable wages for the year. This includes wages subject to FUTA tax. Next, they must accurately fill out the form, detailing any adjustments to their tax liability. Once completed, the form should be submitted along with the annual Form 940, which consolidates the employer's unemployment tax information. It is crucial to ensure that all figures are accurate to avoid penalties.

Steps to complete the 940 Schedule A Form

Completing the 940 Schedule A Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including payroll records and previous tax filings.

- Calculate total taxable wages and any adjustments, such as overpayments or credits.

- Fill out the form accurately, ensuring all information matches your records.

- Review the completed form for errors or omissions.

- Submit the form along with your annual Form 940 by the specified deadline.

Legal use of the 940 Schedule A Form

The legal use of the 940 Schedule A Form is governed by federal tax laws. Employers are required to file this form to remain compliant with the Internal Revenue Service (IRS) regulations regarding unemployment taxes. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their obligations and ensure that the form is used correctly to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 940 Schedule A Form are crucial for compliance. Employers must submit the form along with their annual Form 940 by January 31 of the following year. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Staying aware of these dates helps businesses avoid late filing penalties and ensures timely payment of any owed taxes.

Examples of using the 940 Schedule A Form

Employers may encounter various scenarios that necessitate the use of the 940 Schedule A Form. For instance, a business that has adjusted its payroll due to a reduction in workforce might need to report these changes to accurately reflect its FUTA tax liability. Another example includes a business that has overpaid its unemployment taxes in previous years and wishes to claim a credit. In both cases, the 940 Schedule A Form serves as a critical tool for reporting and adjusting tax obligations.

Quick guide on how to complete 2010 940 schedule a form

Effortlessly Prepare 940 Schedule A Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 940 Schedule A Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to Edit and Electronically Sign 940 Schedule A Form with Ease

- Obtain 940 Schedule A Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize critical portions of your documents or redact sensitive information with the tools specifically designed for that function by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, and mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 940 Schedule A Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 940 schedule a form

Create this form in 5 minutes!

How to create an eSignature for the 2010 940 schedule a form

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the 940 Schedule A Form?

The 940 Schedule A Form is an essential document used by employers to report their Federal Unemployment Tax Act (FUTA) liability. It provides information regarding the total wages paid and the employment tax credits claimed. Understanding this form is crucial for accurately filing annual payroll taxes.

-

How can airSlate SignNow assist with the 940 Schedule A Form?

airSlate SignNow streamlines the process of completing and eSigning the 940 Schedule A Form. With its user-friendly interface, businesses can easily fill out, send, and receive signed documents securely. This saves time and ensures compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing the 940 Schedule A Form?

airSlate SignNow provides features like document templates, automated workflows, and real-time tracking specifically for the 940 Schedule A Form. These tools enhance productivity and ensure that all required fields are accurately completed. Additionally, users can store and access previous forms with ease.

-

Is there a cost associated with using airSlate SignNow for the 940 Schedule A Form?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing the 940 Schedule A Form and other documents. Plans are tailored to fit different business sizes and needs. Exploring these options can help you find the right fit for your organization’s budget.

-

Can I integrate airSlate SignNow with other software for the 940 Schedule A Form?

Yes, airSlate SignNow integrates seamlessly with numerous business applications to enhance your workflow while managing the 940 Schedule A Form. You can connect it with accounting software and CRMs for a more streamlined document management process. This integration ensures that data flows smoothly between systems.

-

What are the benefits of using airSlate SignNow for the 940 Schedule A Form?

Using airSlate SignNow for the 940 Schedule A Form offers numerous benefits, including increased efficiency, reduced processing times, and enhanced security. It eliminates the need for printing and mailing, allowing for quick digital submissions. Businesses can also benefit from tracking and reminders, ensuring timely filings.

-

Is airSlate SignNow compliant with federal regulations for the 940 Schedule A Form?

Absolutely! airSlate SignNow complies with all relevant federal regulations regarding electronic signatures and document management for the 940 Schedule A Form. This compliance ensures that your electronically signed documents are legally upheld and recognized by the IRS.

Get more for 940 Schedule A Form

- Judicial interim release orderrecognizance of bail yorklaw form

- Police declaration form

- Form nr301

- Accesscorrection request form toronto police service torontopolice on

- Finance and treasury board form

- Wsib purchase certificate worksheet form

- Client intake form new perspectives counselling newperspectivescounselling

- Consent form for dental treatment

Find out other 940 Schedule A Form

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile