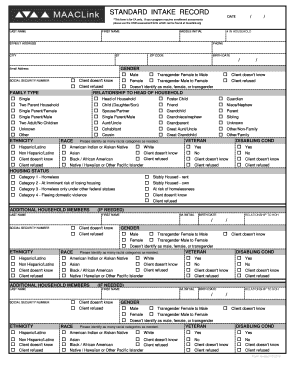

Standard Intake Record MAAC Emergency Assistance and HMIS 2016-2026

Understanding the HMIS Form and Its Purpose

The HMIS form, or Homeless Management Information System form, is a critical document used to collect and manage data related to homelessness services. This form is designed to help service providers track the needs and services provided to individuals experiencing homelessness. The information gathered through the HMIS form is essential for reporting to government agencies and ensuring compliance with federal and state regulations. It supports the development of effective programs and policies aimed at addressing homelessness in the United States.

Key Elements of the HMIS Form

When filling out the HMIS form, several key elements must be included to ensure it is complete and effective. These elements typically encompass personal information, such as:

- Name

- Date of birth

- Gender

- Race and ethnicity

- Housing status

- Income sources

- Service needs

Each of these components plays a vital role in understanding the demographics and needs of the population served. Accurate data collection is crucial for tailoring services and securing funding for programs aimed at assisting those in need.

Steps to Complete the HMIS Form

Completing the HMIS form involves several straightforward steps. First, gather all necessary personal information and documentation. Next, ensure that you understand each section of the form, as clarity is essential for accurate data entry. Once you have filled out the form, review it for any errors or omissions. Finally, submit the completed form according to the guidelines provided by your service provider. This process ensures that your information is recorded accurately and can be used effectively in service planning and delivery.

Legal Use of the HMIS Form

The HMIS form is governed by various legal standards to protect the privacy and rights of individuals. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the U.S. Department of Housing and Urban Development (HUD) guidelines is essential. These laws ensure that the information collected is handled securely and used only for its intended purpose. Understanding these legal frameworks is important for both service providers and clients to ensure that data is managed responsibly.

Obtaining the HMIS Form

To obtain the HMIS form, individuals typically need to contact local service providers or agencies that participate in the HMIS program. Many organizations offer the form in both digital and paper formats to accommodate different needs. Additionally, some service providers may have specific procedures for accessing the form, including online portals or in-person requests. It is advisable to check with the relevant agency for the most efficient method of obtaining the form.

Examples of Using the HMIS Form

The HMIS form is utilized in various scenarios, primarily within service organizations that assist individuals experiencing homelessness. For instance, a shelter might use the form to intake new clients, documenting their needs and history to provide appropriate services. Additionally, outreach programs may use the form to collect data on individuals living on the streets to connect them with resources. These examples illustrate the form's versatility and importance in addressing homelessness effectively.

Quick guide on how to complete standard intake record maac emergency assistance and hmis

Discover how to effortlessly navigate the Standard Intake Record MAAC Emergency Assistance And HMIS completion with this simple tutorial

Submitting and validating forms online is becoming more popular and the preferred choice for many clients. It provides numerous advantages over outdated printed documents, including convenience, time savings, improved precision, and security.

Using tools like airSlate SignNow, you can locate, modify, signNow, and send your Standard Intake Record MAAC Emergency Assistance And HMIS without being hindered by endless printing and scanning. Refer to this brief guide to begin and complete your form.

Follow these instructions to obtain and fill out Standard Intake Record MAAC Emergency Assistance And HMIS

- Commence by clicking the Get Form button to access your document in our editor.

- Pay attention to the green label on the left that indicates required fields to ensure none are missed.

- Leverage our advanced tools to annotate, modify, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable format using the appropriate tab features.

- Scroll through the document and examine it for errors or inconsistencies.

- Select DONE to complete your edits.

- Rename your form or keep the original title.

- Select the storage service where you wish to save your document, send it via USPS, or click the Download Now button to retrieve your file.

If Standard Intake Record MAAC Emergency Assistance And HMIS isn’t what you intended to find, you can explore our extensive library of pre-uploaded templates that you can complete with minimal effort. Experience our platform today!

Create this form in 5 minutes or less

Find and fill out the correct standard intake record maac emergency assistance and hmis

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the standard intake record maac emergency assistance and hmis

How to generate an electronic signature for the Standard Intake Record Maac Emergency Assistance And Hmis online

How to create an electronic signature for the Standard Intake Record Maac Emergency Assistance And Hmis in Google Chrome

How to create an electronic signature for putting it on the Standard Intake Record Maac Emergency Assistance And Hmis in Gmail

How to make an electronic signature for the Standard Intake Record Maac Emergency Assistance And Hmis straight from your smart phone

How to generate an electronic signature for the Standard Intake Record Maac Emergency Assistance And Hmis on iOS devices

How to create an electronic signature for the Standard Intake Record Maac Emergency Assistance And Hmis on Android OS

People also ask

-

What is the maac intake record online feature offered by airSlate SignNow?

The maac intake record online feature allows users to create, send, and sign documents securely and conveniently. This feature streamlines the intake process, making it easier for businesses to capture necessary information without the hassle of paper forms.

-

How does airSlate SignNow ensure the security of my maac intake record online?

Security is a top priority for airSlate SignNow. Our platform employs encryption, multi-factor authentication, and secure servers to protect your maac intake record online, ensuring that your sensitive information remains confidential and secure from unauthorized access.

-

What pricing plans are available for accessing the maac intake record online?

AirSlate SignNow offers several affordable pricing plans tailored to different business needs. Each plan includes access to the maac intake record online feature, ensuring that you can choose the option that best fits your budget and required functionality.

-

Can I integrate the maac intake record online feature with other tools?

Yes, the maac intake record online feature seamlessly integrates with various applications such as CRM systems, cloud storage services, and productivity tools. This flexibility allows for a more streamlined workflow, enhancing overall efficiency in document management.

-

What are the benefits of using airSlate SignNow for my maac intake record online?

Using airSlate SignNow for your maac intake record online offers several benefits, including increased efficiency, cost savings, and enhanced accessibility. Our platform simplifies the process, reduces errors, and allows for faster document turnaround times.

-

Is there a mobile application for managing the maac intake record online?

Yes, airSlate SignNow provides a mobile application that lets you manage your maac intake record online on the go. This app enables you to send, sign, and monitor documents from your smartphone or tablet, ensuring you stay productive wherever you are.

-

How do I get started with the maac intake record online feature?

To get started with the maac intake record online feature, simply sign up for an airSlate SignNow account. Once registered, you can create and customize your intake records, making it easy to collect information from your clients or team members.

Get more for Standard Intake Record MAAC Emergency Assistance And HMIS

- Dsa 140 form

- Igi life insurance policy status form

- Tanzania visa application fillable form

- A lohnausweis certificat de salaire salary certificate estv admin form

- Va entitlement worksheet borrowersloan v form

- Web host contract template form

- Web development contract template form

- Corp to corp contract template form

Find out other Standard Intake Record MAAC Emergency Assistance And HMIS

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later