Calculating Your Own Retirement Plan Contribution and 2023-2026

Understanding the Fidelity Salary Reduction Agreement Form

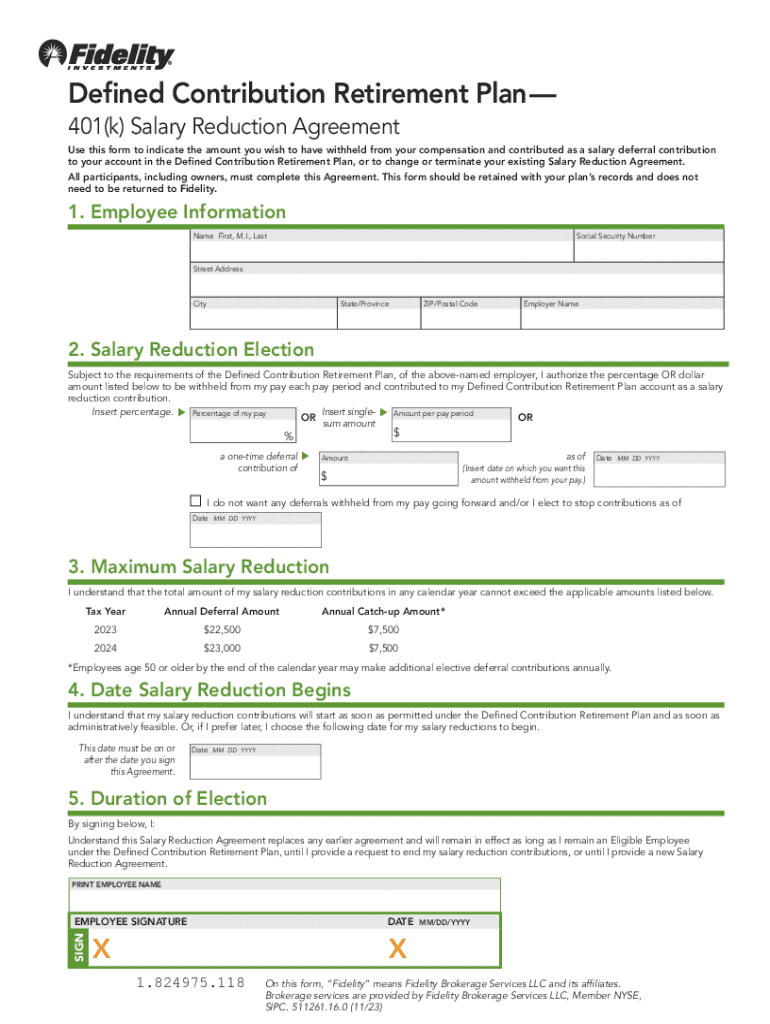

The Fidelity salary reduction agreement form is a crucial document for employees wishing to participate in a retirement plan, such as a 401(k). This form allows employees to specify the percentage or amount of their salary they wish to contribute to their retirement savings. By completing this form, employees can take proactive steps toward securing their financial future while benefiting from potential tax advantages associated with retirement contributions.

Steps to Complete the Fidelity Salary Reduction Agreement Form

Filling out the Fidelity salary reduction agreement form involves several straightforward steps:

- Gather necessary information, including your employee identification number and current salary details.

- Determine the percentage or dollar amount you wish to contribute to your retirement plan.

- Complete the form by entering your personal information and contribution details accurately.

- Review the form for any errors or omissions to ensure all information is correct.

- Submit the completed form to your employer’s HR or payroll department for processing.

Key Elements of the Fidelity Salary Reduction Agreement Form

Several key elements are essential when completing the Fidelity salary reduction agreement form:

- Employee Information: This includes your name, address, and employee identification number.

- Contribution Amount: Specify the percentage or fixed amount of your salary you wish to contribute.

- Plan Information: Indicate the specific retirement plan you are contributing to, such as a 401(k) or similar plan.

- Effective Date: The form should include the date when the salary reduction will begin.

Legal Use of the Fidelity Salary Reduction Agreement Form

The Fidelity salary reduction agreement form must be used in compliance with IRS regulations governing retirement contributions. Employers are required to maintain accurate records of contributions and ensure that they do not exceed the annual contribution limits set by the IRS. Proper use of this form helps employees maximize their retirement savings while adhering to legal requirements.

IRS Guidelines for Retirement Contributions

The IRS provides specific guidelines regarding contribution limits and eligibility for retirement plans. For example, the contribution limit for a 401(k) plan may change annually, so it is important to stay updated on these figures. Additionally, employees should be aware of catch-up contributions available for those aged fifty and older, allowing for increased savings as retirement approaches.

Form Submission Methods

Once the Fidelity salary reduction agreement form is completed, it can be submitted through various methods, depending on your employer's policies:

- Online Submission: Many employers allow electronic submission through their HR platforms.

- Mail: The completed form can be sent via postal mail to the HR department.

- In-Person: Employees may also choose to submit the form directly to HR during business hours.

Quick guide on how to complete calculating your own retirement plan contribution and

Effortlessly Prepare Calculating Your Own Retirement Plan Contribution And on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Calculating Your Own Retirement Plan Contribution And on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Calculating Your Own Retirement Plan Contribution And with Ease

- Locate Calculating Your Own Retirement Plan Contribution And and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method of sharing your form—via email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Calculating Your Own Retirement Plan Contribution And and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calculating your own retirement plan contribution and

Create this form in 5 minutes!

How to create an eSignature for the calculating your own retirement plan contribution and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fidelity salary reduction agreement form?

A fidelity salary reduction agreement form is a document that allows employees to agree to reduce their salary in exchange for certain benefits, such as contributions to retirement plans. This form is essential for ensuring compliance with IRS regulations and helps employees manage their tax liabilities effectively.

-

How can airSlate SignNow help with fidelity salary reduction agreement forms?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning fidelity salary reduction agreement forms. With its user-friendly interface, businesses can easily manage these documents, ensuring that all agreements are executed efficiently and securely.

-

What are the benefits of using airSlate SignNow for salary reduction agreements?

Using airSlate SignNow for fidelity salary reduction agreement forms offers numerous benefits, including reduced processing time, enhanced security, and improved compliance. The platform allows for easy tracking of document status, ensuring that all parties are informed throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for these forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. The cost-effective solution ensures that you can manage fidelity salary reduction agreement forms without breaking the bank, making it accessible for companies of all sizes.

-

Can I integrate airSlate SignNow with other software for managing salary reduction agreements?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage fidelity salary reduction agreement forms alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are in one place.

-

How secure is the airSlate SignNow platform for handling sensitive documents?

The airSlate SignNow platform prioritizes security, employing advanced encryption and authentication measures to protect your fidelity salary reduction agreement forms. This ensures that sensitive employee information remains confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for managing salary reduction agreements?

airSlate SignNow offers a range of features for managing fidelity salary reduction agreement forms, including customizable templates, automated reminders, and real-time tracking. These features simplify the document management process, making it easier for businesses to stay organized and compliant.

Get more for Calculating Your Own Retirement Plan Contribution And

- Register to votehousedemscom michigan house form

- Michigan voter registration form

- Mtg turn structure form

- Driver diversion program form

- Sponsor form mn rodeo association

- Hale school pta request for funds minneapolis public schools form

- 2014 watercraft title and registration application 2014 watercraft title and registration application form

- Instructional rounds template pdf form

Find out other Calculating Your Own Retirement Plan Contribution And

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple