Application for GSTHST Public Service Bodies' Rebate and 2020-2026

What is the Application for GST/HST Public Service Bodies' Rebate

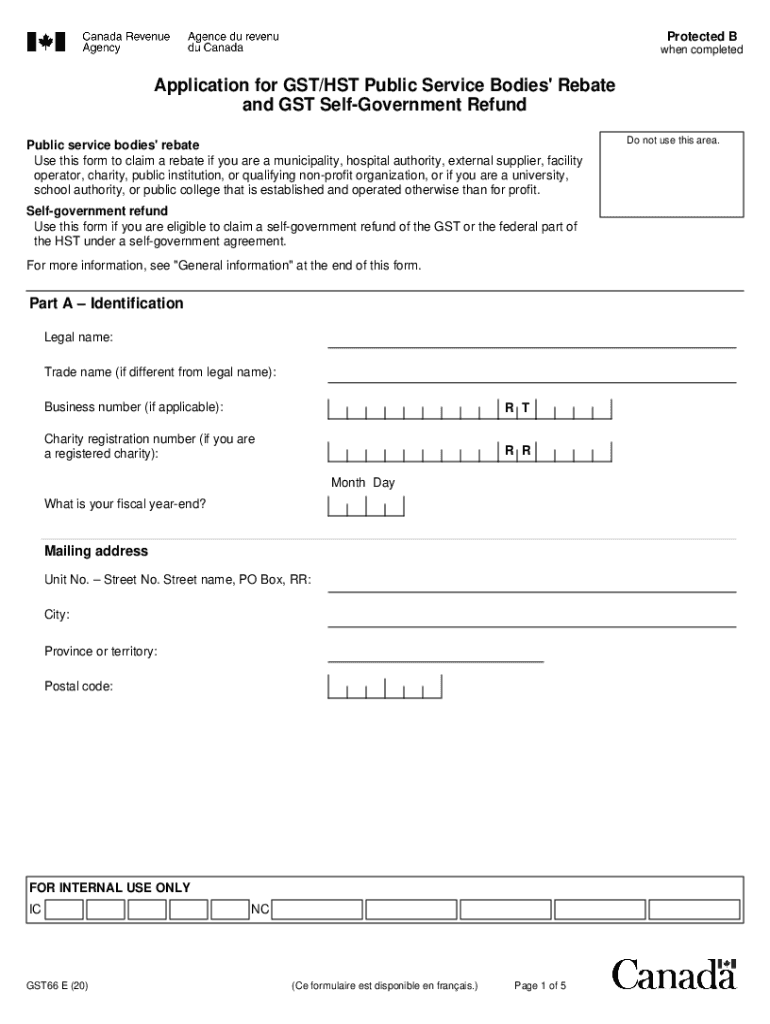

The Application for GST/HST Public Service Bodies' Rebate is a form designed for specific organizations to claim a rebate on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) they have paid. This application is particularly relevant for public service bodies, such as charities, non-profit organizations, and certain government entities. By submitting this form, eligible organizations can recover a portion of the taxes incurred on their purchases, which can significantly aid in managing their operational costs.

Steps to Complete the Application for GST/HST Public Service Bodies' Rebate

Completing the Application for GST/HST Public Service Bodies' Rebate involves several key steps to ensure accuracy and compliance. Here’s a detailed guide:

- Gather Required Information: Collect all necessary documentation, including receipts and invoices that detail the GST/HST paid.

- Fill Out the Form: Complete the gst66e form accurately, providing all required details about your organization and the taxes paid.

- Calculate the Rebate: Determine the eligible rebate amount based on the calculations outlined in the form instructions.

- Review for Accuracy: Double-check all entries to ensure there are no errors that could delay processing.

- Submit the Application: Send the completed form along with any supporting documents to the appropriate tax authority.

Legal Use of the Application for GST/HST Public Service Bodies' Rebate

The Application for GST/HST Public Service Bodies' Rebate is legally binding when completed and submitted according to established guidelines. It is crucial for organizations to ensure that they meet the eligibility criteria set forth by tax authorities. Compliance with relevant tax laws not only legitimizes the application but also protects the organization from potential legal issues. Understanding the legal implications of the rebate application is essential for maintaining transparency and accountability in financial practices.

Eligibility Criteria for the Application for GST/HST Public Service Bodies' Rebate

To qualify for the GST/HST Public Service Bodies' Rebate, organizations must meet specific eligibility criteria. These include:

- Being a recognized public service body, such as a registered charity or a non-profit organization.

- Having incurred GST/HST on eligible purchases related to the organization’s activities.

- Meeting any additional requirements set by the relevant tax authority, which may include specific documentation or operational guidelines.

It is vital for applicants to thoroughly review these criteria to ensure compliance and maximize their chances of a successful rebate application.

Required Documents for the Application for GST/HST Public Service Bodies' Rebate

When submitting the Application for GST/HST Public Service Bodies' Rebate, certain documents are necessary to support the claim. These typically include:

- Receipts and invoices showing the GST/HST paid on eligible purchases.

- Proof of the organization’s status as a public service body, such as registration documents.

- Any additional documentation requested by the tax authority to substantiate the claim.

Ensuring all required documents are included can help facilitate a smoother processing experience and reduce the likelihood of delays.

Form Submission Methods for the Application for GST/HST Public Service Bodies' Rebate

The Application for GST/HST Public Service Bodies' Rebate can typically be submitted through various methods, including:

- Online Submission: Many organizations prefer to submit their applications electronically for quicker processing.

- Mail: The completed form can be printed and sent via postal service to the appropriate tax authority.

- In-Person Submission: Some organizations may choose to deliver their applications directly to a local tax office.

Choosing the right submission method can depend on the organization’s resources and preferences, as well as the specific guidelines provided by tax authorities.

Quick guide on how to complete application for gsthst public service bodies rebate and

Complete Application For GSTHST Public Service Bodies' Rebate And effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to acquire the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Application For GSTHST Public Service Bodies' Rebate And on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Application For GSTHST Public Service Bodies' Rebate And with ease

- Obtain Application For GSTHST Public Service Bodies' Rebate And and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Application For GSTHST Public Service Bodies' Rebate And to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for gsthst public service bodies rebate and

Create this form in 5 minutes!

How to create an eSignature for the application for gsthst public service bodies rebate and

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is gst66e and how does it benefit my business?

Gst66e is a unique identification that helps users navigate the features of airSlate SignNow more efficiently. With gst66e, businesses can streamline their document signing processes, ensuring quick and secure transactions. This enhances operational efficiency and improves customer satisfaction.

-

How much does airSlate SignNow with gst66e cost?

The pricing for airSlate SignNow using gst66e varies based on the plans you choose. Typically, the costs are competitive and designed to provide maximum value for businesses of all sizes. You can explore subscription options directly on our website to find the best fit for your needs.

-

What features are included with the gst66e plan?

The gst66e plan includes a variety of features such as document templates, automated workflows, and secure eSigning capabilities. Users can also access advanced security features to protect sensitive information. All these features are aimed at enhancing user experience and facilitating efficient document management.

-

Can I integrate airSlate SignNow with other applications using gst66e?

Yes, airSlate SignNow offers seamless integrations with various third-party applications when using gst66e. You can connect it with CRM tools, cloud storage, and productivity apps to streamline your workflow further. This allows for a more cohesive working environment, enhancing overall productivity.

-

What types of documents can I eSign with gst66e?

With gst66e, you can eSign a wide range of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This ensures that all your document signing needs are met efficiently and securely.

-

Is airSlate SignNow with gst66e compliant with legal standards?

Yes, airSlate SignNow using gst66e complies with all major electronic signature laws, ensuring that your signed documents are legally binding. We prioritize security and adhere to standards such as ESIGN and UETA. This compliance gives our users peace of mind regarding the legality of their documents.

-

How does airSlate SignNow enhance the eSigning process with gst66e?

AirSlate SignNow optimizes the eSigning process using gst66e by providing an intuitive user interface and fast document turnaround times. The platform simplifies the steps needed to prepare and send documents for signature, saving you valuable time. This speed and efficiency in processing documents help elevate your business operations.

Get more for Application For GSTHST Public Service Bodies' Rebate And

Find out other Application For GSTHST Public Service Bodies' Rebate And

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word