NCBRBusiness Registration Application for Income T 2019

What is the NCBR Business Registration Application for Income T

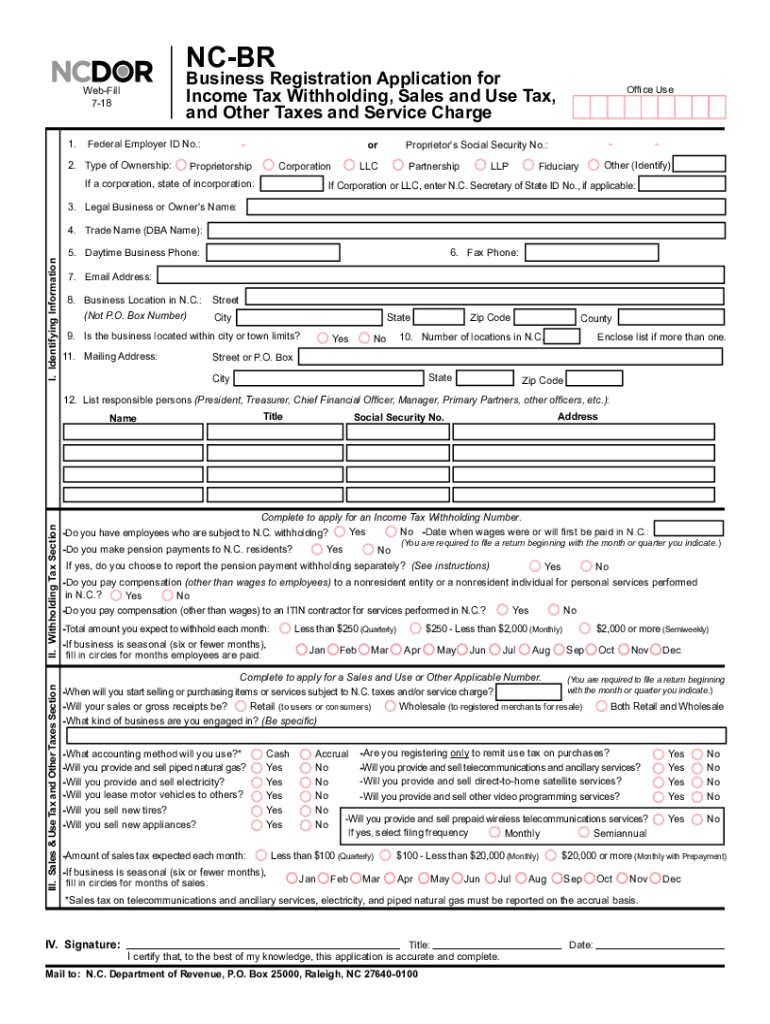

The NCBR Business Registration Application for Income T is a crucial document for businesses in the United States seeking to register for tax purposes. This form is specifically designed to help entities report their income and ensure compliance with federal tax regulations. It serves as a foundational tool for businesses to establish their identity with the Internal Revenue Service (IRS) and to facilitate the accurate reporting of earnings.

How to Obtain the NCBR Business Registration Application for Income T

To obtain the NCBR Business Registration Application for Income T, businesses can visit the official IRS website or contact their local tax office. The form is typically available in both digital and paper formats. For those preferring a digital approach, downloading the form directly from the IRS website ensures that the most current version is used. Additionally, local tax offices can provide physical copies and assistance in understanding the form's requirements.

Steps to Complete the NCBR Business Registration Application for Income T

Completing the NCBR Business Registration Application for Income T involves several key steps:

- Gather required information, including your business name, address, and Employer Identification Number (EIN).

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person, depending on your preference and local guidelines.

Required Documents for the NCBR Business Registration Application for Income T

When completing the NCBR Business Registration Application for Income T, certain documents are necessary to support your application. These may include:

- Your Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

- Proof of business address, such as a utility bill or lease agreement.

- Any relevant business licenses or permits required by your state or local government.

Eligibility Criteria for the NCBR Business Registration Application for Income T

Eligibility for the NCBR Business Registration Application for Income T typically includes:

- Businesses operating within the United States.

- Entities that generate taxable income and require registration for tax purposes.

- Compliance with state-specific regulations that may affect business registration.

Form Submission Methods for the NCBR Business Registration Application for Income T

The NCBR Business Registration Application for Income T can be submitted through various methods, allowing for flexibility based on business needs:

- Online: Many businesses prefer to submit the form electronically through the IRS website, ensuring faster processing.

- By Mail: Completed forms can be mailed to the appropriate IRS address, which varies depending on the business's location.

- In-Person: Some local tax offices may accept in-person submissions, providing immediate confirmation of receipt.

Quick guide on how to complete ncbrbusiness registration application forincome t

Complete NCBRBusiness Registration Application For Income T seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools required to generate, modify, and eSign your documents quickly and efficiently. Handle NCBRBusiness Registration Application For Income T on any operating system with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign NCBRBusiness Registration Application For Income T effortlessly

- Obtain NCBRBusiness Registration Application For Income T and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign NCBRBusiness Registration Application For Income T and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ncbrbusiness registration application forincome t

Create this form in 5 minutes!

How to create an eSignature for the ncbrbusiness registration application forincome t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NCBRBusiness Registration Application For Income T.?

The NCBRBusiness Registration Application For Income T. is a streamlined process designed to help businesses register for income tax purposes efficiently. By utilizing airSlate SignNow, you can complete and eSign the necessary documents quickly, ensuring compliance with tax regulations.

-

How does airSlate SignNow simplify the NCBRBusiness Registration Application For Income T.?

airSlate SignNow simplifies the NCBRBusiness Registration Application For Income T. by providing an intuitive platform for document management and eSigning. Users can easily fill out forms, track their progress, and securely sign documents from any device, making the registration process hassle-free.

-

What are the pricing options for using airSlate SignNow for the NCBRBusiness Registration Application For Income T.?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a startup or an established company, you can choose a plan that fits your budget while ensuring you have access to all the features necessary for the NCBRBusiness Registration Application For Income T.

-

What features does airSlate SignNow provide for the NCBRBusiness Registration Application For Income T.?

Key features of airSlate SignNow for the NCBRBusiness Registration Application For Income T. include customizable templates, secure eSigning, document tracking, and integration with popular business tools. These features enhance efficiency and ensure that your registration process is smooth and compliant.

-

How can airSlate SignNow benefit my business during the NCBRBusiness Registration Application For Income T.?

Using airSlate SignNow for the NCBRBusiness Registration Application For Income T. can signNowly reduce the time and effort required for document management. The platform's user-friendly interface and automation capabilities allow businesses to focus on growth while ensuring all registration requirements are met promptly.

-

Is airSlate SignNow secure for handling the NCBRBusiness Registration Application For Income T.?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the NCBRBusiness Registration Application For Income T. The platform employs advanced encryption and security protocols to protect your sensitive information throughout the registration process.

-

Can I integrate airSlate SignNow with other tools for the NCBRBusiness Registration Application For Income T.?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, enhancing your workflow for the NCBRBusiness Registration Application For Income T. You can connect with tools like CRM systems, cloud storage, and project management software to streamline your processes.

Get more for NCBRBusiness Registration Application For Income T

- Commercial contract for contractor michigan form

- Excavator contract for contractor michigan form

- Renovation contract for contractor michigan form

- Concrete mason contract for contractor michigan form

- Demolition contract for contractor michigan form

- Framing contract for contractor michigan form

- Security contract for contractor michigan form

- Insulation contract for contractor michigan form

Find out other NCBRBusiness Registration Application For Income T

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast