Fin 542s 2018-2026

What is the Fin 542s

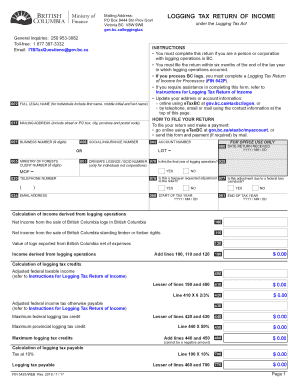

The Fin 542s is a crucial document for individuals and businesses involved in logging activities in British Columbia. This form serves as a declaration of income derived from logging operations, allowing the government to assess tax obligations accurately. It is essential for compliance with local tax regulations and ensures that logging entities report their earnings transparently.

Steps to complete the Fin 542s

Completing the Fin 542s requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including financial records and previous tax returns related to logging income.

- Accurately fill in all required fields, ensuring that all income sources are reported.

- Review the form for completeness and accuracy before submission.

- Sign and date the form to validate the information provided.

How to use the Fin 542s

The Fin 542s is used primarily for reporting income from logging activities. Once completed, it must be submitted to the appropriate tax authority to ensure that logging income is accounted for in tax calculations. This form is vital for maintaining compliance with tax laws and avoiding penalties associated with underreporting income.

Required Documents

To complete the Fin 542s, certain documents are necessary. These include:

- Financial statements detailing income from logging operations.

- Receipts or records of expenses related to logging activities.

- Previous tax returns, if applicable, to provide context for income reporting.

Legal use of the Fin 542s

Using the Fin 542s legally requires adherence to local tax laws. It is important to ensure that all information reported is accurate and truthful. Misrepresentation or failure to file this form can lead to legal consequences, including fines or other penalties. Understanding the legal implications of this form helps logging businesses maintain compliance and avoid issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Fin 542s are critical for compliance. Typically, the form must be submitted by a specific date each year, which aligns with the tax filing season. Staying informed about these deadlines helps logging businesses avoid late fees and ensures that they remain in good standing with tax authorities.

Quick guide on how to complete fin 542s 2018 2019 form

A Brief Guide on How to Prepare Your Fin 542s

Locating the appropriate template can be a challenge when you need to provide official international documentation. Even if you possess the necessary form, it can be tedious to rapidly complete it according to all the specifications when you utilize paper copies instead of handling everything digitally. airSlate SignNow is the online eSignature platform that assists you in overcoming these hurdles. It allows you to acquire your Fin 542s and swiftly fill it out and sign it on-site without the need to reprint documents every time you make an error.

Follow these steps to prepare your Fin 542s with airSlate SignNow:

- Press the Get Form button to upload your document to our editor right away.

- Begin with the first vacant section, enter the necessary information, and proceed using the Next tool.

- Complete the empty fields with the Cross and Check tools from the options above.

- Select the Highlight or Line features to emphasize the most crucial details.

- Click on Image and upload one if your Fin 542s requires it.

- Utilize the right-side panel to add additional fields for you or others to fill in if necessary.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the form modifications by pressing the Done button and selecting your file-sharing preferences.

Once your Fin 542s is ready, you can share it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finalized documents in your account, organized in folders according to your preferences. Don’t waste time on manual form filling; take advantage of airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct fin 542s 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the fin 542s 2018 2019 form

How to make an eSignature for the Fin 542s 2018 2019 Form in the online mode

How to make an electronic signature for your Fin 542s 2018 2019 Form in Google Chrome

How to generate an eSignature for putting it on the Fin 542s 2018 2019 Form in Gmail

How to make an eSignature for the Fin 542s 2018 2019 Form straight from your smart phone

How to create an electronic signature for the Fin 542s 2018 2019 Form on iOS

How to create an eSignature for the Fin 542s 2018 2019 Form on Android devices

People also ask

-

What are the benefits of using airSlate SignNow for logging British Columbia?

Using airSlate SignNow for logging British Columbia offers numerous benefits, including the ability to streamline document management and enhance workflow efficiency. With our eSignature solution, logging companies can quickly send, sign, and store important documents securely. Additionally, our platform is designed to reduce paperwork and improve compliance, making it an ideal choice for the logging industry.

-

How does airSlate SignNow integrate with other tools in the logging British Columbia sector?

airSlate SignNow seamlessly integrates with a variety of applications commonly used in logging British Columbia. This includes popular tools for project management, accounting, and customer relationship management, allowing for a smooth data flow and enhanced operational efficiency. By integrating with existing systems, logging businesses can ensure a more cohesive and productive workflow.

-

What is the pricing structure for airSlate SignNow in relation to logging British Columbia businesses?

The pricing for airSlate SignNow is designed to be flexible and cost-effective for logging British Columbia businesses of all sizes. We offer various plans to suit different needs, whether you’re a small startup or a larger operation. By providing affordable options, we help logging companies maximize their return on investment while managing document processes more efficiently.

-

Is airSlate SignNow user-friendly for logging British Columbia staff who are not tech-savvy?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, ensuring that all logging British Columbia staff can easily navigate the platform. With a simple interface and easy-to-follow instructions, even those who are not tech-savvy can effectively send and sign documents without any hassle. Our platform prioritizes accessibility for all users in the logging industry.

-

Can airSlate SignNow help improve compliance and security for logging British Columbia documents?

Yes, airSlate SignNow is equipped with robust security features that ensure compliance with industry regulations in logging British Columbia. Our platform uses encryption and secure storage to protect sensitive documents against unauthorized access. This commitment to security helps logging companies maintain compliance while safeguarding their critical information.

-

What support options are available for logging British Columbia customers using airSlate SignNow?

Logging British Columbia customers can access comprehensive support options when using airSlate SignNow. We provide resources including a detailed knowledge base, step-by-step guides, and responsive customer service available via chat and email. Our goal is to ensure that logging companies receive the assistance they need to maximize their use of our platform effectively.

-

What features make airSlate SignNow suitable for the logging industry in British Columbia?

airSlate SignNow offers features that cater specifically to the needs of the logging industry in British Columbia, such as bulk sending, templates for commonly used documents, and automated reminders for signatures. These features streamline the document signing process, helping logging companies save time and reduce delays. Our solution is tailored to enhance operational efficiency in the logging sector.

Get more for Fin 542s

- Statement of claimant or other person example form

- Jrotc certificate of completion form

- Analytic geometry eoc practice questions form

- Canara hsbc oriental bank of commerce life insurance pradhan mantri jeevan jyoti bima yojana form

- Avid ebinder template form

- Conference funding request form springfield college spfldcol

- Course repetition request long beach city college form

- Transcript request form suny schenectady

Find out other Fin 542s

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online