US Nonresident Alien Income Tax ReturnForm 1040NR 2023

What is the US Nonresident Alien Income Tax Return Form 1040NR

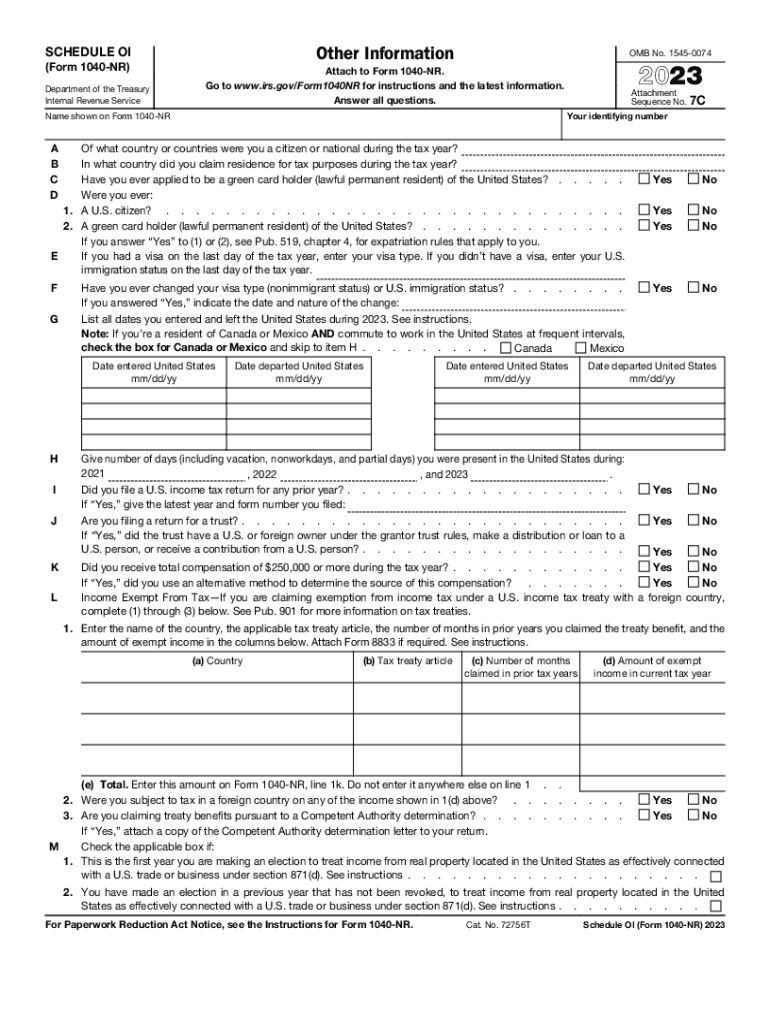

The US Nonresident Alien Income Tax Return Form 1040NR is a tax form used by nonresident aliens to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). This form is specifically designed for individuals who are not US citizens and do not meet the green card or substantial presence tests. Nonresident aliens must file this form if they have US-source income, which includes wages, salaries, tips, and certain types of investment income.

How to use the US Nonresident Alien Income Tax Return Form 1040NR

To effectively use the Form 1040NR, nonresident aliens should first gather all necessary documentation regarding their income and expenses. This includes W-2 forms, 1099 forms, and any relevant receipts for deductions. The form requires detailed information about the taxpayer’s identity, income sources, and applicable deductions. It is essential to follow the instructions provided by the IRS carefully to ensure accurate reporting and compliance with tax laws.

Steps to complete the US Nonresident Alien Income Tax Return Form 1040NR

Completing the Form 1040NR involves several key steps:

- Gather necessary documents, including income statements and deduction records.

- Fill out personal information, such as name, address, and taxpayer identification number.

- Report all US-source income in the appropriate sections of the form.

- Claim deductions and credits that apply to your situation.

- Calculate your total tax liability and any refund or amount due.

- Sign and date the form before submission.

Key elements of the US Nonresident Alien Income Tax Return Form 1040NR

Key elements of the Form 1040NR include:

- Personal Information: Name, address, and taxpayer identification number.

- Income Reporting: Sections for reporting wages, interest, dividends, and other income types.

- Deductions: Areas to claim standard or itemized deductions applicable to nonresident aliens.

- Tax Calculation: A section for calculating the total tax owed based on reported income.

- Signature: A requirement for the taxpayer to sign and date the form to validate the submission.

Filing Deadlines / Important Dates

The filing deadline for Form 1040NR typically aligns with the US tax season, which is April 15 for most taxpayers. However, nonresident aliens may have different deadlines depending on their specific circumstances, such as whether they are in the US on a temporary visa. It is crucial to verify the exact filing date each year and ensure that all forms are submitted on time to avoid penalties.

Required Documents

When preparing to file the Form 1040NR, nonresident aliens should collect the following documents:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance or contract work.

- Documentation of any US-source investment income.

- Receipts for deductible expenses, if applicable.

- Passport or visa information to verify nonresident status.

Quick guide on how to complete us nonresident alien income tax returnform 1040nr

Complete US Nonresident Alien Income Tax ReturnForm 1040NR effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed forms, as you can access the appropriate template and securely preserve it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents rapidly without holdups. Manage US Nonresident Alien Income Tax ReturnForm 1040NR on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign US Nonresident Alien Income Tax ReturnForm 1040NR without hassle

- Obtain US Nonresident Alien Income Tax ReturnForm 1040NR and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign US Nonresident Alien Income Tax ReturnForm 1040NR and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us nonresident alien income tax returnform 1040nr

Create this form in 5 minutes!

How to create an eSignature for the us nonresident alien income tax returnform 1040nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040nr other information form?

The 1040nr other information form is a tax document used by non-resident aliens to report their income and calculate their tax liabilities in the United States. Understanding this form is crucial for complying with U.S. tax laws and ensures proper submission to the IRS.

-

How can airSlate SignNow assist with the 1040nr other information form?

airSlate SignNow streamlines the process of completing and eSigning the 1040nr other information form by providing an easy-to-use platform. With our software, you can quickly fill out your form, obtain necessary signatures, and submit it securely.

-

What are the benefits of using airSlate SignNow for the 1040nr other information form?

Using airSlate SignNow for the 1040nr other information form offers numerous benefits, including enhanced efficiency, reduced paper clutter, and secure document storage. Furthermore, our electronic signatures are legally binding, ensuring that your submissions meet compliance requirements.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to test all the features related to the 1040nr other information form and more. This provides an excellent opportunity to experience the convenience and functionality of our platform before committing to a subscription.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides flexible pricing plans to accommodate different business needs and budgets. Our subscription options range from a basic plan for individuals to more advanced solutions for businesses managing multiple 1040nr other information forms.

-

Can airSlate SignNow integrate with other software for managing the 1040nr other information form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the 1040nr other information form and other documents. This integration allows for improved workflow efficiency and data management across platforms.

-

Is airSlate SignNow secure for handling sensitive documents like the 1040nr other information form?

Yes, airSlate SignNow prioritizes the security of your documents, including the 1040nr other information form. Our platform employs advanced encryption and security measures to ensure that your data remains confidential and protected throughout the signing process.

Get more for US Nonresident Alien Income Tax ReturnForm 1040NR

- Notice cure default form

- Maryland terminate form

- Notice terminate lease tenant form

- Maryland holder 497310293 form

- Maryland deed trust 497310294 form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property maryland form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497310297 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property maryland form

Find out other US Nonresident Alien Income Tax ReturnForm 1040NR

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer