Motor Vehicle Appraisal for Tax Collector Hearing Bonded Txdmv 2011

What is the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

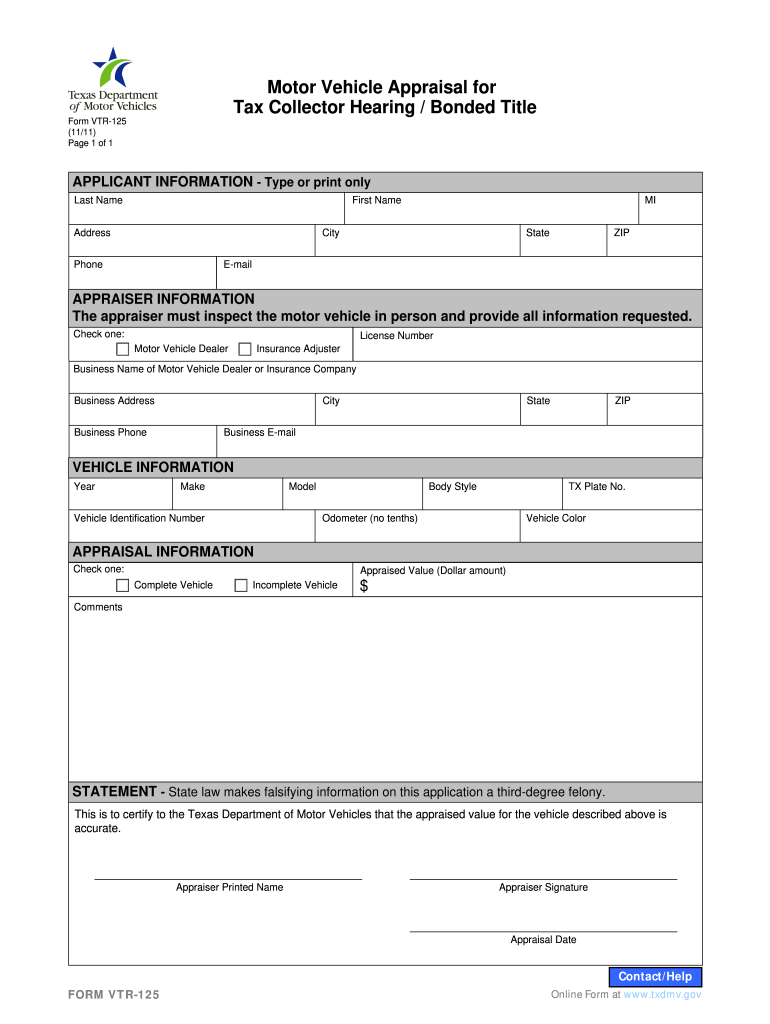

The Motor Vehicle Appraisal for Tax Collector Hearing Bonded TXDMV is a crucial document used in the state of Texas to determine the value of a motor vehicle for tax purposes. This appraisal is particularly relevant when there is a dispute regarding the assessed value of a vehicle, often arising during tax collector hearings. The appraisal serves as an official assessment that can influence tax liabilities and ensure compliance with state regulations.

Steps to Complete the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

Completing the Motor Vehicle Appraisal for Tax Collector Hearing Bonded TXDMV involves several important steps:

- Gather necessary information about the vehicle, including make, model, year, and VIN.

- Assess the vehicle's condition, noting any damages or modifications that may affect its value.

- Fill out the appraisal form accurately, ensuring all fields are completed with precise information.

- Sign and date the form to validate it legally.

- Submit the completed form to the appropriate tax collector's office, either online or in person.

Legal Use of the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

This appraisal form is legally binding when filled out correctly and submitted according to Texas state laws. It is essential for taxpayers to understand that inaccuracies or omissions can lead to penalties or disputes regarding vehicle assessments. The appraisal must comply with relevant regulations, including the Texas Tax Code, to be considered valid in hearings.

How to Obtain the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

To obtain the Motor Vehicle Appraisal for Tax Collector Hearing Bonded TXDMV, individuals can typically access the form through the Texas Department of Motor Vehicles (TXDMV) website or visit their local tax office. It is advisable to check for any specific requirements or additional documentation needed when requesting the appraisal.

Key Elements of the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

Key elements of the Motor Vehicle Appraisal for Tax Collector Hearing Bonded TXDMV include:

- Vehicle identification details, such as the VIN, make, and model.

- Current condition of the vehicle, including any damages.

- Estimated market value based on comparable sales and appraisal standards.

- Signature of the appraiser or the individual completing the form.

State-Specific Rules for the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

In Texas, specific rules govern the completion and submission of the Motor Vehicle Appraisal for Tax Collector Hearing Bonded TXDMV. These rules may include deadlines for submission, required supporting documents, and procedures for disputing an appraisal. It is crucial for individuals to familiarize themselves with these regulations to ensure compliance and avoid potential issues during tax hearings.

Quick guide on how to complete motor vehicle appraisal for tax collector hearing bonded txdmv

Simplify your life by validating Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv form with airSlate SignNow

Whether you need to register a new vehicle, request a driver’s permit, transfer title, or carry out any other task related to automobiles, managing such RMV paperwork as Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv is an unavoidable necessity.

There are several methods to obtain them: via postal service, at the RMV service facility, or by downloading them from your local RMV website and printing them. Each of these options is time-consuming. If you’re looking for a quicker solution to complete and authorize them with a legally-binding signature, airSlate SignNow is the optimal choice.

How to finalize Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv swiftly

- Select Show details to read a brief overview of the document you are interested in.

- Pick Get document to initiate and open the document.

- Follow the green label indicating the required fields if that applies to you.

- Utilize the top toolbar and make use of our advanced feature set to modify, annotate, and enhance your document.

- Add text, your initials, shapes, images, and other elements.

- Click Sign in in the same toolbar to create a legally-binding signature.

- Review the document content to ensure it contains no mistakes and inconsistencies.

- Select Done to complete the document.

Using our solution to finalize your Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv and other related documents will conserve a considerable amount of time and effort. Enhance your RMV document completion process from the beginning!

Create this form in 5 minutes or less

Find and fill out the correct motor vehicle appraisal for tax collector hearing bonded txdmv

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle appraisal for tax collector hearing bonded txdmv

How to generate an eSignature for the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv in the online mode

How to generate an eSignature for your Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv in Chrome

How to generate an electronic signature for signing the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv in Gmail

How to create an electronic signature for the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv straight from your smartphone

How to generate an electronic signature for the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv on iOS devices

How to generate an eSignature for the Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv on Android

People also ask

-

What is a Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv?

A Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv is a formal assessment of a vehicle's value, required for tax-related hearings. It provides essential documentation for disputing vehicle valuations and ensuring accurate tax assessments. This process helps protect vehicle owners from unfair taxation.

-

How much does a Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv cost?

The cost of a Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv can vary depending on the appraisal service you choose. Generally, prices range from $150 to $500 based on the vehicle's complexity and the appraisal provider. It's best to request quotes from multiple providers to find a competitive price.

-

What features does airSlate SignNow offer for handling Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv documentation?

airSlate SignNow provides features like eSignature capabilities, document templates, and secure cloud storage for all Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv-related documents. These features simplify the process of sending, signing, and managing signNow paperwork efficiently. This ensures compliance and expedites the appraisal process.

-

What are the benefits of using airSlate SignNow for Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv?

Using airSlate SignNow for your Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv enhances efficiency and reduces processing time. It provides a user-friendly interface that makes document handling straightforward, even for those unfamiliar with eSignatures. Additionally, it ensures document security and legal compliance.

-

Can airSlate SignNow integrate with other tools for Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv management?

Yes, airSlate SignNow integrates seamlessly with various software solutions that are essential for managing Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv tasks. This includes CRM systems, cloud storage services, and other document management tools. These integrations enhance workflow efficiency and simplify data exchange.

-

How can I ensure my Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv documents are secure?

airSlate SignNow employs advanced security measures like encryption and secure access controls to protect your Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv documents. You can also track document status and receive notifications, ensuring that your sensitive information remains safe throughout the appraisal process.

-

Is there customer support available for issues related to Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv on airSlate SignNow?

Absolutely! airSlate SignNow offers customer support to assist with any issues related to Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv. Their dedicated support team can help you navigate the platform, troubleshoot problems, and provide guidance on best practices for document management.

Get more for Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

- Form 657 authorized user form complete this form to add an authorized user to you credit card account

- Isevpo form

- Application for registration by competency examination form

- Vrtmod revenue form

- Lijsl game roster form long island junior soccer league

- City of hemet find your alarm permit form

- Hqp pff 002 form

- Priority health appeal form

Find out other Motor Vehicle Appraisal For Tax Collector Hearing Bonded Txdmv

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document