Gst66 2018

What is the Gst66?

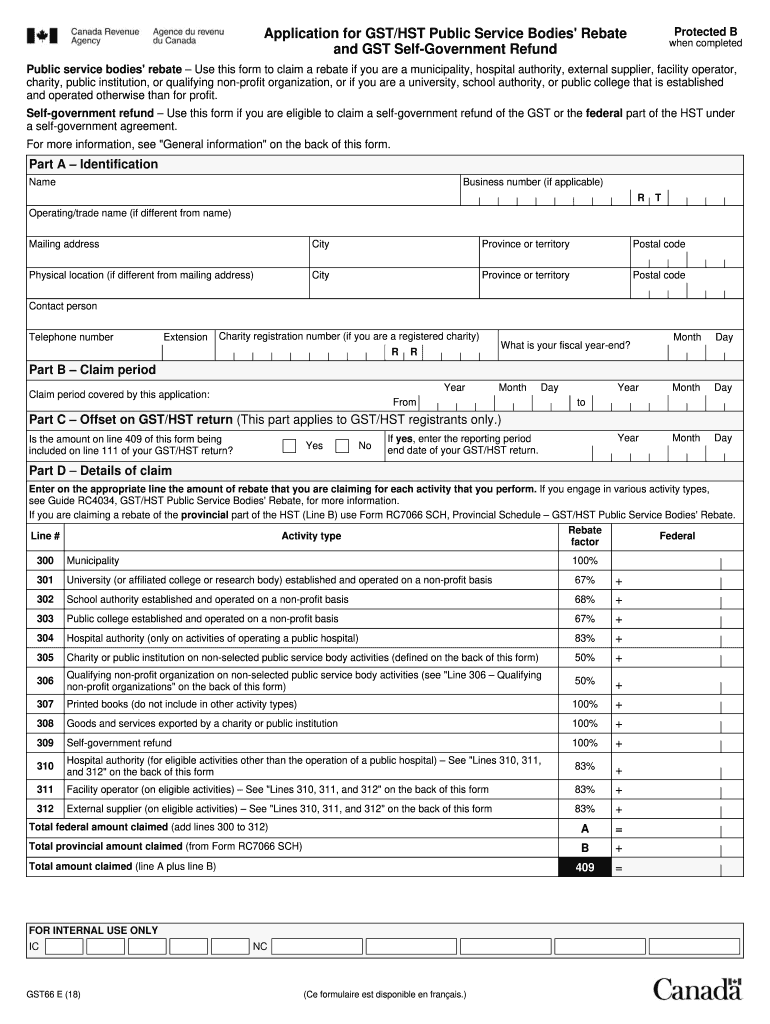

The Gst66, also known as the GST66E 13, is a form used primarily for claiming a rebate on the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) in Canada. This form is specifically designed for public service bodies, including charities and non-profit organizations, allowing them to recover a portion of the taxes they have paid on eligible expenses. Understanding the Gst66 is essential for organizations looking to optimize their tax position and ensure compliance with tax regulations.

How to use the Gst66

Using the Gst66 involves several steps to ensure that the form is completed accurately. First, gather all necessary documentation, including receipts and invoices related to eligible purchases. Next, fill out the Gst66 form with precise information, ensuring that all required fields are completed. It is crucial to double-check the figures and details provided to avoid any discrepancies that could lead to delays or rejections. Once completed, the form can be submitted through the appropriate channels, either online or via mail.

Steps to complete the Gst66

Completing the Gst66 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including receipts for eligible expenses.

- Download the Gst66 form from the official source or access a fillable PDF version.

- Fill in the organization’s information, including name, address, and GST/HST number.

- Detail the eligible expenses and calculate the total amount being claimed.

- Review the form for accuracy, ensuring all required fields are filled.

- Submit the completed form through the designated method, either online or by mail.

Legal use of the Gst66

The Gst66 must be used in compliance with the applicable tax laws and regulations. Organizations must ensure that they are eligible to claim the rebate and that the expenses listed on the form are indeed qualifying costs. Misuse of the Gst66, such as claiming ineligible expenses or providing false information, can lead to penalties and legal repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility or compliance.

Required Documents

When submitting the Gst66, certain documents are required to support the claim. These typically include:

- Receipts for all eligible purchases.

- Invoices that clearly show the GST/HST charged.

- Proof of the organization's registration as a charity or public service body.

- Any additional documentation that may be necessary to substantiate the claim.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Gst66. Typically, claims must be submitted within a specific time frame following the end of the reporting period. Missing these deadlines can result in the forfeiture of the rebate. Organizations should keep track of their financial reporting periods and ensure timely submission of the form to maximize their potential refunds.

Quick guide on how to complete application for gsthst public service bodies rebate and gst self government refund

A concise handbook on how to ready your Gst66

Locating the appropriate template can be a difficulty when you need to submit formal international documents. Even when you possess the necessary form, it might be cumbersome to swiftly prepare it in accordance with all the stipulations if you rely on paper versions instead of managing everything digitally. airSlate SignNow is the web-based electronic signature solution that assists you in overcoming these hurdles. It allows you to obtain your Gst66 and rapidly complete and sign it on-site without the need for reprinting documents if an error occurs.

The following are the actions required to prepare your Gst66 with airSlate SignNow:

- Hit the Get Form button to immediately upload your document to our editor.

- Begin with the first vacant field, enter your information, and continue with the Next option.

- Complete the empty fields using the Cross and Check tools found in the toolbar above.

- Select the Highlight or Line features to accentuate the most essential details.

- Click on Image and upload one if your Gst66 requires it.

- Use the right-side pane to add additional fields for you or others to fill in if necessary.

- Review your entries and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by selecting the Done button and choosing your file-sharing preferences.

After your Gst66 is ready, you can distribute it in any manner you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely safeguard all your finalized documents in your account, systematically arranged in folders according to your preferences. Don’t squander time on manual document completion; experience airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct application for gsthst public service bodies rebate and gst self government refund

Create this form in 5 minutes!

How to create an eSignature for the application for gsthst public service bodies rebate and gst self government refund

How to make an electronic signature for your Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund in the online mode

How to create an eSignature for your Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund in Google Chrome

How to make an eSignature for signing the Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund in Gmail

How to make an eSignature for the Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund from your smartphone

How to create an electronic signature for the Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund on iOS devices

How to generate an eSignature for the Application For Gsthst Public Service Bodies Rebate And Gst Self Government Refund on Android devices

People also ask

-

What is gst66e 13 in relation to airSlate SignNow?

The gst66e 13 is a unique identifier for specific features within the airSlate SignNow platform. It helps users navigate various functionalities associated with document signing and management. By using gst66e 13, you can access tailored solutions for your eSignature needs.

-

How much does airSlate SignNow cost for gst66e 13 features?

airSlate SignNow offers competitive pricing for its services, including those linked to gst66e 13 features. Customers can choose from various plans based on the scale of their signing needs. By selecting the right plan, users can efficiently manage costs while benefiting from robust eSignature capabilities.

-

What key features does gst66e 13 offer?

The gst66e 13 features include robust document editing, streamlined workflow automation, and secure eSigning options. These functionalities are designed to enhance user experience and ensure compliance with electronic signature regulations. Utilizing gst66e 13 can signNowly improve document management efficiency.

-

What are the benefits of using gst66e 13 with airSlate SignNow?

Using gst66e 13 with airSlate SignNow brings numerous benefits, including enhanced productivity and reduced turnaround time for document signing. Users also enjoy increased security and ease of use. With gst66e 13, businesses can streamline their operations and improve customer satisfaction.

-

Can I integrate other applications with the gst66e 13 features?

Yes, airSlate SignNow allows seamless integration with numerous third-party applications, enhancing the functionality of the gst66e 13 features. This can include CRM systems, cloud storage, and productivity tools. Integrating these applications helps boost overall efficiency in document workflows.

-

Is it easy to use gst66e 13 for document signing?

Absolutely! The gst66e 13 features are designed with user-friendliness in mind, ensuring that anyone can easily navigate the platform. With intuitive controls and streamlined processes, users can send and sign documents without unnecessary complications.

-

What kind of support is available for gst66e 13 users?

airSlate SignNow offers comprehensive support for users of the gst66e 13 features. This includes access to detailed documentation, tutorials, and customer service representatives who can assist with any queries. The aim is to ensure that users can fully leverage the capabilities of gst66e 13.

Get more for Gst66

- Wells mountain foundation application form

- Formulir kredit bank

- Dermastamp dermaroller treatment consent form

- Autorisation parentale de prise de vues dun mineur et dutilisation photos state form

- Pliform pdf

- Transfer of land form wa

- Scholarship application south dakota state university form

- Devry graduation application form

Find out other Gst66

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy