Motor Vehicle Claim Non Theft QBE Insurance Aus 2014-2026

Understanding QBE Renters Insurance

QBE renters insurance provides coverage for personal belongings within a rented property. This type of insurance helps protect tenants from financial losses due to theft, fire, or other unforeseen events. It typically covers items such as furniture, electronics, and clothing, ensuring that renters can recover their losses without significant financial strain.

Eligibility Criteria for QBE Renters Insurance

To qualify for QBE renters insurance, applicants usually need to meet specific criteria. This includes being a legal resident of the United States and renting a residential property. The property must be occupied by the insured tenant, and the coverage amount should reflect the total value of personal belongings. Additionally, applicants may be required to provide personal identification and proof of residence.

Required Documents for QBE Renters Insurance

When applying for QBE renters insurance, several documents are necessary to facilitate the process. These typically include:

- Proof of identity, such as a driver's license or passport

- Lease agreement to confirm rental status

- Inventory list of personal belongings, detailing their estimated value

- Any previous insurance documents, if applicable

Application Process for QBE Renters Insurance

The application process for QBE renters insurance is straightforward. Prospective policyholders can initiate their application online or through an insurance agent. The process generally involves filling out a form that includes personal information, property details, and the desired coverage amount. After submitting the application, the insurance provider may conduct a review and provide a quote based on the information provided.

Filing Claims with QBE Renters Insurance

In the event of a loss, filing a claim with QBE renters insurance is essential. Policyholders should promptly report the incident to their insurance provider. The claims process typically requires submission of a claim form, along with supporting documentation such as photographs of the damage and receipts for lost items. Timely filing is crucial to ensure that claims are processed efficiently and that policyholders receive the compensation they are entitled to.

Key Features of QBE Renters Insurance

QBE renters insurance offers several important features that enhance its value for tenants. Key features often include:

- Coverage for personal property against various risks

- Liability protection in case of accidents occurring on the rented property

- Additional living expenses coverage if the rental becomes uninhabitable due to a covered event

- Optional add-ons for specific items, such as high-value electronics or jewelry

Understanding the Importance of Renters Insurance

Having renters insurance is crucial for tenants as it provides peace of mind and financial security. It protects personal belongings from unexpected events and offers liability coverage, which can be beneficial in case of accidents. By investing in renters insurance, tenants can safeguard their assets and ensure they are prepared for unforeseen circumstances.

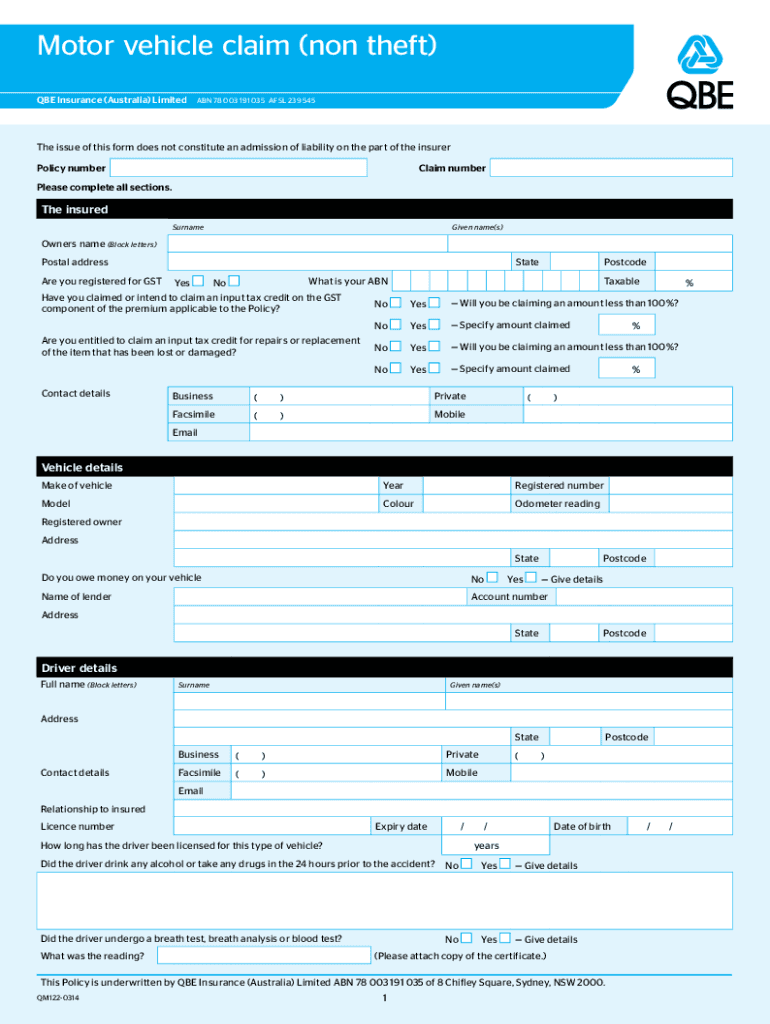

Quick guide on how to complete motor vehicle claim non theftqbe insurance aus

Effortlessly Prepare Motor Vehicle Claim non Theft QBE Insurance Aus on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Handle Motor Vehicle Claim non Theft QBE Insurance Aus on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Motor Vehicle Claim non Theft QBE Insurance Aus with Ease

- Find Motor Vehicle Claim non Theft QBE Insurance Aus and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Motor Vehicle Claim non Theft QBE Insurance Aus to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motor vehicle claim non theftqbe insurance aus

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle claim non theftqbe insurance aus

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is QBE renters insurance?

QBE renters insurance is a policy designed to protect tenants from financial losses due to theft, fire, or other damages to their personal property. It also provides liability coverage in case someone is injured in your rented space. This insurance is essential for anyone renting a home or apartment.

-

How much does QBE renters insurance cost?

The cost of QBE renters insurance varies based on factors such as location, coverage limits, and personal belongings. On average, renters can expect to pay between $15 to $30 per month for adequate coverage. It's advisable to get a personalized quote to understand the exact pricing.

-

What does QBE renters insurance cover?

QBE renters insurance typically covers personal property against risks like theft, fire, and vandalism. Additionally, it includes liability coverage for accidents that occur within your rented space. Always review the policy details to understand specific coverage limits and exclusions.

-

Are there any discounts available for QBE renters insurance?

Yes, QBE renters insurance often offers discounts for bundling policies, having security features in your rental, or maintaining a claims-free history. It's beneficial to inquire about available discounts when obtaining your quote to maximize savings.

-

How do I file a claim with QBE renters insurance?

To file a claim with QBE renters insurance, you can contact their claims department directly or use their online portal. You'll need to provide details about the incident, including any supporting documentation like photos or police reports. The claims process is designed to be straightforward and efficient.

-

Can I customize my QBE renters insurance policy?

Absolutely! QBE renters insurance allows you to customize your policy to fit your specific needs. You can adjust coverage limits, add endorsements for valuable items, and choose deductibles that work for your budget.

-

Is QBE renters insurance required by landlords?

While not all landlords require tenants to have QBE renters insurance, many do recommend it as a best practice. Having this insurance can protect you from unexpected expenses and provide peace of mind while renting. Always check your lease agreement for specific requirements.

Get more for Motor Vehicle Claim non Theft QBE Insurance Aus

- How to fill out a joint tenancy grant deedhome guides form

- Grant deed with retained form

- I the undersigned declare that i am the attorney for the applicant form

- Federal notice of traumatic injury and claim for continuation form

- Corporation to husband and wife form

- Control number ca 010 78 form

- California state lien law summary levyvon beck form

- Licensing notices form

Find out other Motor Vehicle Claim non Theft QBE Insurance Aus

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF